Measuring the ‘Value’ of College – Part 2: The Calculating

By The Effin Sequel is better

“Never Lose Hope. Storms Make People Stronger and Never Last Forever….Even the Worst Storms aren’t Student Loans, those things last forever”

-Roy T BenInDebt

Quick Summary

You can value your college decision using capital budgeting

2 of the most used methods are the payback method and net present value

This post shows a sample calculation using generic results of a high school and college graduate that you can use to calculate your own decision trade-offs

This post also includes some internal benchmarks I would use to ensure you get your moneys worth

In Part 1 I went over the background on student loan debt and what I referred to as the ‘College Industrial Complex’. Take a minute to read it as it will help you go into this article with clear eyes about the size of the problem. It is important for you to understand all the forces that benefit from the current system. Once you see the con for what it is, you free yourself to maximize your own gains without hesitation.

Here in Part 2, we will get into the way to actually figure out if your future career plans are worth the cost of college debt & the lost time you are taking on.

How The College Value Proposition Should be Calculated?

Capital Budgeting.

When a business is looking to decide between 2 or more projects it will use capital budgeting. It doesn’t matter if the projects have different costs, different profits, and different time horizons as capital budgeting accounts for those differences. It is business decision making 101. And I have never seen it recommended to actually calculate the value of your college plans.

There are a few different methods of capital budgeting. Net Present Value (NPV) is the most used. NPV calculates the present value of 2 strings of cashflows. It relies heavily on time value of money concept. Here is a prior post detailing time value of money. However, the summary is its just the preference for a dollar today over a dollar in the future. You would want to receive more money if you need to wait.

The other useful method is Payback Period. This is simply the time it takes to recoup the original cost. If you spend $75 on a machine and make $50 a year using it, the payback period on your investment is 1.5 years ($75/ $50). Lower the payback period the better as it shows you are earning back your initial cost faster.

Other methods include the internal rate of return and the profitability index. Both are useful, just not for valuing college.

Introduction to Capital Budgeting

The below example is a generic capital budgeting illustration. Assume you own a company and are choosing between 2 projects. For instance, you are buying a machine that will produce income for your business.

Project A is a cheaper machine that costs $100. It is also easy to use, therefore you can immediately start making good income on it. However, since it is cheap, its expected life is only 3 years then it breaks. Over those 3 years you earn $400, $500, and $600.

Project B is a more expensive machine costing $1,000. It is also more difficult to learn so there is training cost in the first year which decrease year one’s income. However, it lasts for 5 years and you can earn $600 each year once you get up and running.

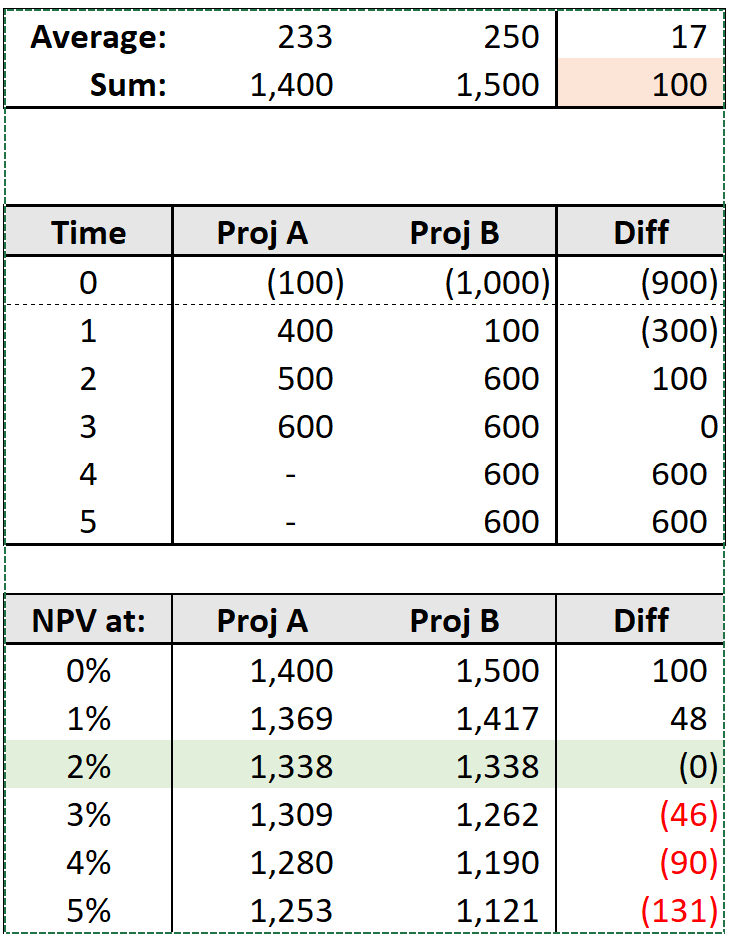

Exhibit shows the 2 separate projects A & B and the difference in cashflows over 5 years

