Why Your Wrong About Good Debt And Bad Debt

aka stop listening to grifter boomers getting rich selling books about a world that doesn't exist

Debt is always a touchy subject. So many people have been conditioned to be disgusted at the thought of debt that they view the world through the lens of “all debt bad”.

And I get it.

If you are drowning in debt it is a terrible feeling. It is demotivating to work hard all week and then see most of your paycheck go towards debt and be struggling.

There is certainly a point where you are way too far into debt. And, unfortunately, there are financially irresponsible people who really can’t act right outside of super strict budgets and a life of scarcity.

But it is not the majority of people. And chances are that is not you.

So let’s run through some examples of myths you hear and come up with some better mental frameworks around debt.

“All Debt is Bad”

Let’s jump right to the big one…”All debt is bad”. It doesn’t matter what kind of debt, the APR, the other opportunities out there, or why you are using it.

Debt = Bad

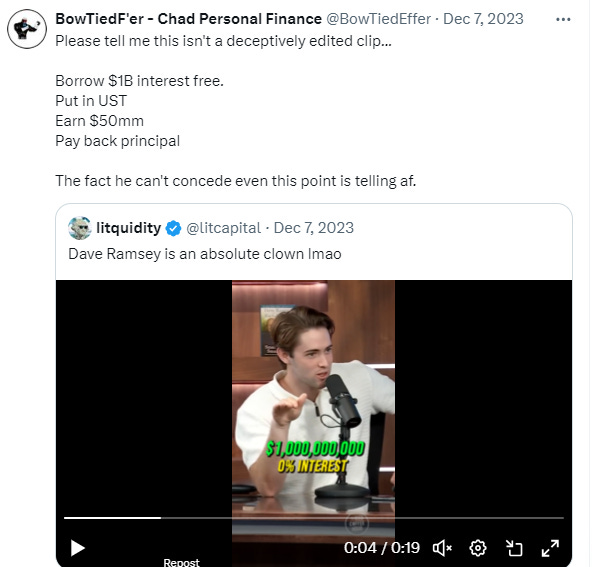

And if you think I am exaggerating, click the tweet below and watch the short 20 second clip of Dave Ramsey saying he wouldn’t take a $1B interest free loan. This is at a time when UST were earning 5% and HYSA 4%+.