What Kind Of Investor Are You? Part 1

Let’s get Zen this week….

We are going to ask a fundamental question. Just like the great philosophies all try to answer questions such as:

‘What is the meaning of life?’

‘Who am I?’

‘What does it mean to be?’

When you are starting your journey of investing, you need to ask “what kind of investor am I?”

“What kind of Investor am I?” - One of the most important questions to answer on your journey to wealth accumulation

Many people will start investing without attempting to answer this question. Then they wind up jumping onto whatever strategy is ‘working’ just in time to buy the top before selling the lows and rotating to a different popular strategy.

The BEST Investment Plan (shh)

We wrote 2 posts laying out in detail what we think is a great investment strategy:

Optimizing Your Investment Account Returns with Options Part 1

Optimizing Your Investment Account Returns with Options Part 2

You may be thinking that we are going to rehash this strategy again.

You’d be wrong.

We will let you in on the absolute BEST investment plan right now though…

And we will do it in a FREE post…

Because we are just that nice and thoughtful of people…

We could charge $999 for a course…

We could allow you to buy now & pay later (BNPL) for only 5 easy payments of $199.99…

We could put this behind our paywall because if you are too cheap to spend $5 a month you are likely NGMI…

(seriously, after the recent inflation, that is like $3.50…practically a dime. You can’t buy anything for $5 nowadays…)

Enough build up…

The BEST plan EVER is….

The one you will stick to

“The BEST plan is the one you will stick to”

-BowTied F’er

Yes. It is really that simple of an answer. One of the most central and core tenants of life is that almost everything and anything that isn’t full [redacted] CAN work. YOU just need to stick to the plan long enough for success.

This advice goes further than investing too.

The best workout plan is the one you will stick to

However BowTiedOx has optimal plans and would be a great place to start

The BEST business plan is the one you will stick to

However, absolute Chads like BowTiedOpossum, BowTiedTetra, BowTiedHandyman, BowTiedArticFox, BowTiedDevil, BowTiedParrotFish, or BowTiedPickle all have great resources to start building with

The BEST life plan is the one you will stick with

However, BowTiedBull is the OG for better understanding life

(Note - there are many other outstanding resources in the jungle for nearly any and all aspects of life. Join/follow and find an expert for any part of life you are trying to improve on.)

And the best investment plan is the one that you will stick to.

What Determines If You Will Stick To An Investment Plan?

You need to start with what kind of person you are.

Do you enjoy learning about investments?

Do you like watching markets?

Are you able to stay calm in turmoil?

Do you have an informational edge?

Are you a quick learner?

Can you pick up complex topics and technical subjects easily?

Are you emotional and reactive?

Can you grind when things aren’t working out for you?

Are you able to objectively look at past performance and adjust?

Any and every investment will have periods where it outperforms and underperforms. You need to have a sense of your personality in order to know what strategy works best for you.

We will cover a handful of common investment strategies for this post and a part 2. But at the end of the day, it is up to you to pick the one that is best for you and start there.

However, 2 important points before going into various options for you.

Investing Is More Than Stocks

When people hear investing, they tend to think of stocks or maybe real estate. They go right to assets you can buy.

However, investing is wider than that. You may be someone who is super active, but if you are investing that energy in your business or career, you still may be much better off with a passive asset portfolio. If you try to be very hands on with everything, you may wind up with subpar results for all of them.

Consequently, you may seem like a hands-off investor, but you have your main income on auto-pilot and looking for a new challenge. Therefore, you may try your hand at something more active to get a little extra alpha on your investments.

Like most of our advice, you need to look holistically across your life, and can’t make decisions on each aspect in a silo.

Your Investing Style CAN Change As You Change

As your life changes and as you grow and mature, your investing style can change with you. If you are starting out completely new, you may want to invest mainly in passive, broad-market ETFs. Over time you may try a few different styles as you become more comfortable and find one that works best for you.

Also, if you hit a very busy point of life, you may need to adjust to a strategy that needs less of your time.

In short, just because you start with one style doesn’t mean you need to stick with it for 40 years.

Just make sure any style changes are done strategically, and not because you have a short-attention span and are jumping around to whatever is popular at the time.

You choose a style based on what you can stick to. NOT based on what is trendy.

This part 1 post will introduce some of the passive investment strategies:

1) Buy & Hold And DCA into Passive ETFs

One of the simplest and most passive investing styles is to buy & hold broad market ETFs.

This strategy has you dollar-cost averaging into index ETFs and holding them for all of eternity.

Dollar-cost averaging (DCA) is buying at regular intervals regardless of the market price or current macro economic backdrop.

ETFs should be low-cost funds that track broad market indices. For example, an S&P500 ETF will hold roughly all the stocks in the S&P500 in roughly the same allocation as the index and a Nasdaq ETF will hold roughly all the stocks in the Nasdaq in roughly the same allocation as the Nasdaq. There are low (<0.10% and no expense passive ETFs nowadays).