The average and sum of the cashflows is in the top table

The table at the bottom shows the NPV at various discount rates

Notice NPV at 0% is the same as a sum of cashflows in the top table – NPV at 0% is the same as summing up the cashflows

Results:

If you discount at anything over 2%, you would be better off going with project A as it has a higher NPV at higher interest rates

Note how the discount rate chosen is very impactful on the end results

The payback periods are also different:

Project A pays back the $100 initial investment within the first year

Project B pays it back mid-way through year 3

How to select the discount rate to use in NPV calculation is very important decision. Typically, you would use the cost on the investment or another opportunity cost. For example, if you took out a loan at 4% interest rate to buy the machine, 4% discount rate could be reasonable. However, if you have a different opportunity with a 6% expected return, you could also discount at 6%.

Lastly, you will notice that the payback period and the NPV can tell you 2 different optimal choices. This is not unusual as payback period is only concerned with the near term, while NPV looks over the entire projection. When they don’t agree this is useful as well. In this case, higher NPV would be the optimal choice.

Now you can actual value the college decision.

Calculating Value of College with Capital Budgeting

I will walk through an example on how to use capital budgeting to value college. However, the summary is pretty simple.

Find the starting salary and long-term salary expectations for your career choice

Find the expected student loans you will graduate with

Put 47 rows into excel from age 18 to age 65 (47 years)

IF you choose to work right out of high school you earn income from 18 to 22, whereas going to college means expenses

Now project out your career salary growth from the starting salary to the long-term salary for each path

Adjustments for taxes, student loans loans, and discount using a reasonable rate

You can start with the discount rate being your student loan rate

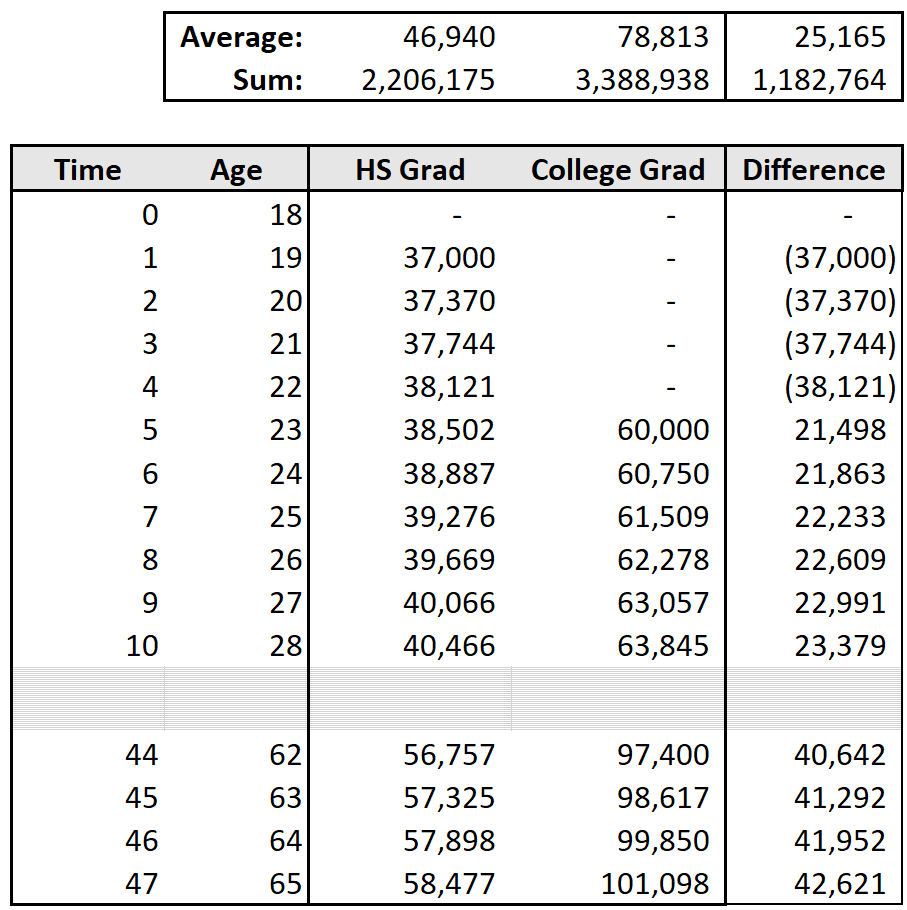

For simplicity, the below is using some average salary numbers from online, but note these can vary from website to website:

