You may have heard of “Bogleheads” or be aware of the late Jack Bogle. We had a passing familiarity to both when we set out to answer this subscriber request. We were pretty surprised by how prevalent the ideologies credited to Bogle have become 'common knowledge’ in today’s world….(Editor’s note - you are supposed to be working on copywriting….We did the research so you don’t have to. And what we found will SHOCK you!!!!!)

We will briefly cover Bogle, summarize the tenants of Bogleheadism, and then provide our critiques. If you want to know why ‘dollar cost average into low cost passive ETFs in tax-advantaged accounts’ became such standard advice, this Bogle is for you.

Who is Jack Bogle

Jack Bogle was the founder of Vanguard and one of the O.G. champions behind the low-cost & simple investment strategies. Jack is credited with creating the first index fund and preached for reduced broker fees. His 1999 book “Common Sense on Mutual Funds: New Imperatives for the Intelligent Investor” is considered a classic.

In 1975 Bogle had the idea of creating the first index mutual fund and taking the returns of the market instead of trying to beat the market with activity. He then spent the rest of his time arguing for the superiority of index funds over actively traded mutual funds.

Bogle had 8 rules for investors (written in 1970s English apparently):

Select low-cost funds

Consider carefully the added costs of advice

Do not overrate past fund performance

Use past performance to determine consistency and risk

Beware of stars (mutual fund managers who had a winning streak)

Don’t own too many funds

Buy your fund portfolio - and hold it

Enter Bogleheads & Taylor Larimore

Taylor Larimore is the “King of the Bogleheads”. He read John Bogles book and embraced the simple, low-cost, very diversified and passive view on investing.

He was instrumental in creating the concept of Bogleheads and pushing the investing style to others. He is a founder and major contributor to the Bogleheads.org forum which is very active still. (It also looks like the 1990s old school internet forums.)

Larimore & other prominent Boglehead forum members have teamed-up to write a handful of books to build out on the original rules from Bogle.

In short, Larimore helped gather and grow a community of like-minded investors to follow and expand on the principles laid out by Bogle.

Basics of Bogleheadism

Bogleheadism is very similar to the framework laid out by Bogle. The underlying tenants of being a Boglehead are:

Live below your means

Spend less than you earn, establish a budget, and make sure you have money left over each month to invest

Develop a workable plan

Establish a sound financial lifestyle, sensible household budget with room for discretionary spending

Avoid bad debt and pay off any bad debt you have

Save a significant portion of your wealth each month

Make a long-term plan with goals and targets you would like to achieve

Save & Invest Regularly and Early

Save at least 20% of your income and invest at regular intervals

(Note - We think 20% is likely too little savings for the future due to inflation and lower real returns and recommend at least 25% )

The ‘best way to save money in a planned fashion is paycheck withdrawals to your 401k and set up automatic contributions to your IRAs

Keep Costs & taxes low

Opt for the lowest fee funds when given 2 options

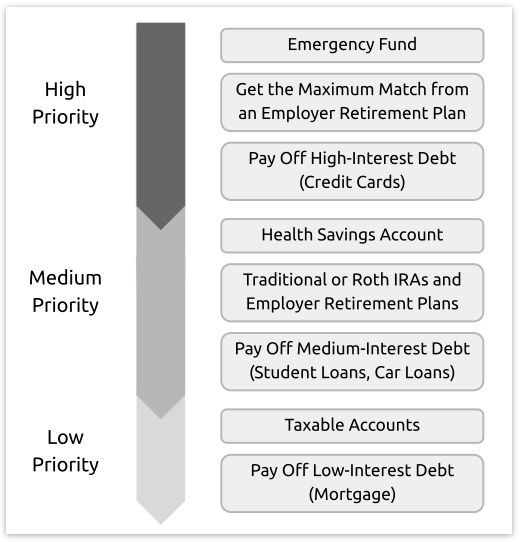

Make full use of tax-advantaged accounts like 401ks and IRAs

In taxable accounts, try to take advantage of funds with the lowest tax drag for each investment