You are basically investing in the broad market. For domestic indices, if the USA economy does well and domestic stocks trend up, you capture that performance.

[Note - buying the ‘market’ is investing in ‘beta’ if you want to sound kewl]

This is one of the most passive strategies as you are basically setting up a purchase plan and ignoring it.

This strategy is recommended if:

You are newer to investing

You are emotional and likely to panic buy and sell or chase the newest shiny thing

You don’t have any information edge that makes stock picking likely to outperform

You don’t enjoy investing, watching the markets, or researching stocks

You don’t have time to devote to your portfolio because you are building income sources

You are independently wealthy

This strategy is recommended often from people who think the market is efficient and that you can’t ‘beat the market’.

2) Buy & Hold Individual Stocks

This is similar to #1, but instead of buying a broad market index, you pick individual stocks you like. This is similar to the alleged Warren Buffet strategy of “buy great companies at fair prices and hold them forever”.

[Note - we are no fans of Buffet as we think he is a grifter who has benefited immensely from political inside information and has run a multi-decade psyops where his PR makes it seem like he is a nice old uncle when he is a conniving shark. But, he is often quoted when discussing this type of strategy so we included him here for explanation purposes.]

If there is a company with a ‘wide moat’ or good long-term business prospect, you buy them under the assumption they will outperform the broader market.

If you think a company will be around for the next 30 years and be profitable, then you invest in that name and plan to hold it forever. If you can’t see yourself holding a stock forever, it wouldn’t fit in this strategy.

Buy & hold individual stocks is a good strategy if:

You think you have a good sense on long-term societal trends

You like owning particular names or think there is a lot of subpar stocks in an index

You like a particular sector

You want to be passive but like researching and picking stocks

If you are picking individual names, you think there is some inefficiency in the market. Some stocks are over-valued and they will underperform (and drag down the index they are in) while others are under-valued and will outperform over the long-term. And you think you can find those under-valued names.

3) Dividend Stock Investing

Dividend stocks have a cult like following.

There are 2 general ways to make money in stocks. The stock price goes up OR the company pays you a dividend. Dividend investors focus on the latter.

[Note - A dividend is a cash payment made to you from the company. It is a ‘return of capital’. In theory, since this is a cash transfer from the company to you, the price of the stock will drop commensurate with the dividend.

If a company has a stock price of $100 and pays out a $1 dividend, the day after the dividend is set to be paid, the price of the stock will drop from $100 to $99. (we aren’t going to get into the details of dividend dates, but there is a cutoff weeks before the payment is made where the stock trades with and then without the dividend).]

There is a lot of material written about dividends and dividend strategy (enough for a separate future post). But in short, there are a few reasons investors like dividends:

If management is returning cash to shareholders, they are signaling that the company is strong enough that it doesn’t need the cash

Dividends keep management from destroying value

IE - When companies have a lot of cash on the balance sheet, it impacts the return metrics (return on capital/equity) negatively. Therefore, companies without dividends, tend to either do M&A or buyback shares. But when companies have a lot of cash, it tends to be when the industry is doing well. This means company shares and competitor’s value are relatively expensive. The end result is companies overpaying and destroying value.

Allows shareholders to decide what they want to do

You can take the dividend as cash and spend it elsewhere or you can reinvest the dividend into the stock through a dividend reinvestment plan (DRIP)

Generates cashflow for retirees who want to live off dividends and not touch their principal

Can be tax advantageous

However, there are a few arguments against dividends:

If management is returning cash to shareholders, they are signaling that they ran out of ‘better uses of money’ OR they are forgoing other better uses

For example, if a company could invest $100 into a line of business and get a 50% return, they should do that instead of paying it out as a dividend. It would in theory be better as a 50% return on the money would make the stock price increase a lot more than the value of the dividend paid out. Therefore, by paying out the dividend, the company is either missing out on a high return or its saying it doesn’t have any high return business to invest in

Can be disadvantageous from a tax perspective

Historically, buybacks were considered ‘tax-free’ for long-term investors until they decided to sell. So even though dividends have been taxed less than capital gains at various points in history, they were still forcing you to pay a tax. However, a buyback that increases the share value has no tax implication to you, and you could elect when to sell and pay the capital gains tax.

Note - current legislation may result in a share buyback tax

Stock price changes by same amount as the dividend payout so it is net neutral to the investor

There are different sub-groups of dividend investors as well. There is a decent amount of overlap between these groups, so this is more a broad summary of some of the strategies.

3a) DRIP-ers

These people like dividends to reinvest back into the stock and grow their share count over time. Most brokerages offer automatic dividend reinvestment plans (DRIPs) that will buy fractional shares in a dividend stock.

True DRIP-ers like companies who have a long history of paying dividends and use the dividend to dollar-cost average into a name over time. It is like the buy & hold dividend strategy.

