Target Net Worth - Introduction

It's great to know where you are...but even better when you know where you are going

Your net worth is your total assets minus your total liabilities. People like to make it controversial by arguing about what should be included because controversy sells…

Do you include your house value? (No, not unless you are moving soon and are going to realize it).

Do you include your car value? (No, not unless you are a twitter gooroo who is trying to pad their stats).

Do you include every account you have? (No, keep transactional accounts out of it)

It is great to track your net worth over time. It tells you if you are growing your wealth and making the proper moves in big enough steps to become financially free.

But knowing your net worth without having a target is like driving to a hotel on the Cali coast with no GPS. Sure, if you go West you will be making progress, but it is far from the most efficient way. You may be trending towards your hotel, but making wrong turns in the near-term and extending the time it takes to get to your destination.

In this analogy, your target net worth is your GPS. It sets a course and tells you when you veer off the path.

What is target net worth? What are the common recommendations (for the masses)? And what is the way Chad/Chadettes like you can get a better number?

Target Net Worth

We won’t beat this to death because it is fairly straightforward. Your target net worth is just a net worth you are targeting at each age and income level. Sinple.

The current en vogue target net worth formula comes from “The Millionaire Next Door” and bases the number on age and pre-tax income level. The formula provided is:

Target Net Worth = Age x (Pre-Tax Income / 10)

If you are 30 and make $200k a year, your target would be $600k. If you are 50 and make $200k a year it would be $1 million. Similar, if you are 30 and make $50k, your net worth target is $150k.

Pretty basic. But here is a table for convenience:

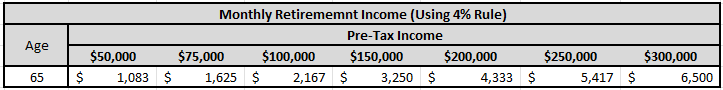

And to layer on more normie finance, using the 4% rule on the age 65 net worths gets you the following monthly retirement income:

Overall, this isn’t terrible for the masses. We would argue the formula works better in the middle (age 30-55 and $100k-$200k income) and less good for the edges.

For example a 25 year old making $50k a year should have a target net worth of $125k. But most 25 year olds have 3 years of work experience and haven’t even paid off student loans. Most likely they still have a negative net worth if they are only making $50k pre-tax. That is ~$40k after-tax (round numbers). So even if they saved 100% of their income, that is $120k after 3 years.

Similarly, a 65 year old should have more net worth than shown. Not only have you had 40 years of market returns, but after your kids move out, your expenses should go way down letting you really save. The difference from 55 to 65 is too small.

But putting that aside, there are some other glaring flaws in this formula that make it subpar.

Millionaire Next Door Target Net Worth Formula Flaws

First, this formula ignores where you have been. If you get into a career with a high starting salary but low room for salary increases, you will have a very different glide path than if you are in a career with a low starting salary and large salary increases.

For instance, nurses tend to make a high starting salary and small increases. Let’s say you start at $100k a year but max out at $120k. Compare that to a person in sales who may only make $40k starting but 10 years later is making $300k. The savings at each age will be very different between the 2.

Second, it ignores people who stay in school longer. If you go for a medical degree and graduate at 30, then this formula isn’t helpful to you. You may be 30 with $300k in student loans, but making $250k a year. It is going to take a while before your net worth is positive.

Third, it completely ignores the stages of life. For most people, your expenses peak around the time you have older kids. Then start going down. Having a linear relationship ignores the real life impact of expenses.

Fourth, and related to above, it ignores compounding. If the market returns 10% and you have $100k invested, your net worth increased $10k (ignoring all else). But if you have $1 million invested, your net worth increased $100k. In short, your net worth should be increasing at a faster rate the older you get due to compounding of returns.

There are other issues, but the above should be enough to rest the case that this is fine in a book targeting the low financial IQ masses, but not sufficient for a more robust analysis.

Target Net Worth As An Expense Multiplier

A second commonly used target net worth formula is an expense multiplier. This is a little more calculation intensive and solves some of the problems we have with the above formula. However, it still isn’t ideal.

This formula uses a 2 step calculation:

Take your expenses and make an adjustment based on how many years you are from retirement

Apply a constant multiplier to #1 to get your target.

There are different flavors of this out there, so we chose one that popped up a few times. For your expense adjustment, you use the following:

75% if within 5 years of retiring

80% if 6-10 years away from retirement

85% if 11-15 years away

90% if 16-20 years away, and

100% if more than 20 years away

And for your expense multiplier you use:

2x your expenses at 25 years old

5x your expenses from 35 years old

10x your expenses from 45 years old

15x your expenses at 55 years old

20x your expenses at 65 years old

So lets say you are 55 years old and spend $60k a year. Your target net worth would be calculated by:

Take 80% of you expenses since 10 years from retirement ($60k x 80% = $48k expense)

Multiply $48k by a 15x multiplier for a $720k net worth target

The pros of this approach is that it considers your expenses. Your expense adjustment changes to reflect inflation as well.

[F’er Note - A quick note explain the expense adjustment and multiplier and why they directionally make sense.

A common rule of thumb is that in retirement your expenses actually go down. You don’t need to commute. You slow down and do less. etc. This is a bit counterintuitive, but appears to play out in studies that retirees spend ~75-80% in their first few years of retirement than in their pre-retirement years. Hence the expense adjustments less than 100%.

Additionally, each year further you are from retirement, is one more year for inflation to increase the cost of living. This is why the further you get from retirement, the higher the adjustment factor is. So if you are more than 20 years away from retirement, you assume inflation has increased the cost of living by time you retire that your current spending level is what you need.

The expense multiplier reflects the impact of compounding and years of earnings. The older you get, the more years of earnings you have which means the more years of savings which means the more years your investments have to grown. This is why the multiplier increases as you get older, you are expected to have made more money.]

If you are spending $60k a year in your 30s, inflation over the next 30 years is assumed to keep your retirement spending at $60k a year. If you are spending $60k a year in your 60s, it is assumed that in retirement you spend less as you slow down, and with almost no years for inflation to kick in, you only need 75% of your pre-retirement expenses.

We think this is an improvement over the Millionaire Next Door Formula, and like an expense based approach, but it ignores income. If I spend $50k and make $60k vs make $200k, the above will give you the same target. If you make almost 5x as much, you should be putting away a lot more and have a higher net worth target.

Also, generalized rules where you have the same multiplier for everyone tend to work for the masses, but less so for the edges.

The above formula is more ofo a “FIRE” concept of measuring when you have enough savings that you are on track to hit a wealth level that covers your expenses.

Wrap-up

To wrap up this free intro post, we will highlight that you need some targeted amount to know if you are on track.

But both these common recommendations are simplistic and neither one of them gives you a goal based on your own individual situation.

In the paid post later this week, we will walk you through the 2 ways we measure our target net worth.