Another day, another personal finance gooroo saying how annuities are a scam.

“Just follow the 4% rule and you can’t run out of money”

“Fees and surrender charges and commissions, oh my”

[Yes those are all present. But why? And does that necessarily make it a bad deal for you?]

“The illustrations use unrealistic numbers”

[They are regulated with limits of what can be shown based on recent history vs the returns being regurgitated by said gooroos]

“Commissions again. And Sales guys bad”

I’ve said it before, and I’ll say it again in any post about insurance or annuities…these things are complex. I get it.

It isn’t a 1-page budget that has a percent multiplied by a number.

Annuities don’t fit into a broad 1-size-fits-all rule like “save 20% of your income”.

And there is a massive amount of different product types (SPIA, DIA, VA, FA, FIA, RILA, and QLAC to name a few) and each company offers its own version of the products with their own nuances. So it is not as basic as buy the SP500 ETF and hold or buy NASDAQ and hold…or go crazy and buy both to diversify. See how smart your gooroo is telling you to do fancy things…

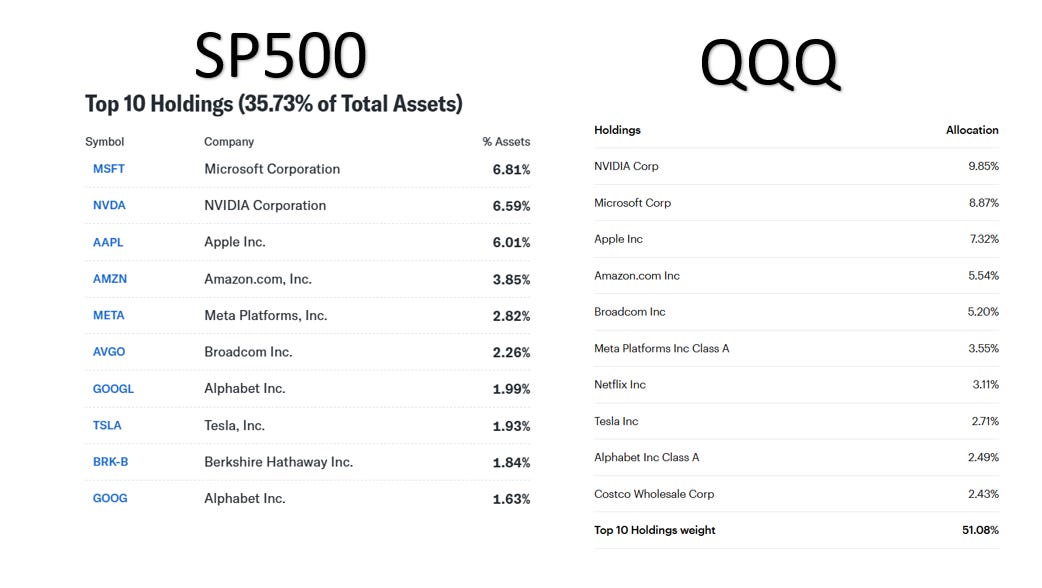

But at the end of the day, whether your gooroo is an SP500 Doggie or a QQQ Doggie… it is a small difference in allocation to literally the same 10 big stocks. So your gooroo really isn’t going out on a limb saying to buy one or the other.

Honestly, it all reminds me of the quote that to a primitive person, "Any sufficiently advanced technology is indistinguishable from magic".

But in this case it is that to most gooroos “Any sufficiently advanced financial concept is indistinguishable so lets call it a scam” (literally, it is incomprehensible to understand to your online budgetpoors.)

So today, lets cover annuities. What are they? What are the downsides? Where and when may they make sense?

I have discussed my personal purchase of an annuity that was driven by a fairly sudden event - Now I chose a more complex in structure product for myself but that is largely because I am very familiar with it from designing and pricing these types of products at the old W2 - but there was reason enough going the annuity route made sense for me.

After today’s post you may think an annuity doesn’t seem so bad for yourself…

WTF is a Registered Index-Linked Annuity (RILA)???

Insurance is not known as an exciting industry. It is big, slow, heavily regulated, complex, and lots of legalese.