Student Loan Forgiveness - What You Can Learn

Are there any lessons in the recent loan transfer that we can apply elsewhwere

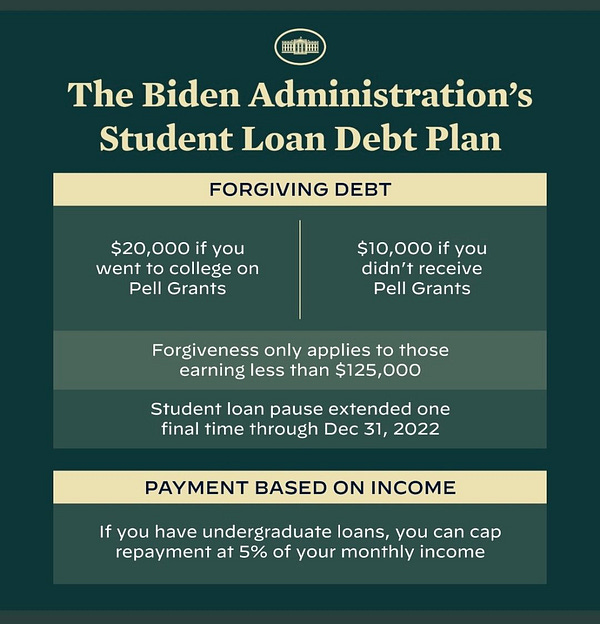

The long anticipated announcement about student loan transfer…I mean bribes, no thats not the word…forgiveness there we go. The “student loan forgiveness” official announcement is summarized in the below infographic:

This post isn’t going to be us waxing on and on about the actual forgiveness…we have gave our takes on twitter…if you want our opinion, 1) this is a bribe and only helps a very small subset of people and most are in the ‘academia’ class. 2) if we have to spend money, we’d rather spend the money bailing out kids here for their poor choices than shipping weapons overseas 3) We aren’t eligible so no personal gains 4) This is really a transfer of wealth to colleges as they get to continue their grift.

We aren’t going to get political (there isn’t a red team and blue team, there is a single team and they hate you)

We aren’t going to complain about not being eligible due to refinancing and income limits (it would suck to have made $125,001 last year).

Nope. We want to use the student loan forgiveness as a backdrop to discuss decision-making concepts that you should be familiar with. These concepts will help you a lot more than a political rant or complaining about fairness.

The last few months have given many potential lessons on optionality, telegraphing, trade-offs, entitlements, and PR spin.

Background on Student Loans

It is becoming common knowledge just how bad of a value college offers most people. There is a large group of grifters that benefit immensely from the entire HS to college to mediocre job pipeline, we have dubbed it the College Industrial Complex (in a reference to the grifters around the Military Industrial Complex).

No one has any incentive to show high-school kids how to calculate the actual Return on Investment of the degree they are taking out massive debts for. Nor does anyone direct people to the best ROI occupations, but rather HS is full of bad advice like ‘do what you love’.

There is no end in sight of the student loan ‘crises’. This $10k (or any amount of money) doesn’t fix anything and arguably just makes the likelihood of future debts to be bigger. Until serious reform happens, the college problem doesn’t go away.

Back on March 13, 2020, the then president Trump froze student loan payments and dropped interest to 0% due to the coronavirus. This was a 60 day emergency measure during the lockdowns, which is now extended through the end of the year 2022, almost 3 years.

The continuing loan freeze, and now the loan ‘forgiveness’ have all had their legality questioned as they are done by executive order (ie- no voting on it, president just says so with no checks or balances). There is some language in the Higher Education Act that allows for a large swath of activity by the president through the secretary of education. Also in the HEROES Act (LOL! aka the $3 Trillion Covid stimulus), gave the president the right to wave or modify loans while we are in an emergency.

In short, since mid March 2020 no one had to pay a penny on any federal student loans and there has been no interest accrued on them.

On Weds, the payment freeze that was supposed to expire end of month was extended through the end of the year. Additionally the $10k per borrower and $20k for pell grants up to a certain income level was ‘forgiven’.

Now with that background, what can we learn from this? Even if you don’t have loans, a lot of people didn’t play this correct and we can take lessons and apply it to other situations.