Credit Suisse, Counterparty Risk, Global Financial Crises of '07-'08, and Banks Are Zeros

Some thoughts on recent events and explaining counterparty risk & GFC

We have generally stayed away from writing about current events as there is enough noise from all the talking heads. However, we have almost 80 posts published on our stack and now it is time to start being more topical. This week there is a lot of news articles on Credit Suisse.

This all feels very similar to the Global Financial Crises (GFC) of ‘07-‘08. For those of you 30 and younger who weren’t around, it was a huge shock to the financial system at the time.

Why should you care?

A lot of people lost a lot of money following talking heads during the GFC. Learning a bit about it may help you avoid falling into the same traps.

[F’er Note - The GFC has had entire books written about it. There is no way we can do it justice and cover all the nuances and details in a single post. We will take some liberty with generalizing and paraphrasing items as well as bouncing around the timeline a bit.

The purpose of this post isn’t a historical re-telling of the GFC, but to pull out some of the more interesting anecdotes and tie it back to what is going on in the world today.

We were working at one of the many firms who were underweighting Treasuries to overweight AAA-rated securitized products and underweighting utilities to overweight financials. This trade worked great, till it didn’t. We had a front row view to the chaos. In short, don’t @ us with reply guy about nuances.]

The Global Financial Crises (2007-2008)

F’er was a relatively recent college grad around the GFC and working at an asset manager. We got to see it first hand and watch as 30+ year investment veterans threw up their hands in disbelief at what was going on. All sorts of ‘rules’ were broken and it was a tumultuous time.

So what was the GFC?

The wikipedia link above sums it up well in the first paragraph so we will quote it directly

The financial crisis of 2008, or Global Financial Crisis (GFC), was a severe worldwide economic crisis that occurred in the early 21st century. It was the most serious financial crisis since the Great Depression (1929). Predatory lending targeting low-income homebuyers, excessive risk-taking by global financial institutions, and the bursting of the United States housing bubble culminated in a "perfect storm." Mortgage-backed securities (MBS) tied to American real estate, as well as a vast web of derivatives linked to those MBS, collapsed in value. Financial institutions worldwide suffered severe damage, reaching a climax with the bankruptcy of Lehman Brothers on September 15, 2008, and a subsequent international banking crisis.

At its core, excessive leverage (debt) in the system made the entire economy extremely fragile. As the housing market got hot and house prices increased, people got complacent and thought the good times would go on forever.

Home owners were taking equity out of their homes left & right. Most of this money was squandered on junk. Banks were lending to anyone with a pulse. Bad loans were being bundled and sold off to investors with the most secure AAA-rated debt. Investors were buying up the AAA junk to get a bit more yield. Banks were selling credit default swaps (CDS) which gave them small profits today but exposed them to massive losses if companies were downgraded or went bankrupt. (For simplicity, you can think of a CDS as a put option and banks as selling puts which is likened to ‘picking up pennies in front of a steamroller’…despite our love of doing it.)

When the music finally stopped, everyone was caught with their pants down.

In the periods that followed the mid-September bankruptcy of Lehman Brothers, we found out how atrocious the entire financial system was.

Banks were lending to borrowers who should never have qualified for a loan. The debt was changing hands as they were sold off to other servicers. Then they were obfuscating the poor loans by slicing, dicing, and bundling them with better loans.

Much of the time the paperwork wasn’t even being done correctly. This lead to a handful of cases where banks couldn’t foreclose and take ownership of the property because no one could produce the correct documentation to prove they actually had the right to foreclose. (This article explains the process best from what we could find).

Frozen Markets

One of the biggest issues that resulted from the above was a complete seizing up of markets. Banks couldn’t even tell how bad their own balance sheets were, let alone have any insights into other banks.

Trillion dollar liquid derivative markets suddenly couldn’t find a bid as no one wanted to further add exposure to counterparties who may actually be bankrupt.

Bid-ask spreads got huge. Market prices are set based on the marginal buyer, so illiquid markets lead to huge price drops as no one is willing to buy the security.

