BowTied Wombat Guest Post & Free Ebook for Subs

The Two-Sided Economy: Real vs Financial Comparing the Impacts of Fed Actions on Today's Market and the 2008 Global Financial Crisis

This week we got a free guest post from one of the most criminally underfollowed bowtieds out there.

drops some serious helpful economic and financial alfa. He is going to help make sense of what is going on in the world and despite all our time spent on the subjects, I learn things from his twitter & stack - 100% worth a sub.But before getting into this great breakdown of why 2022-23 is not the same as the 2008 GFC (we did some history on the global financial crises from our spot being in investments at the time), some quick housekeeping.

I just wrapped up the first (of hopefully many), long-form material. Our book is ready to go live and later this week I will be dropping a link. In this weeks paid post, I will provide a code to get it 90% off plus some extra incentives. I mentioned it was coming a few months ago, and ended up with over 100 pages of material to help take you from zero to some when it comes to personal finance.

If you are a free sub and been thinking about going paid, its a great time to do it now. You get a few months of your sub paid for just with the discount. And instead of combing through posts, you get the full plan in one spot in order. Subscribe below:

Without further ado, here is BowTied Wombat

Introduction

In this post, we will build out a basic model of the economy and then use it to discuss the current economic situation and compare it to the 2008 Global Financial Crisis (GFC). To keep things simple, we won’t discuss topics like government spending, bank credit, and international trade; instead, we will focus on the differences and connections between 2 systems:

Real economy

Financial system

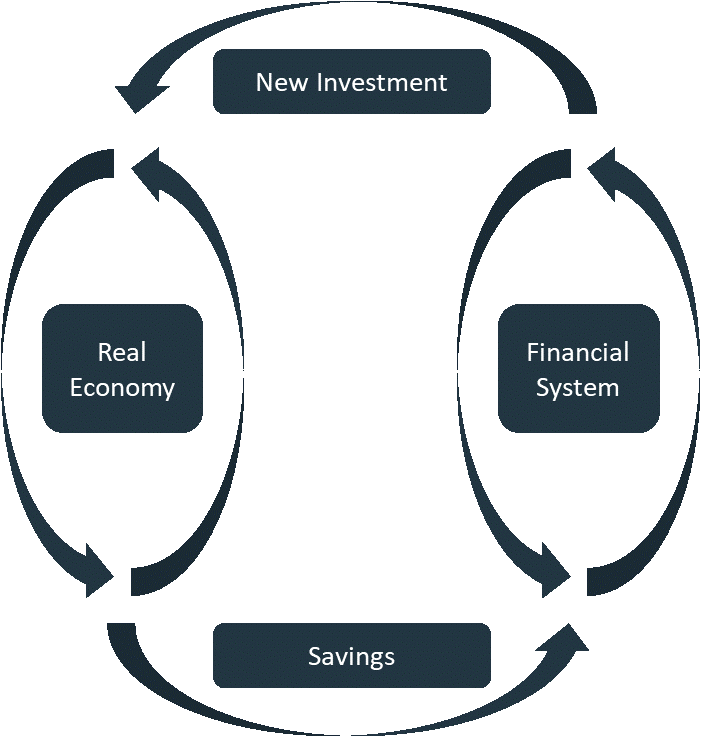

We will be walking through and explaining the following visual:

Think of the economy as two separate but interconnected systems: the real and the financial.

In general, these systems can be described as:

Real economy: Where people buy and sell actual goods and services. It involves consumers and businesses

Financial system: Where investors trade investments like stocks and bonds. Participants include investors, brokers, and traders

Money transfers between the two through:

Money goes from the real economy to the financial system when saved (even bank accounts are invested)

New stock or bond issuances transfer money from the financial system to the real economy

Let’s dive deeper into each system through more detailed examples.