Average college graduate with a bachelors earns approximately $60,000 starting salary

Average high school graduate will earn approximately $37,000 starting salary

Average earnings of a college grad is $78,000 vs $45,000 for average high school graduate

This implies college grad gets slightly higher raises than a high school graduate as well.

Average student loan debt is $37,500 upon graduating

The table to the left uses the above numbers to create a reasonable scenario. In real-life you would want to tailor these numbers to your actual situation.

This table looks pretty good for college. Even though the high school grad has 4 extra years of earnings and salary increases from age 19-22 while the college graduate is in school, the post-college salary is more than $20,000 more. This quickly makes up for the lost time.

Notice, the differences in the sum of the 2 cashflow streams in the top table ($2,206,175 vs 3,388,938) is where that “earn $1 million more over your career, on average” statistic gets calculated from. However, there are a few more steps to be done.

Adding College Costs and Taxes to Capital Budget

There are 2 main adjustments that need to be made to the above projection. First, the college path needs to add in the expense of going to college. Second, most of the western world has progressive income taxes, therefore we need to account for this by making our numbers after-tax. Lastly, we need to take into account the time value of money.

Here is the same table as before but I included 4 years of college costs into the college graduate’s path. (37,500/4 = 9,375)

Tax rates vary based upon income and I only calculated federal tax rates for a single, 0 dependent person

The effective federal tax rates calculated can be found here

Progressive tax rates means, the higher your income, the higher your taxes

State taxes are not included and tax rates are constantly changing, you just want a rough estimate

To calculate an after-tax number, you take the pre-tax number multiplied by (1 – Tax Rate)

You will notice the differences are smaller when reflecting taxes and the cost of college. You can best see this on the 2nd row where the sum of the columns are. The number all the way on the right is now $895,095 where it was $1.18 million in the first table.

However, $895,095 is still a sizable number of after-tax income you earn from college in this situation.

Calculating the Payback Period

“Payback is a dish best served in a short period of time after the initial investment”

– Charles Bronson in Death Wish 12: The Retirement Advisor (the series really jumped the shark at the end)

The payback period is the amount of time to recoup the initial cost/investment.

First, I would define your cost of college as both the (1) actual amount you paid out of pocket & loans borrowed to attend, and (2) the lost income you could have made working if you didn’t go to college. This is over $175,000 over the first 4 rows of the difference column.

Secondly, the gains on the investment in college is not your salary. It is the additional salary over what you would earn without attending college. This is again represented by the difference column.

For simplicity, I didn’t provide the full table. However, when you do this yourself, you just sum up the numbers in the difference column until the cumulative difference is positive. The payback period for college is slightly over 15 years in the above example.

I would personally consider that entirely too long. Anything over 8 years would be my cut off. Yes, this means that within the first 4 years after graduating with a 4-year degree you should have earned enough to pay off college AND out-earned the 4 years of salary given up. This is very doable. The investment in college is $175k above. If you made $100,000 a year after college, that would be around $80k after-tax, and almost $50k over the salary of a high school grad. At that income level, you would be able to pay the $175k initial cost off in under 4 years.

Alternatively, you could (1) go to a cheaper school, (2) take extra courses and graduate in less than 4 years to start working sooner, or (3) work a legitimate part-time job to earn money while in school. But if it is taking you more than 4 years to realize the benefits of your college choice I would call it a poor decision.

Calculating the Net Present Value (NPV)

Last step to do NPV capital budgeting is to calculate the NPV of each decision. It is easy to run a few different discount rates so the table below shows NPV for 0% to 5%. However, the number I would focus on is the NPV using the average interest rate on your student loans.

Reminder that the NPV at 0% is just the sum of the cashflows and matches the nearly $900k higher earnings of a college graduate shown above

Assuming 2.75% cheapest student loan rate, the difference on a NPV basis is only around $350,000

If you are taking out private loans at 5%+ the value proposition starts to look pretty bad

NOTE: Excel has a net present value function in it, so type “=NPV( )” into a cell and select the discount rate and cashflow stream to get the result.