Huge AAA-rated securitized product markets saw their yields blow out like they were junk bond.

[F’er note - securitize products are mortgage-backed securities (MBS), commercial mortgage-backed securities (CMBS), asset-backed securities (ABS), etc. There are many different underlying mechanisms, but these basically function like the following:

Banks make a bunch of loans (ie-mortgages)

Banks bundle a bunch of loans into a ‘security’ and sell it to investors

When borrowers made a payment on the loan, the bank takes a small percent of the payment and passes the rest of the payment through to the investors as interest and return of principal

The securities had tranches (ie-different risk options), or were over-collateralized (ie - $110 of loans sold as if only $100 so the first $10 of defaults wouldn’t impact the investor) which allowed them to get the ‘safest’ AAA rating. (Or were just so complicated that the rating agency couldn’t understand them).

If you want more information, the answers on this quora do a good job walking through the nuances of MBS.

At the time, these structured products offered above Treasury yields while still being AAA-rated. This allowed companies to meet the investment portfolio standards for good credit ratings while getting higher yields.]

[F’er Note 2 - The credit rating agencies are another interesting story around conflicts of interest. Their jobs were to look at fixed income (bond) securities and give them a rating based on how risky they were.

Companies would pay to get their securities rated as most institutional investors had mandates based on credit ratings (ie-could only buy securities with credit ratings above a certain level and needed to keep a certain average credit rating across the entire portfolio).

So investors were the ‘customer’ of the credit rating agency, but the company asking for a rating was the only one paying the agency. Lots of words have been spilt asking if credit rating agencies were unable to correctly evaluate risks or were incentivized to be ignorant about the real risk to ensure more products were made and sent for a rating = more revenue for the rating agency.]

Talking Heads During The GFC

What shouldn’t be surprising was how wrong the ‘experts’ got it during the GFC…or at least how wrong their public decrees were since we don’t know if they were doing the opposite in private.

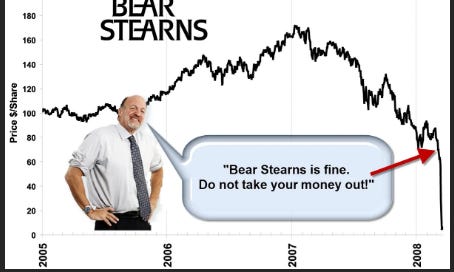

In probably the most famous example, Jim “counter-trade me” Cramer answered a viewer question about Bear Stearns with the infamous quote “Bear Stearns is fine. Do not take your money out!!!”

The actual segment:

Cramer: Peter writes, “Should I be worried about Bear Stearns in terms of liquidity and get my money out of there?”

No! No! No!

Bear Stearns is fine. Do not take your money out. If there’s one takeaway, Bear Stearns is not in trouble. I mean, if anything, they’re more likely to be taken over. Don’t move your money from Bear. That’s just being silly. Don’t be silly.

The stock was trading in the low $60 range when this segment aired and a week later Bear Stearns was finished.

From a $60 stock price to $2 price is a ~97% drop. If you had $10k in Bear Stearns you ended up with $300. That type of lighting of money on fire is typically reserved for sh!tcoins not huge banks.

Cramer may be the most egregious example, but there were plenty similar cases. Banks were firing employees to cut costs and the talking heads were saying how this would result in leaner orgs who would be great investments. A lot of people got absolutely rekt listening to this advice.

Government Picks Winners & Losers

The other major thing that happened was the Gov’t stepped in and basically picked winners and losers. The Gov’t set aside over $700 Billion to give to banks and then chose how to distribute it.

We will throw on our tinfoil hat and point out that the banks that got some of the biggest chunks of the bailout happened to be banks that were well connected to the people in charge of distributing the money.

At the time, the government set up the Troubled Asset Relief Program (TARP). TARPs purpose was to provide liquidity to the illiquid & frozen markets. The theory was the government providing huge loans to market participants and an implied backing of the system would make banks more willing to lend. (There is a ton of controversy around TARP and how it was executed. With 20/20 hindsight it looked bad and no one was happy, however at the time there was a feeling of it being necessary.)