For example, bond funds produce interest that is taxed at higher tax rates, therefore put those in your tax-advantaged account

Avoid Large Mistakes

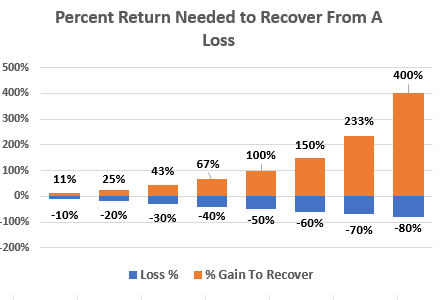

You can recover from a small mistake, but it is hard to recover from a large mistake

Keep Things Simple

“Simplicity is the master key to financial success. When there are multiple solutions to a problem, choose the simplest one.” - Bogle

You don’t need to own many funds if you own diversified funds

A common portfolio recommended by the Bogleheads is the “three fund portfolio” that is made up of 33% Bonds/TIPS, 33% International stocks, and 34% US Stocks

Stay the course

Make a plan, stick to it, and don’t let emotion deter you

It is important that you choose a portfolio with a risk you can stomach so you don’t deviate during market crashes.

Don’t let ‘shiny new objects’ distract you as new investment opportunities arise

Diversify

Buy diversified funds that approximate the entire market

Don’t be overly risky or overly safe

Find an asset allocation that is right for your risk tolerance & be brutally honest - you don’t want to be a panic seller in a bear market

Owning stocks is necessary to get positive expected return to accumulate enough for retirement

Have an allocation to bonds to balance the risk. Bogle was one of the people who came up with the “roughly your age” as the percent allocation to bonds (a 50 year old has 50% allocation to bonds).

Note: We addressed target date funds and age-related bond allocations here

Don’t time the market

Make a plan and stick to it. People are notoriously bad at timing the market and tend to buy more when the market is high (FOMO) and sell when the market is low (capitulation)

Most investors underperform a buy & hold strategy

Don’t gamble in individual stocks

Bogle was the ‘inventor’ of the low cost index fund precisely because he didn’t think individual stock picking was positive for the portfolio

Don’t use past performance as a predictor of future performance (FOMO)

If you read that list and think “Bogleheadism sounds like putting a name on vague principles everyone espouses nowadays”….well you wouldn’t be horribly wrong. There has been a large shift to Boglehead-type investing, usually without anyone using the term Boglehead or mentioning Jack Bogle.

These generalized principles have gained very wide acceptance as the go to options for the majority of retail investors. It is now common knowledge - everyone knows that everyone knows that low-cost ETFs passively purchased is the way to go.

Lastly, the concept of the 3 fund portfolio is very prevalent across Bogleheads. The 3 fund portfolio is a portfolio equally weighted in:

A Total US Stock Index Fund

A Total International Stock Index Fund

A Total Bond Market Index Fund

[Note - a Total Index is a fund that invests in ALL the assets. So for the Total US Stock Fund, investing in the S&P500 isn’t sufficient as it only has 500 of the large car stocks and completely ignores mid cap & small cap positions. ]

Boglehead Investing Rebuttals

There is a lot of common sense in the Boglehead principals.

Spend less than you make

Invest

Don’t take on more risk than you can handle and cause yourself to sell at the most inopportune times

There is nothing there that is controversial.

However, as you get into the more nuanced advice, there is certainly some aspects of Bogleheadism that can be argued against.

Survivorship Bias

First, survivorship bias. As with any system or strategy, the ones that tend to gain popularity are the ones that have been recently successful.

If there were only 10 gooroos in the world…[F’er note - we will pause so all our readers can stop and imagine a world with only 10 gooroos…The glory of not having a 23 year old kid with the IQ of a houseplant who yolo’ed into something that happened to work out who is now selling courses….]

Allright, enough imagining…

So there are only 10 gooroos and they all come up with 10 different ways to invest. Over the next 20 years one of those ways is going to perform very well purely due to happenstance. All 10 ideas could be equally as valid and likely to work, but over the 20 years one will work out and 9 won’t.