Similar to the payback period, the $350k NPV benefit of attending college is not large enough for my liking. There is a lot of uncertainty and for making the initial investment of $175k, I would want a much better pay off. Especially since we used a low discount rate of 2.75%, which makes college compare better. If I was to do this for myself, I would use a 7% discount rate as an estimate for a return on investing in the markets. I would also target $1 million high NPV from college. This roughly means starting at a $100,000 salary and working up to a $500,000 salary at retirement. That is the kind of career growth that would justify going to college and graduating with $37,500 in debt.

Comparing Different Careers & Colleges with Capital Budgeting

The above example used generic ‘average’ numbers quoted off the internet. First, recall that ‘averages’ are generally not useful. For instance, nearly all very high starting salaries require a college degree. Therefore, the average starting salary number for college graduates gets driven higher by these high-earning majors. However, many majors will result in jobs that make less than the average.

Additionally, many careers require more than 4 years of schooling. The calculation doesn’t change. You just input the actual numbers for your specific situation. For instance, spread the cost of a 6-year masters out over years 1-6 in the cashflow projection.

If you recall above, I said anything over 8 year payback is too long. You may have recognized it can take 8+ years to get through school to be a doctor, dentist, lawyer, etc.

Yes, that means I think these are bad professions to choose. You make good money when you get out, but you spend your most high-energy years in school building up massive debts.

“Doctor Doctor, I’ll give ya some news, you got a whole bunch of debt coming due”

-Robya Palmya

Teachers need more than 4 years of school and typically make less than the average college graduate quoted above. Therefore, not only do they typically leave college with >$50,000 in debt, they lose an additional 2+ years of earnings while being in school. Then make a below average salary. This should be self-evident since there are so many loan forgiveness programs for teachers. If the pay was worth the career you’d be able to pay off the student loans, not have them forgiven in 10 years.

For a masters in journalism you wind up with $300,000 in student loan debt, a job paying $10 an article writing for some internet site, and a crippling need to write (terrible) ‘advice’ articles explaining why people should follow in your footsteps, or so it seems.

The great thing about capital budgeting methods are that you can compare all these different paths and more. Are you looking at the difference between engineering at 5-year engineering focused college vs. finance at a private school vs. accounting at a public school? You can compare 3, 5, 10, or 1,000 different paths to see what options work for you.

Are you considering going back to school for a masters or MBA in your 30s? You can use the same method, just plug in the new numbers and project out to retirement age.

Average High School Graduate

Just like how a college grad’s salary will differ from the average based on career choice, the average high school grad’s salary will also vary.

First, a large portion of high school grads who don’t go to college are just lazy people who plan to work menial jobs. This group will drag down the average high school grad’s result. in the group that didn’t go to college.

Second, there are careers that don’t require college that can pay well over $50k or $70k a year. Welders and truck drivers routinely make $50,000 a year. Sales is a field that you can hustle for huge salaries. The only limit to your salary is how much sales you can close.

Lastly, one of the most confusing things is when a child is going to take over the successful family business but is still sent off to college. It makes no sense. If 2% of what you learn in college is ever used again, you are lucky.

Think of college as a very expensive toll that is required for some careers. If you already have a career, college is a waste of time at best. Or, as Sonny says, college is negative value as you wind up going and getting “stupid”.

In short, you could graduate college and end up in a job that makes less than a high school graduate depending on your choice.

Conclusion of Calculating College Value

This post was dense. However, the using payback period & NPV to actually quantify the cost & benefit of your college choice is very powerful. Therefore, I did not want to strip even more details out.

I did gloss over the details of setting up the spreadsheet calculation for brevity, though. I assume readers can follow along, but if you do have questions I can put a post with detailed steps on how to set up the spreadsheet.

If you read all the way to the end, congratulations. You are going to make it. Capital budgeting can be applied to any financial decision in your life. If you end up working in business, some form of capital budgeting is used in nearly all business decisions as well.

Using the average numbers, going to college failed both the thresholds you should use, greater than 8 year payback period and less than $1 million higher NPV. It is not surprising student loan debt is such a problem with these numbers.

Lastly, you may still choose to pursue a career you love even if the pay is poor. You should still use these tools to better understand the type of financial situation you are getting yourself into. It may persuade you to go to cheaper school, do community college for a few years and transfer, try to graduate early, etc. At a minimum, you can walk in knowing the consequence of your choice.

We will finish up with Part 3 where we discuss how to make an optimal career and college decision.