Goldman Sachs got somewhere around $125 Billion and had the benefit of Treasury Secretary Henry Paulson & the “bailout czar” Neel Kashkari as company alum.

Merrill Lynch was purchased by Bank of America which we later found out was less of a purchase and more of an extortion. Treasury Secretary Paulson threatened Bank of America CEO Ken Lewis with being fired and having the board of directors replaced when Lewis tried to back out of the deal after seeing how much of a mess Merrill was.

Additionally, the Government takes over Fannie Mae & Freddie Mac, the 2 US agencies backing conforming loans.

Lehman Brothers was allowed to fail. During all the bailouts, there was a growing chorus of voices decrying that all the banks were getting billion, they were paying $10s of millions in bonuses to their executives who just caused the crises, and meanwhile normal people were getting crushed in the recession. The narrative moved to ‘at least one bank needs to fail otherwise you are reinforcing risky behavior’. Lehman drew the short straw.

This post from Wharton provides extra details on Lehman vs AIG. AIG received a big bailout the same week Lehman went bankrupt. In short, AIG was deemed systemic because it had so much interconnectedness with other banks due to derivatives. If AIG failed, all those derivatives would go to 0, and all the banks would need to take losses which would result in failing the required regulatory capital. Which brings us to counterparty risk.

Counterparty Risk

A counterparty is just the other person in a contract. If bank A and bank B enter into an over-the-counter (OTC) private contract, then:

Bank B is the counterparty to Bank A and

Bank A is the counterparty to Bank B

Simple enough, but what if Bank B wants to hedge some of this OTC exposure? It goes and contracts with Bank C in a separate OTC contract. Now you have

Bank B to Bank A

Bank A to Bank B

Bank C to Bank B

Bank B to Bank C

But even though Bank A and Bank C don’t have a contract with each other, if Bank A fails, it impacts Bank B directly but also causes a loss to Bank C since C indirectly had exposure to A. Now include the investment arm of Bank A, B, C, and D all purchasing and selling different products based on the performance of A, B, and C….If your head is spinning already, this is just 2 contract between 3 banks, there were dozens of banks with Lord knows how many contracts between them. The number of permutations gets huge in a hurry.

Counterparty risk is the risk the the other party in a contract fails to uphold their end of the deal.

So in short, as these increasingly complex derivatives are made to take a slice of the risk and trade it, more and more entities become entangled. This is how you have banks with Trillions of counterparty risk on their balance sheet.

But surely, with how terrible the GFC was we learned our lesson and it won’t ever happen again right?

Are We Headed For Another GFC?

Let’s first look at derivatives and systemic risk. A cool 2 Quadrillion (that is the number after Trillion) in derivatives on bank balance sheets.

The current bull run that peaked at the end of 2021 was caused by very loose monetary policies and easy money. When you can borrow at near 0% interest, everything looks very attractive and people start taking on massive debts and leverage. Then they need to go out the risk curve to chase better returns since the safer investments aren’t returning enough.

The Fed funds rate was at 5.25% at the start of the GFC and we are increasing back to a similar level.

All it takes is for one bank to fail and suddenly the whole system freezes up due to how interconnected it all is…

Is Credit Suisse The First Domino?

Credit Suisse ($CS) is making a lot of financial news recently. Most financial news reports start with the stock price and spend 1k words saying “the stock is down, here are 10 peoples opinion about what the stock will do next”. But basically CS made a bunch of shit-tier loans (yes that’s a pun, as it is shittier and also shit-tier as in not tier 1, or tier 2). What kind?

