Student Loan Updates...Did you get your Free Money?...and Nonsense

What is going on with Student loans?

If you followed the news, the Supreme Court just struck down the voter buyout…I mean $10-20k student loan forgiveness proposal. Additionally, as part of debt ceiling negotiations the student loan forbearance is ending after over 3 years of no interest.

What does it all mean for you? And some looking back at our previous advice on it all.

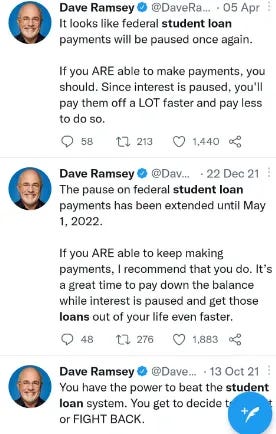

And we will have some fun with tweets like this and why is all so tiresome:

(Don’t worry - she is a politician so as a public figure we can laugh about this tweet)

Student Loan Freeze - Some Background

Back in March 2020, Trump put all student loans on pause with the HEROs act. This meant that on federal loans both:

The interest was forgiven, basically a 0% APR loan

Payments were paused - so you didn’t have to make them

The program was extended again and again and some more.

Now, the program was officially ended and will expire on September 1, 2023 with interest accruing. The first payments start in October.

There is still an outside shot that a new relief package is sorted out and approved, but it is a much harder road. The president could unilaterally extend the program under the HEROs act, but a new package would need to be proposed and voted on. However, Biden is allegedly trying to find other active acts that he could use to start a new program without Congress.

I am less of a believer that the latter will pan out and view it more as a way to keep the base engaged. But there is a chance.

In short - if you had Fed loans that you weren’t paying, you more-likely-than-not will need to start in a few months.

Our Advice

You can check our earlier post here:

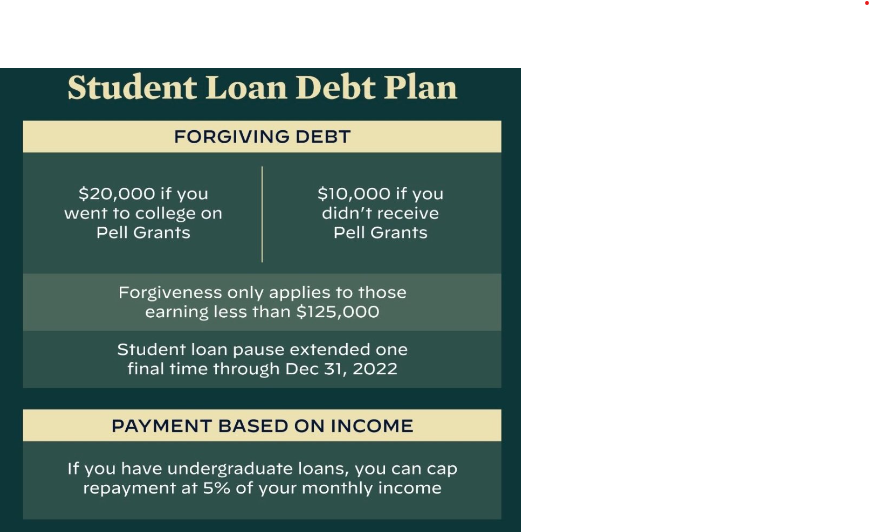

Student Loan Forgiveness - What You Can Learn

The long anticipated announcement about student loan transfer…I mean bribes, no thats not the word…forgiveness there we go. The “student loan forgiveness” official announcement is summarized in the below infographic: This post isn’t going to be us waxing on and on about the actual forgiveness…we have gave our takes on twitter…if you want our opinion, 1) this is a bribe and only helps a very small subset of people and most are in the ‘academia’ class. 2) if we have to spend money, we’d rather spend the money bailing out kids here for their poor choices than shipping weapons overseas 3) We aren’t eligible so no personal gains 4) This is really a transfer of wealth to colleges as they get to continue their grift.

I have been a huge advocate of taking advantage of the payment pause. If you have a 0% loan that you don’t need to make payments on, you need to be very very low IQ or extremely irresponsible to actually make payments.

Let’s use some simple math to compare the F’er Method vs the no-debtooor method. For illustration, let’s use some nice round numbers and assume you:

$500 monthly student loan payment

Could earn 2% in 2020 and 2021, 3% in 2022, and 4% in 2023 putting that money in a high-yield savings account (assume after-tax for simplicity)

Have $25,000 loan balance

From March 2020 to Sept 2023 there were 42 months if you paid $500 a month like the no-debtoooor crowd recommended you would have paid down $21,000 on your debt and would owe $4k more… Not bad.

If instead you opened a HYSA in March 2020 and put the $500 each month into your account you would be sitting on $22,214 in cash come Sept 1st.

That is an extra $1,214.

That means you could pay the same $21k off your student loans and still have over $1k in cash that you earned completely risk-free.

Or you could pay $22,214 to your loans and owe less, only $2,786 total still outstanding.

Sooo by ignoring the no-debtooor advice you are over $1k better off.

And we haven’t even gotten to the best part…

Liquidity

Stuff happens in life. A car breaks down. An appliance needs a repair. Someone gets sick. You need liquidity to cover these unexpected expenses. It is why an emergency fund with a minimum of 3 months of living expenses is a baseline when I recommend setting up finances.

Unfortunately most people don’t have any liquidity. You have seen the headlines:

And extra unfortunate, many people follow the no-debtooor path when trying to UnFukt Their Finances.

(Insert Shameless plug - if you want a better way, pick up my ebook aptly named “Your Finances UnFukt” here)

Let’s take one of these people who don’t even have $500 of liquidity. This student loan pause was a blessing - finally you can start building an emergency fund. You could have paid off the $21k and been sitting on $1,200 liquid cash in an FDIC-insured account. You have the start of an emergency fund.