Real Economy

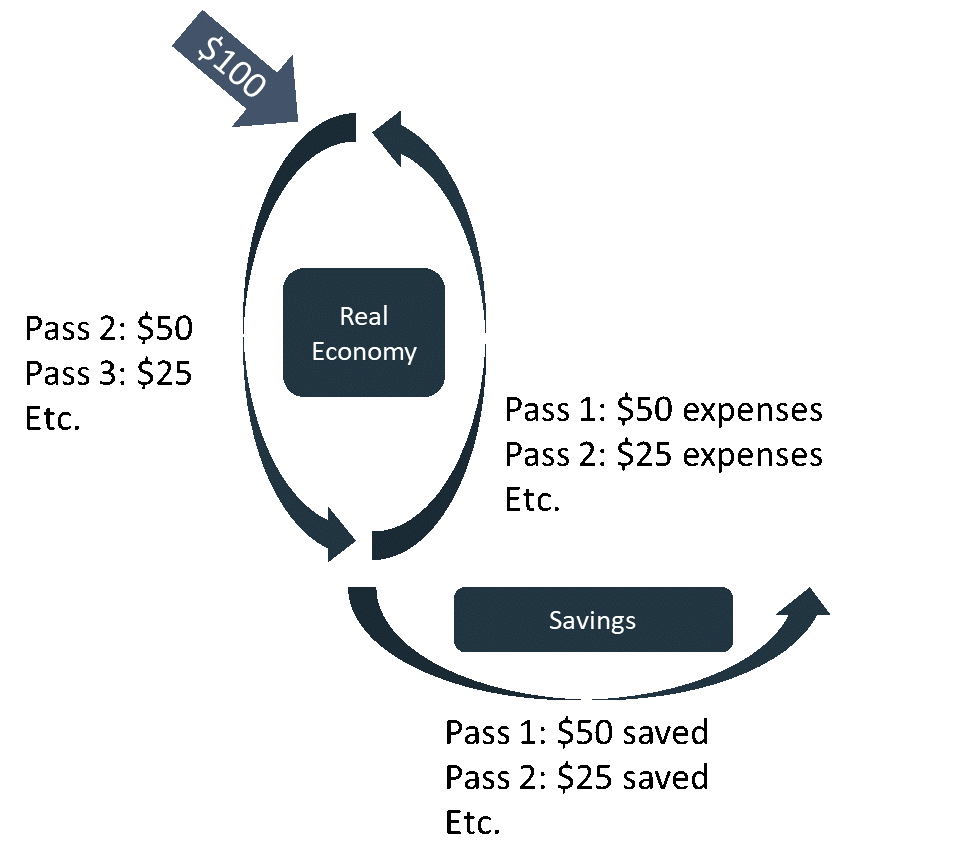

When you buy from a business, the revenue is used for expenses or income. Let's consider the following example:

Revenue is split 50% for expenses and 50% for income.

Expenses are all wages.

Workers spend all their wages.

Business owners save and invest all net income.

In this example, a $100 purchase is divided into $50 for wages and $50 for income. The $50 for wages is spent back into the real economy, while the $50 for income is saved and sent to the financial system.

The $50 for wages is split again, and the process repeats itself. A portion of the spending is transferred to the financial system each iteration until its effect is negligible. In reality, the amount is much less than 50%, allowing circulation in the real economy to last longer.

A few notes and additional points:

The impulse of spending has a multiplier effect, where its impact is greater than the amount spent (because a portion is recycled)

Time is a crucial factor; the speed (and thus impact) differs if all the spending cycles are spread over one day versus ten years

The tendency to save or spend influences impact

If a billionaire gets the $100, they'll likely save it

If a non-rich person gets the $100, they'll probably spend it

Therefore, who receives the stimulus affects which system it circulates in

The real economy needs to be renewed (food spoils, time is spent, maintenance is necessary, etc.) while investments are more enduring

Financial System

Now, let's focus on the financial system. Consider this simple equation:

This equation is oversimplified, but it does adequately capture some dynamics:

If there is a $100 of new savings that is invested, the total money in the system increases by $100 while the number of investments stays the same, leading to asset price increases.

If $100 is taken out and invested in a new business, the total money in the system decreases, and the number of investments increases, leading to potential asset price decreases. In reality, the $100 investment stimulates the real economy, leading to new investment, so it probably washes out.

In a third scenario, an investor sells an investment and buys another one. No new money enters or leaves the system, and no new investments are made or destroyed. The overall size of the financial system remains the same, but one asset class or asset increases in value while another decreases.

If no one trades, prices don't change. If one person trades, the rest of the investments are marked up or down, impacting wealth, but no net money is created.

Let’s walk through an example. A seller with cash can:

Reinvest in an existing asset

Invest in a new asset

Spend in the real economy

Option 1 recycles money within the financial system, increasing circulation. Like the real economy, the financial system can grow through increased money circulation (velocity of money). If you want to learn more about this topic, check out my post on Inflation. Circulation stops when a seller chooses options 2 or 3.