3b) Dividend Growth Investors (DGI)

Dividend growth investing is slightly different than pure DRIP-ing as they look for companies with a long track record of increasing their dividends. You will hear them talk about companies with “60 years of annual dividend increases”. Many of these companies do pretty immaterial increases year-over-year in order to court DGI guys. (like 1 cent per share dividend increases on $100 stocks, so 0.01% yield increase)

Whereas DRIP investors like all dividend paying stocks, DGI investors narrow their universe down even further. Additionally, since DGI investors like the growth component, they will buy companies with 1% dividend yields as long as they believe the company will raise dividends annually.

Note - DGI investors do tend to DRIP the dividends. So they are very similar to 3a, but just operating with a smaller universe of stock picks.

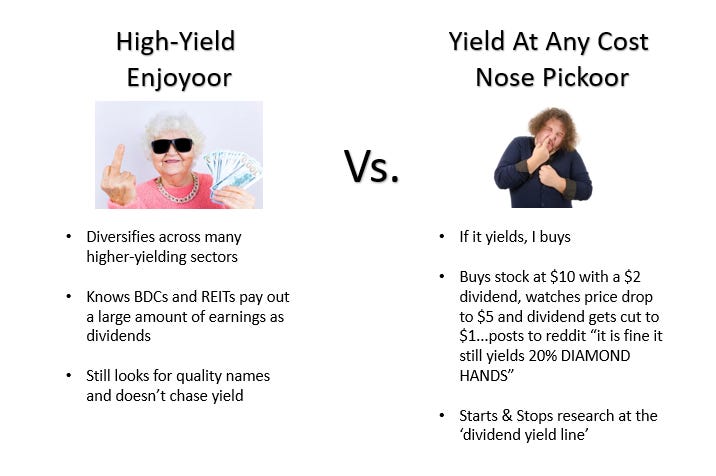

3c) High-Yield Chasers

A 3rd group of dividend investors is the high-yield chasers. These investors want the big yielding stocks. The high-yield chasers can be further broken down into:

High-yield sector enjoyooors

Yield at any cost nose pickooors

You can pursue higher-yield names (call it Treasury rates +3%) by choosing naturally higher-yielding sectors:

Real-estate investment trusts (REITs)

mortgage REITs (mREITs)

Business Development Companies (BDCs)

Master Limited Partnerships (MLPs)

“Sin” stocks (tobacco, firearms, alcohol, etc) / Utilities / Energy

These sectors all have higher-yields either due to regulatory reasons (ie- BDCs get tax breaks for paying out 90% of income) or market reasons (ie- tobacco stocks spit out a ton of cashflow but have a lot of regulation limiting future prospects of growth…aka the proverbial ‘cigar butt’ stock while being literal cigar stocks).

High-yield enjoyooors will take the 5%-10% yields in these sectors and choose higher-quality names. They recognize the stock price growth will be limited due to the company paying out high amounts of cash instead of reinvesting in the business, but prefer the income to stock price growth.

The “yield at any cost nose pickoooors” are the people who chase ultra high-yields with no further research or understanding. They see a 20% yield and buy on the spot. Then when the price drops 50%, and the company decreases the dividend by 50%, they see that the stock still yields 20% and double down.

3d) Dividends for Cash Flow Investors

The last group is investors who use dividends for cash flow. These are typically retirees or near-retirees who are spending the dividend money and trying not to touch principal. They want steady and reliable dividends and would like a little stock appreciation to keep up with inflation, but don’t need stock price growth.

They likely have a mix of bonds, dividend stocks, and some preferred stock (maybe) to supplement their pension and social security.

These investors will typically own “high-yield” ETFs and big “blue-chip” names of mega-cap dividend stocks.

The main difference with this group is that they are taking the cash dividend out of the portfolio and not reinvesting it.

Conclusion: What Kind Of Investor Are You Part 1

That wraps up part 1 of 2 for what kind of investor are you. This week we introduced the topic and went over the more passive investment strategies Next week we will get into the more active types of strategies and the use of options.

It is important to learn what kind of investor you are so you can find a strategy that resonates with you that you can stick with.

Two parting points.

First, there is a lot of overlap in these strategies. You can buy & hold dividend stocks or dividend paying ETFs and most ETFs pay a dividend that you can DRIP. So these aren’t mutually exclusive groups.

Second, you need to take a holistic view of your portfolio when you are deciding how to invest. A holistic view means you are considering all the places your money is.

For example, you could have most your money in a 401k which are largely limited to broad market ETFs that you DCA into (ie- each paycheck contributes). If you have a small brokerage account that you pick some individual names, you are largely being a passive DCA into an ETF investor. It helps to take a holistic look for the purpose of retaining your composure in your smaller active portfolio.

That is all for today Anons, Good Luck.