Biases, fallacies, & heuristics will absolutely F up your decisions.

You want to avoid them. But you need to identify biases before in order to know what you are looking out for so you can correct it.

In Investing Biases Part 1, we introduced the concept of bias, explained the difference between bias vs fallacies vs heuristics, and introduced our first 2 biases: Naïve diversification and mental accounting. We also did a separate post on Naïve Diversification to elaborate on it more as we see it a happen a lot.

Today, we continue with 3 more investing biases to help you become more rational in life & as an investor.

III) Hindsight Bias

This might be one of our favorite. You can think about it as “Sunday Morning Quarterbacking” or since sportsball is for losers now, maybe “ex post facto Twitter expert”.

[We even included a little Latin* in there for you, so now you have to agree per the rules of Twitter arguments where even if you are wrong just accuse everyone of ad hominems and not being smart enough to understand your nuanced points. Right Scott?

*Latin is an old language and different than Latina]

What is hindsight bias?

“Hindsight bias, also known as the knew-it-all-along phenomenon or creeping determinism, is the common tendency for people to perceive past events as having been more predictable than they actually were.” - Wikipedia

That sums it up well. Basically hindsight bias is when you look back at an event and think it is super obvious in hindsight. We all suffer from hindsight bias, some people much more than others. If you have ever had a conversation with a midwit who KNEW that Apple would be huge and definitely would have invested in them but had that…ummm..eye doctor appointment and then life got busy you know, that’s why they didn’t…., that is hindsight bias.

You see this type of retroactive expertise play out in all avenues - politics, sports, investing, markets, etc. “I knew sportsball team A was going to upset team B because [insert random player who had a good game] had a favorable match up”. [alfa leak - If only there was a way to take all that expertise and make money on it…maybe if there was an easy way to wager money, maybe with a middle man who assigned odds that pay you back more for choosing an upset correctly….someone should come up with that. Then all these midwits who are always right could be rich.]

Looking back it is easy to connect the dots and see why a success was a success. However, at each step along the way, knowing the future is much harder to do.

Hindsight bias is slightly different than confirmation bias. Confirmation bias is when you seek out information that confirms your preconceived notions, whereas hindsight bias is looking at outcomes and then seeking out memories where you were correct in predicting those outcomes.

Midwits claiming they definitely would have played every turn in the market perfect isn’t the reason why hindsight bias is a pain for you though. Hindsight bias is a pain because it makes it harder for you to learn from mistakes.

If you look back and think you could have correctly predicted an event, you will overstate your predictive capabilities. People will do this even if they were around at the time of the event and didn’t act on information. They will still convince themselves that they knew the answer and create mental hoops to explain why, despite being so sure now how it was obvious, they didn’t do anything at the time.

Additionally, as markets move, people tend to have changing opinions. One day you may feel like a company is a good investment and the next day you don’t. A year later the company’s stock rips and you think back, you are more likely to remember the days you thought it was a good investment and forget the ones that kept you from buying (or vice versa).

By selectively only recalling the correct predictions you make, you lead yourself to believe you are a better predictor than you are.

If you aren’t tracking your actual performance and relying on your memory and feelings, you are probably suffering from hindsight bias. If you are constantly underperforming but you think of yourself as being correct more often than not, that is a very good tip-off that you have this bias (along with the next one, overconfidence).

If you want to proactively avoid hindsight bias, the best thing to do is write all your predictions down and then actually look them over from time to time and see what your hit rate is. That is a pain. It is much easier to assume you have it and every time your monkey brain see an outcome and thinks “I knew that”, remind yourself that you can literally bet on almost anything. And you didn’t put any money on this supposed obvious thing. So no, you did not know it.

Hindsight bias is very closely tied to the next bias on the list, overconfidence bias.

IV) Overconfidence Bias

Overconfidence bias is driven by ego and our inflated sense of intelligence, physical strength, etc. It basically boils down to you being more likely to remember your successes and your ego telling you that you are better than you are.

In studies, if you ask a group of people if they are better than average, a high percent (call it 80%) will say they are better than average. This indicates the average person is suffering from overconfidence bias as roughly 1/2 should be better and 1/2 should be worse than average, on average.