$5 billion loss on a loan to client Archegos Capital Management & Bill Hwang that went bankrupt in scandal

$5.5 billion payouts due to the $10 billion in funds with bankrupt Greensill Capital

$475 million fine for ‘tuna bonds’ in Zimbabwe

$800 million lawsuit from a whale investor in one of their funds that is still ongoing

After $10 billion+ in losses from bad loans and risk management, CS had a CEO quit, a bunch of long time top execs quit and is undergoing restructuring (ie-laying off a bunch of people and trying to sell a line of business).

Well if you just went through a bunch of bad loans and scandals, your bank now has a discount on any business you sell. Who wants to buy a line of business and then get hit with a bunch of losses and lawsuits?

So with the looming question of “what else is coming down the pipe?”, people start losing confidence in your solvency. And since you are a bank holding people’s money, they get nervous and want that money back. This starts the negative flywheel of people taking out capital and the bank’s capital position looking worse which makes more people panic and take out their capital.

Arguable the biggest tell that things aren’t pretty, is the CEO putting out a memo reassuring everyone that things are fine and doing a client visiting tour to tell them it is great & no need to panic.

In last week's memo, Mr Koerner told staff: "I trust that you are not confusing our day-to-day stock price performance with the strong capital base and liquidity position of the bank."

He said there were "many factually inaccurate statements being made" in the media, but urged staff to stay committed ahead of the transformation plan, which will be unveiled on 27 October.

"We are in the process of reshaping Credit Suisse for a long-term, sustainable future - with significant potential for value creation.

"I am confident we have what it takes to succeed."

-https://www.bbc.com/news/business-63117352

You know what CEOs of companies that are fine don’t do? Tell everyone things are fine.

The WSJ post goes into more details and speculates it’ll take $4-6 billion in capital to shore up the company. As of this writing CS total market cap is a bit over $10 billion, meaning that if they need to raise capital through an equity offering, it will be extremely dilutive.

Additionally, CS’s CDS have blown out past the GFC level meaning a lot of people are willing to pay up for protection in case CS gets rekt.

Not pretty.

Summary - Credit Suisse, Counterparty Risk, and Global Financial Crises

We aren’t full on sounding the alarm. There are many commonalities with the GFC, but some of the reform since the GFC has lead to banks holding more capital. Additionally, CS is a Swiss bank and the Franc has been one of the better performing European currency which should help a bit. Lastly, rising interest rates are a good guy for banks as it gives them more room to make margin between loans and accounts (assuming rising rates don’t lead to recession and defaults and CS didn’t hedge away all their interest rate exposure).

We also recognize our bias in believing banks are zeros, so discount everything we have said for that.

The biggest and ‘brightest’ companies continue to show they will chase near-term profits at the expense of taking on too much risk.

We won’t claim to have any idea where things go, but the GFC was a slow bleed followed by an explosion.

August 9, 2007 was when French bank BNP signaled it was in trouble.

Jan 22, 2008 the FED slashed the fed funds rate.

March 2008 Bearn Stearns gets forced acquired

Sept 2008 Lehman goes bankrupt and everything goes crazy

These things can take a while to materialize. The S&P500 spent 3-6 months around its August 2007 level (when a European bank first sounded the alarm) before tanking.

What does it mean for you?

Make sure you have an emergency fund. Make sure you aren’t taking on new debt unnecessarily. And start working on your side incomes while staying in good standing at your W2. (almost like that advice is universally good advice).

Good Luck Anon.

Thank you! This is helpful as I was quite young during the GFC. Please continue to give your perspective as the potential sequel in 2022-? develops for good or ill. I saw a bad omen the other day -- that NINJA Loans have returned. No credit check. No income check. Just lots of extra fees and more interest payments. Banks seem to be SPRINTING to offload as much bad real estate inventory as possible. Have you noticed this as well?

And yes -- I absolutely will continue to stay in good standing with my W2 and work on side hustle. I recently passed having a 15 month emergency fund. Rapidly adding more due to my enhanced cash flow. Got 3 months of dry food (not enough, i'm afraid). I am projected to have 40 month Emergency savings at the end of this year. Life is good.

Excellent write-up! Thank you for the historical reminder. This definitely feels like the beginning of “slow bleed”.