And that gooroo will be hailed as a visionary and a savior. This is survivorship bias.

Is Bogleheadism a superior strategy going forward? Or did it just outperform over a select period of time?

Over the last ~30 years passive ETFs and a bond/stock portfolio mix have had great success.

The overall market has gone up.

The bond market got a big boost from continued interest rate decreases.

Inflation was largely kept under control.

There was a huge shift from active to passive ETFs - which creates a positive flywheel that makes passive ETFs outperform active ETFs

And companies moved from defined benefit pensions to defined contribution 401ks (Revenue act of 1978 introduced them and they have grown in popularity) while the very large Boomer population was hitting their peak earning years.

With the macroeconomic backdrop and with Boomers contributing to 401ks that were invested into passive ETFs the real world walked a down path that was ideal for the type of passive bond/stock portfolio Bogle was advocating.

[Thought experiment - Jack Bogle is advocating passive ETFs and age% bond portfolio allocations in an alternative time line. In this time line the Volcker FED doesn’t control inflation, interest rates are never high, and Boomers don’t have the wealth to invest. Think about a Japanese lost decades.

In this alternative timeline, the people who outperform are the active investors who are invested in illiquid and actively managed funds.

Does anyone in 2020 even know who Bogle is? Are we talking about some other alternative gooroo the “Reverse-Bogle” who was advocating active investing in 79 while Bogle is a footnote in history as the guy who started “Vanguard low cost funds” and went broke because “EVERYONE knows active management outperforms”…]

Passive ETF Positive Flywheel

When the majority of investments are being done in passive ETFs, it leads to a positive flywheel impact where passive strategies outperform.

Active stock picking usually involves buying ‘value’ or underpriced securities. Therefore, there should be a balancing impact. As a stock becomes over-valued active investors buy less and buy more under-valued stock. The changing demand will trend names to their ‘intrinsic value’ (in theory).

Passive ETFs indiscriminately buying the index loses this ‘corrective’ impact. Since the S&P & most indices are market cap weighted index, it means that the higher priced securities get an outsized proportion of any ETF contributions.

In short, in a world where almost everyone is a passive index buyer, the passive strategy outperforms the active strategy after-fees since all stocks will go up proportionally regardless of their relative value. If all stocks go up the same regardless of value, then you can’t outperform and your fees will always lead to underperformance.

However, the opposite is also true. When Boomers start withdrawing money, the ETFs will sell indiscriminately across the index. We aren’t saying active managers start outperforming during the coming Boomer decumulation…but we aren’t not saying that. There is a good chance the future will see a reversion back to some positive outperformance for those more active as deals pop up.

In short, the passive Bogle method may continue to prove a winning strategy, but the next 40 years in the market is likely going to be a different regime than the prior 40. And the prior 40 years that were pristine for a Boglehead strategy to work. (Aka - is “Boglehead” investing the actual optimal way for everyone OR did Boglehead investing benefit from the wider regime and looks good because of survivorship bias?).

High Allocation to Bonds

We aren’t a big fan of bonds in todays day & age.

When interest rates go down, bond funds outperform. We just saw a 40-year bond bull market as double digit interest rates dropped to essentially 0%. Well, now interest rates don’t have much room to be decreased and may be on a long term increase, so you lose the tailwind of decreasing rates.

Additionally, since we are starting at low rates, the interest earned on bonds purchased today will be very low.

Total Return on Bonds = Income Return + Price return

Low yields = low income return

Flat to increasing interest rates = low to negative price returns

The expected future return on bonds is low.

You can argue there is a diversification benefit of having an allocation to bonds and that bonds ‘tend’ to be less volatile. However, that is historical performance. So far year-to-date 2022 there hasn’t been much benefit in diversifying:

Are we in a different regime where bonds have low returns and high correlation to stocks?

As you can see, even using the Bogle/Vanguard ETFs, you have 15% vs 12% losses year-to-date in stocks & bonds. In June, both funds were down even more and the general pattern/trend is fairly consistent between the 2.