Options 2 and 3 transfer money back to the real economy:

Option 2 provides cash to businesses for capital improvements or new ventures

Option 3 directly transfers money to the real economy and becomes spending

A couple points:

Option 3 is least likely, as savers tend to save. There is a notable exception in retirement, where savers become spenders (which is why demographics matter)

Option 2 is more costly than option 1, as the lack of history for new investments means they require more effort to underwrite and are riskier. More effort and more risk means new investments tend to require a higher expected return than existing investments

In summary, there are two systems circulating cash within each, and there are natural transfer mechanisms between them, creating an overall system like the picture below.

That's great, but why does it matter? In the next section, we will take a look at 2008 and 2022, using our simple economic model to compare the differences between the two situations and what it means for the future.

2008 vs 2022: A Simplified Comparison

2008

In 2008, the Federal Reserve started quantitative easing (QE), which is printing money to buy bonds. This increases money in the financial system and decreases the supply of bonds.

The goal was to encourage money flow from the financial system to the real economy 3 ways:

Wealth effect: When people see their assets, such as their homes, increase in value, they feel wealthier and tend to spend more money

Lower expected returns: The goal was to decrease the expected returns of investments in order to encourage investors to try out new ventures that would provide higher returns

Removing toxic assets: By getting rid of toxic assets, the hope was to make the financial system more stable so that banks would keep lending money in the real economy

However, there were 2 main reasons why the money mostly stayed in the financial system:

Economic and regulatory uncertainty made people more risk adverse

QE meant there was a constant demand for bonds, so rather than lend in the real economy, banks invested in those bonds

The market's new QE dynamic ended up inflating asset prices. When it finally did make it into the real economy, it entered the economy through stock buybacks and venture-backed tech investments (which are essentially call options with their low initial cost and high potential payoff). Financial and tech sectors benefited the most from cheap money.

Inflation did occur just as asset price inflation, not consumer price inflation, because the money didn't flow into the real economy.

Summary: Stimulus went into the financial system and mainly stayed there, inflating asset prices.

2022

In 2020, stimulus money went directly into the real economy to businesses and consumers. This money was spent in the real economy, leading to an increase in both consumer prices and asset prices (the later from low discount rates and strong earnings, check out my post on Risk Premia to learn more about this). To remedy this, the Federal Reserve began interest rate hikes and quantitative tightening (QT).

Higher interest rates hurt asset prices and slow the real economy. QT does the opposite of QE: it decreases money in the financial system and increases the number of assets. In response to these dynamics, the market experienced a downturn in 2022.

Summary: Stimulus went into the real economy causing inflation.

Conclusion

In this post, we built a basic model of the economy and discussed how it relates to the current economic situation, comparing it to the 2008 Global Financial Crisis (GFC).

We focused on two systems - the real economy and the financial system - and how they interact. As we saw in our examples, these two systems are distinct, yet interconnected, with money transferring between them.

While the Fed's actions after the GFC helped boost asset prices, their current actions are working against them, making it more challenging for assets to appreciate.

I often ask myself a question when deciding on a position: What do I need to believe to make this decision?

Right now, the market is pricing assets with the assumption that 3 things are true:

Inflation will soon return to 2%

A recession will force the Fed to lower interest rates

The recession won't hit earnings too hard

This outlook is pretty optimistic. If you're feeling positive about assets, you'll need to be even more optimistic than that.

To make sense of this market, keep the following in mind:

The data the Fed is using to make decisions

The different economic scenarios that could play out based on that data

What the Fed might do in each of those scenarios

How the market's expectations might change as a result

Once you've thought about all of this, decide which scenario you think is most likely to happen. But don't forget to consider a range of possibilities instead of focusing on just one outcome. Look for opportunities when the odds seem to be in your favor. If you're uncertain, consider examining how these factors influence our economic model and their subsequent effects on asset prices.

It’s F’er again. Big thanks to Wombat for a great post laying out how the real economy and the financial economy differ and why 2023 isn’t a direct repeat of 2008. This is a lot of good info synthesized down into a digestible post. This is years of college courses being applied into something anyone can understand.

He has lots of posts breaking down portfolio management, investing fundamentals, and economics.

Go give him a follow as his material will 100% help you when you read our stuff.

And keep your eyes peeled later this week for our paid post & the offical launch of our e-book: “Zero to some - Your Finances UnFukt” and that code to get it for basically nothing if you sub.

Good luck anon.