[Note - the first time we heard one of these study anecdotes it was about driving where 80% of people call themselves better than average drivers. Interestingly, we think this actually isn’t as far off as it first indicates. (And no this doesn’t detract from the above point, its just a fun little musing about averages & stats).

When you think of ‘being a good driver’ what do you base it on? Most people will say ‘if I haven’t caused accidents’ or something similar. From the internet, it looks like if you take the total # of accidents divided by number of drivers, the average person is in 4 accidents in their lifetime. But there are some atrocious drivers. We personally know people who seemingly get in 1 crash a year.

Quick maths - If you assume 80% of people have 0 accidents in their life, but 20% have 20 accidents, you can get a situation where statistically 80% of people are indeed “above average” drivers by the metric of “below the average number of accidents in your life”. (Average can be a poor metric as we have covered here and here).

This doesn’t actually negate the point that 80% of people are overconfident in their driving abilities. If you have ever had to deal with merging on a highway or 4 way intersections, watching someone parallel park, or rode a motorcycle with everyone trying to murder you, you know that 97% of people are absolutely terrible drivers who probably shouldn’t have a license.

So the point still stands that people suffer from overconfidence bias. We just always thought that one particular study may have a logical reason for the results due to the flaw of averages…or maybe we are just suffering from hindsight bias]

This is a finance & money substack, so a more topical study is the one where 3/4s of portfolio managers think they are above average investors. Since 60%+ of actively managed portfolios underperform in a given year and 80%+ over longer-term periods, this clearly isn’t the case.

Overconfidence bias makes you more susceptible to making mistakes, less likely to have adequate safeguards, and less likely to apply adequate risk controls. (This is one of the reasons we are big proponents of using options in our optimal portfolio strategy as it integrates a buffer for being wrong. If we can offset 2-5% of a monthly down move with options, it offsets some overconfidence)

Overconfidence in your investment abilities can result in a similar under-diversification as you get in naïve diversification, but for a different reason. In one you are likely to under diversify because you think you are better than average and concentrate, while the other you think you are diversified, but are over concentrated due to not looking at your portfolio holistically.

We’d be amiss to not mention that not everyone has overconfidence bias and being overconfident in one area doesn’t mean you are overconfident in all areas.

Types of Overconfidence

There are different flavors of overconfidence bias.

1) Illusion of Control Bias

Illusion of control bias is when you think you have more control over a situation than you do. This can be very detrimental as you take on more risk thinking you can impact the ultimate outcomes.

Illusion of control happens often outside of investing and in real life where you have some input into the process - think business or a project where the outcome is largely driven by markets not by your choices. We see it in our day job often where insurance product profitability is driven by mortality or markets moves. When you design a product and do a lot of work around it, there is a tendency to feel like it will succeed. But once the product is launched, the profitability is driven by where markets go or how mortality works.

Covid was a good case of this where mortality was up and out of control of the company.

2) Desirability Effect

Desirability effect is similar to illusion of control, however this is where you think an outcome will happen because you want it to happen. This is very relevant to stocks where you purchase a security and then, because you desire for it to do well, you are confident that it will do well.

3) Optimistic Timing Of Outcome

Overconfidence on timing is when you think something will happen much faster than it actually does. This is one of the most prevalent as everyone thinks they will finish a project faster than expected or an event will happen faster than expected.

If you purchase a stock and expect it to immediately go up, this is an example of overconfidence in the timing.

4) Outcome Overconfidence

As stated above, the last form of overconfidence is just thinking you are better than you actually are. This is when you think you are a higher rank than you are in various pursuits.

Additionally, people most prone to overconfidence also tend to be those who suffer the most from hindsight bias. This is driven by cognitive dissonance, where you have a self-image and you need to protect that self-image so your ego won’t acknowledge any information that goes against that image but seeks out info that supports it. “I am a good investor and will outperform” is your overconfidence, and then you look at the past and say “Because I am a good investor, I knew X would happen, therefore I am even better than I thought”.

