While writing the last post, I realized I never fully explained how I view the concepts of frameworks vs. plans vs. rules. All 3 of those may sound roughly equivalent, hell I may use them interchangeably in my writing here and there.

But they are very, very, different in practice.

A lot of the dislike I have for gooroos in finance is driven from their choice in how they present information. It leaves no room for growth, just making their followers slightly less worse off. And it is because they use the wrong form of teaching how to think. It is all hard rules that are based on “back-tested” information and suffers heavily from survivorship bias.

If a study was published in the 2000s that is based off what worked from 1970 to 1990, and that is the basis for finance advice, it is only going to work best going forward if 2025 to 2045 looks kind of like the 20-year period of the study. The ‘how the [currently] wealthy got wealthy [over the prior 20 years]’ is always used to try to guide you [currently] can get wealthy [over the next 20 years] by following the same rules.

I am partial to the 1970-2000s since this was the period that was used to make all the rules right when I was getting out of school. And I went all in on a lot of the advice. But let’s take a look at that 1970s -1990 period.

10-Year UST Rates

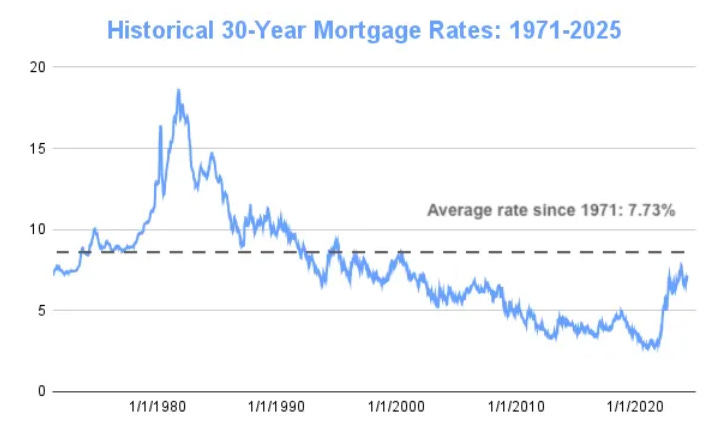

UST rates rose rapidly in the early 1980s but then entered a long 40 year bull-run. People in the 2000s still loved UST because they saw their parent who happened to buy UST in the 1980s and 1990s kill it. Imagine someone who just happened to lock in some UST at 15% and just rode 2x historical stock returns for decades.

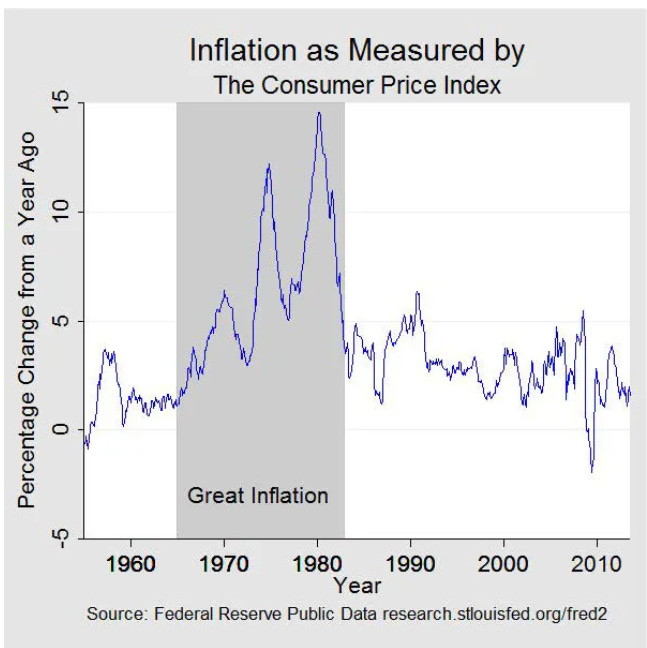

Inflation-

Inflation was volatile and super high (which drove the FED jacking up UST rates to fight it).

Housing

Mortgage rates may have been super high in the 70s & 80s, but home prices were significantly less. The median nationwide home price in 1970 was $24,000 (~$200k in today’s dollars). By time 1990 rolled around, the price of the home was over $100k and people could refinance at significantly lower rates.

This meant people with real estate got super wealthy. Early 2000s, it seemed like every middle class parent had a rental home or few as a side business.

SP500 Index

SP500 was pretty poor in the 70s, but anyone who was accumulating shares for a decade <$100 absolutely made out huge in the 80s when the market 4x. In the late 90s everyone who missed out on the ‘hot stocks’ of the past (but read how stock investing made others rich) jumped in heavy to anything internet and lead to the dot.com bubble. Early 2000s, when people got back on their feet, it was all about “blue-chips” and dividend stocks.

And if you think through each of these charts above, you can see how the previous generation shaped the next one.

People got rich in stocks in the 80s so everyone jumped into the ‘hot thing in the 90s’ leading to the dot com bubble and crash

People got rich taking on massive debt to buy RE in the 70s-80s, then paying off the remainder of a $25k mortgage with significantly de-valued dollars after inflation ate like 1/2 the purchasing power - which lead to everyone buying up RE and taking on debt before the housing bubble and crash

People got rich buying long US Treasuries during the 80s and 90s, so now I get to go to a bank every year and sign + address dozens of $25 UST paper Treasuries relatives bought for my wife as gifts 30 years ago and give to her at maturity

This long introduction is to establish 1 idea in your mind. Looking at the exact steps that worked in the past and thinking you can make hard rules on them and plan to get rich in the future is a losing proposition.

So is the past irrelevant? Can we not learn and apply anything?…

…

…