Instead you followed Dave and the no-debtooors and kept putting $500 into a 0% loan. Then your car breaks down and you don’t have an emergency fund. So you put the $1k to fix it on a credit card earning 25% APR….ouch. Having no debt suddenly turned into having more debt and at a high APR.

In short - even if you want to and could keep paying your loans, this pause was a great opportunity to have a massive amount of liquidity for an emergency.

Even if the $1k in extra cash doesn’t excite you, having more liquidity is always better.

But we haven’t even gotten to the best part…

Asymmetric Upside Scenario

Now let me say upfront, this didn’t pan out. But putting yourself in positions where you have asymmetric upside enough is a sure way to get ahead.

There was a chance of $10k of loan forgiveness coming your way. That is a free $10k payout to you.

Lets say the SC went the other way this week and said “yup, $10k bribe is constitutional”. Now lets compare the 2 paths:

The No-Debtooor path:

You were making your $500 payments towards your initial $25k balance and by July of 2023 yo would have had paid $20k and $5k still outstanding

Great news, you get $10k…well not YOU since you only owe $5k, so you only get $5k

The Smart Path:

You are pocketing the money and earning interest so by July 2023 you have $25k outstanding still, since you made no payments

Great news, you get $10k…and actually get the full $10k. So now you owe $15k while having over $20k in the bank.

Both scenarios you could have $0 loan balance in July. But by playing your cards right, if you went the smart route, you had over $6k in extra cash in the end.

To put another way, when you were looking at the $10k forgiveness, if you did it the smart way your outcomes were:

$10k forgiveness passes and you get the full $10k plus the interest your earned on your deposits for a $11k total gain

$10k forgiveness doesn’t pass and you only get the $1k in interest

This is called heads I win, tails I win more scenario and if you are faced with this you always choose to flip the coin.

Compare this to the no-debtooor path:

$10k forgiveness passes and you aren’t eligible for the full amount so you lost $5k in potential money and gained no interest on deposits

$10k forgiveness doesn’t pass and you still have no interest on deposits

To put this in the 2x2 matrix used when talking about Pascal’s wager:

In summary - you were faced with a choice and 2 outcomes where one option gave you a better result in both scenarios:

No forgiveness and you are better off by the interest you earned on your money

Forgiveness and you are better off by at least the interest you earned on your money and potentially up to $10k + the interest

It was really a no brainer which path to choose.

Some Fun with Twitter:

I’ll summarize the full post next, but first, let’s have some fun. The article teased this earlier, so to remind you, here is the tweet:

First, this is a lawyer who went on to be a politician (which is why we can laugh at her, it isn’t some regular person…its a politician) presumably reads contracts for their job, so no excuse on not reading and understanding a simple loan agreement.

Second, on $180k in student loan debt, the interest every month at 6% APR is $900.

Third, there was 3+ year freeze on interest for Federal loans. This means some combination of:

She paid off her federal loans first (since she paid 2 off) and kept private loans, which is dumb

If you are struggling with your student loans and have a mix of federal and private, you put your federal on the lowest payment option available (like income repayment) and pay the private. This is basic as the federal loans have a lot more flexibility.

She wasn’t even paying enough to cover the interest on the loans - probably as she put them into deferment while getting grad degrees

Which means she didn’t work a part time job in school that earned at least $900 a month…which is absurd as many people work while attending college in order to afford it. Even at $10 an hour, that is a part time 20 hour week to earn $900 a month.

She didn’t have federal loans that got a freeze

Since graduation, she hasn’t earned enough to even pay back her loans in 11 years.

Again, I am picking on this tweet because:

She should know better for being a higher-educated lawyer and

She is a politician and is helping to make decisions on student loans for everyone in the country

Anyway, in other tweets the following came out based on public information and disclosures:

Her salary is over $150k a year

Her husband makes over $300k a year for a $450k combined household income

They live in a $1.5 mm home

Her public disclosure says she has no debt over $10k (so either she is lying in sworn documents or, more likely, lying on twitter)

Lots of people have come to white knight in the replies, including in our tweet on it, saying “she can’t pay her loans because she needs to buy food” and “she is evidence the system is broken”.

In short - twitter can be a trip.

Conclusion

I haven’t put a post outside the paywall in a while, and this seemed like a good one to share for free.

If you are a subscriber and followed our original advice from over a year ago and our many follow-ups you:

Made money on interest

Built up liquidity for any unexpected costs that came up in the mean time

Kept the upside potential of a $10k pay day open

The only people who would be better off following Davey boy’s advice are those who are grossly irresponsible and would spend the money that would be going to their loans on iphones and…i don’t know, wtf else kids buy these days…virtual reality headsets???.

I have said the only people who benefit from the Ramseys and no-debtooors of the world are the bottom 0.1% of financial literacy and self-control.

For everyone else, this fun risk-free arbitrage is sadly coming to an end.

But one last piece of parting advice - if you have student loans that have a lower APR than your HYSA (for federal loans this would be for the young kids who took loans in 21-22), you may want to consider keeping your big emergency fund earning the higher interest and only making the minimum payments.

If your student loan is 3% when it turns back on and your HYSA is 4.25%, you are still better off just paying the minimum payment while HYSA are up.

And who knows, maybe there is a miracle where the forgiveness does get passed. That asymmetric upside seems very unlikely now, but there is a greater than 0% probability it happens. So even though the story is less profitable going forward, it may still make sense for you to play it through to the end.

And now you have the framework and information needed to make that decision for yourself.

Good Luck Anon.

This was a very interesting post, thanks for making it free. I am one of those no-debtooors who basically used most of a year's salary to pay down my frozen loans by the end of 2020. Only now getting into HSA's too 🤣