V) Sunk Cost Fallacy

Last item for this post is the sunk cost fallacy. The sunk cost fallacy is when you make decisions based on the time & money you already spent instead of what is the best decision going forward.

The stereotypical example of the sunk cost fallacy is if you buy tickets for a movie and it is terrible. The movie isn’t what you expected and it sucks. Do you get up and leave? When was the last time you got up and left midway through a movie? Was the ending of Marmaduke really worth the extra hour?

You paid your ticket price, you got popcorn, and even though there is 2 hours more to go you sit there and watch to the end. You already paid the ticket price, it is in the past and it is sunk (gone forever). If you were being logical, you would realize that 2 hours of your time back is more valuable to you than staying to ‘get your money’s worth’.

Another common example is in relationships. You have seen couples who make each other miserable. The relationship is beyond saving & everything they do annoys the other one. They spend all their time hating being together but “we have been together so long and leaving now would throw away all that history”.

Sunk cost fallacy. Staying around throwing good time or money after bad.

In investing, his is typically seen with stocks where you look at your purchase price instead of what the expected future holds. For instance, if you paid $10 for a stock and then anchor on that price for all future decisions. The market doesn’t know or care what your cost basis is when you FOMO bought the top, and you should only care about the future prospects of the stock.

Sunk cost fallacy is extremely common in investing and other areas of life. What makes it particularly difficult is that people also have the tendency to quit too early. It can be hard to distinguish when you are throwing in the towel prematurely vs clinging to a losing position because you already spent so much on it. Each situation is different, so you just need to learn how to be brutally honest with yourself because…your ego.

Cognitive dissonance comes into play with the sunk cost fallacy as well. You aren’t a quitter right Anon? Giving up now would challenge your view of yourself as someone who will perservere through adversity or who makes good decisions. If you stop, even if it is the rational decision, it calls into question the positive view of yourself (ego is a bish, innit? You need to learn its better to admit your wrong and make money than protect your fragile self-image and be poor)

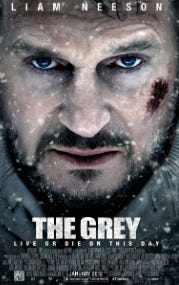

You need to be brutally honest with yourself about the future prospects of what you are doing. A good test is to ask “Would I double down on this?”. Usually the answer is no…Liam Neeson staring in “punches with wolves” except he doesn’t do any punching and just talks for 14 hours was not a good use of your time….

In our movie example, “would you rent this movie and watch again?” No. Then get up and leave.

In our relationship example, “would you date an exact doppelganger of your current boy/girlfriend?” No. Then get up and leave.

And in investing, “would I buy more of this asset today?” If you aren’t buying more of a security, then why are you holding onto to what you have? Answer is usually that you don’t want to sell at a loss.

We have used this before, but it sums it up. You don’t trim your positions and you end up with a big bloated portfolio of old names at big unrealized losses that you can’t even remember why you purchased in the first place but you pretend aren’t sitting there at home waiting for you.

Be ruthless in cutting out things that aren’t serving you, whether in life or your portfolio.

Conclusion

Here are 3 more biases that make you a worse investor. Being aware of your biases and potential future biases will make you a better investor and better in life.

In conclusion,

Everything seems obvious with 20/20 hindsight so don’t trick yourself into thinking you ‘knew’ an event was going to occur after the fact

Recognize when you have an actual competitive advantage and when you are just deluding yourself into thinking you do

Ruthlessly make the best decision going forward at every point in time and put no weight on prior decisions

Good luck Anon.

Sunk cost fallacy struck me when I finally migrated crypto to a hardwallet. To save on gas/approvals, convert it all to Eth then send to the new wallet. Had to ask myself 'do I want to buy this again?' For some of those coins, answer was no. Probably would have been 'no' if I'd moved the coins when they were 50% higher, too.

Great post. Thank you for these reminders! Sunk cost fallacy reminded me of the time years ago a buddy and I went to see the dogshit movie “Legion”. I think we endured 45 mins of that fingernail pulling torture before we literally got up and jogged out the theater. Best part was laughing on our way out.