If the regime has changed where bonds 1) don’t offer much downside protection and 2) aren’t big diversifiers, then you are putting a large allocation of your portfolio into an asset with a lower expected return and little protection.

(Note - we may be biased as we like using options as a way to diversify and protect the downside. As discussed in our ‘optimal portfolio strategy’ series Part 1, Part 2, and Part 3. You can get 10% income using options and get an asset that is fully hedging, aka the most diversification you can get. You can manage both your expected upside and your income and we believe that a stock/option portfolio will grossly outperform a stock/bond portfolio in the foreseeable future.)

What the F is Your Risk Tolerance?

One of the hardest things to measure in investing is your personal risk tolerance…until you are living through a market crash…but at that point it is too late. A lot of Bogle’s advice is around knowing your risk tolerance but that is easier said than done.

We know more than 0 people who are “super high-risk aggressive” both in how they think of themselves and how they score in ‘risk tolerance’ tests. But then during the recent COVID crash, they panicked out of stocks as they watched the market drop 20% and then 30%. Only to miss the near-immediate bounce back.

Similarly, we know more than 0 people who would be considered very conservative by all measures who diamond-handed the crashes.

It is great to set a strategy based on your perceived risk tolerance. But until you have lived through a few crashes where you have REAL money on the line, you really don’t know. ( Real Money because we are looking at you Zoomer who had $10k in the market. Diamond handing it while you got cut to $7,000 and didn’t sell is not the same as watching years of salary disappear. Until you have experienced a 6-figure+ unrealized loss, you don’t know how you will react).

[Note - Arguably the best part of crypto has been living through face-ripping volatility. You quickly learn your risk tolerance and/or blow our your dopamine receptors so you become desensitized to market volatility. When the stock market is down 20% and co-workers are freaking out at their 401k it is hard to relate as you remember Ponzu season and seeing 90%+ losses during hacks. “O your S&P is down 5% this week? That is like an hour to hour move in sh!tcoin crypto.” ]

Continued Obsession Over Fees

There is a huge benefit in halving your ETF fees from 1% to 0.5%. There is a much lower benefit halving the fees from 0.2% to 0.1%. It is essentially meaningless cutting your fees from 0.05% to 0.01%.

At some point, there are other aspects of the ETF that matter more (tracking error, rebalancing cadence, actual holdings, etc).

Bogleheads appear to still be stuck in the world of the past when fund fees were high. At this point, there are so many market ETFs with fees below 0.10% (10bps) that the continued focus on comparing fees is more obsession than logic. Vanguard has a 3bps (0.03%) expense ratio, but Fidelity just came out with a 0bps (0.00%) expense ratio so I am going to switch….Bro, 3 bps of fees is completely irrelevant.

Entire Wealth-Building Focus on Your Portfolio

Something that is largely missing in the Boglehead world is a focus on making more money, starting side hustles, or investing in alternative assets (real estate, illiquid deals, etc).

We enjoy the markets as much as the next guy, but at the end of the day it is more important to make more money so you can save more money than it is choosing a 3 ETF or 8 ETF portfolio.

If you go to the forum, there are lots of posts from people with low savings rates and low incomes majoring in the minors of portfolio construction instead of being told to go make a butt ton of money.

Conclusion - Bogleheads, Yay or Nay?

Overall, Bogleheadism seems like a net positive. It is certainly a formula that has worked in recent history and anything that gets people to invest more is good.

We do think there are some aspects that are far from ideal (Bonds…barf), a lack of focus on your actual income, and an obsession on expenses while most broad ETFs have low fees already.

If we had to summarize our view, it would be that Bogleheadism is like talking to your grandpa about what worked when he was courting your grandma. Yes, the basic elements of attraction are largely unchanged and immutable, but the world we live in is changed enough that you need to update the play book a bit…we don’t think Zoomers even know what a physical piece of mail is, so taking Grandpa F’ers advice to write poems to mail her probably won’t have the same impact.

Like all things in life, take what is useful and discard what isn’t. Overall, Bogle is good for the average investor. There are certainly worst gooroos to follow