After a quick detour or 2, this week it is back to covering the top 10 controversial personal finance topics.

As discussed in the post on frameworks vs rules vs plans (link here), a lot of the controversy is due to people taking some observation of some idea that worked in the recent past (survivorship bias & recency bias), then turning it into a financial rule that they base their whole identity on.

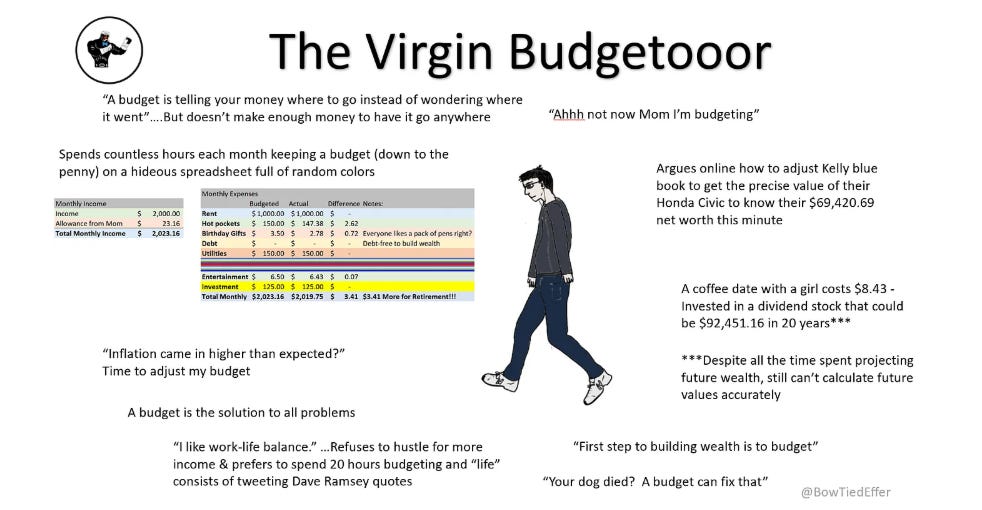

Then they try to cram that rule into every situation. It doesn’t matter what it is, that 1 rule is the secret to success. And if it didn’t work…well you just didn’t apply it hard enough.

The downside of these 1-trick-personal-finance-doggies, is that they end up just confusing and demotivating people.

Confusing people, because they will vehemently argue that any other idea is wrong. Join the cult or you won’t make it. And often time the person is actually doing something positive or has a situation where what they are doing makes sense for them. But no, it doesn’t fit the rule, therefore bad.

And it demotivates people because even if the rule works in the majority of cases, there is a lot of times it won’t. And there is nothing more demotivating than trying to fix an aspect of your life with a ‘guaranteed’ fix and have it not work. You feel like it is just your bad luck or the world is out to get you.

This type of 1-way thinking is all over the place. “Eat carnivore, I lost 100 lbs and it has never failed anyone…EVER…Seriously”. Some obese person tries it and doesn’t work, ‘I guess I’m just meant to be fat, why do I even try’.

“Just budget, it never failed anyone…EVER…Seriously.” Meanwhile the guy making minimum wage still can’t get any wealth growing because even the smallest unexpected expense completely wipes them back out (since they make no money), ‘I guess I’m just meant to be poor, why do I even try’.

And so we continue with 10 of these controversial topics and try to demystify them. Oh and get caught up on part 1 of the series here: