We have been hitting on the retirement topic for a while. After this week, we will likely pivot to a different area for a while (drop a comment if you have a request). Today’s free post is going to go over target date funds & other strategies used to de-risk into your retirement.

If you have a 401k or other retirement account and have ever called the help desk. Or if you have a financial advisor. Or if you have researched retirement advice, you have likely heard about both target date funds & de-risking your allocations going into retirement.

Why Should You De-Risk Your Portfolio As You Approach Retirement?

The common advice is to allocate a higher allocation of your portfolio to fixed income securities (fixed income is also know as bonds) as you approach retirement. Historically, bonds have lower volatility compared to equities & there is consensus that there is diversification between fixed income and equities.

As you approach your retirement date, you become more sensitive to negative returns in your portfolio. When you are young, your portfolio has time to ‘bounce back’ vs when you are a few years away from retirement.

We know that equities may see very large decreases in value during bear markets. Intuitively, if you are 100% equities going into your retirement, you run the risk of having a large decrease in the value of your portfolio.

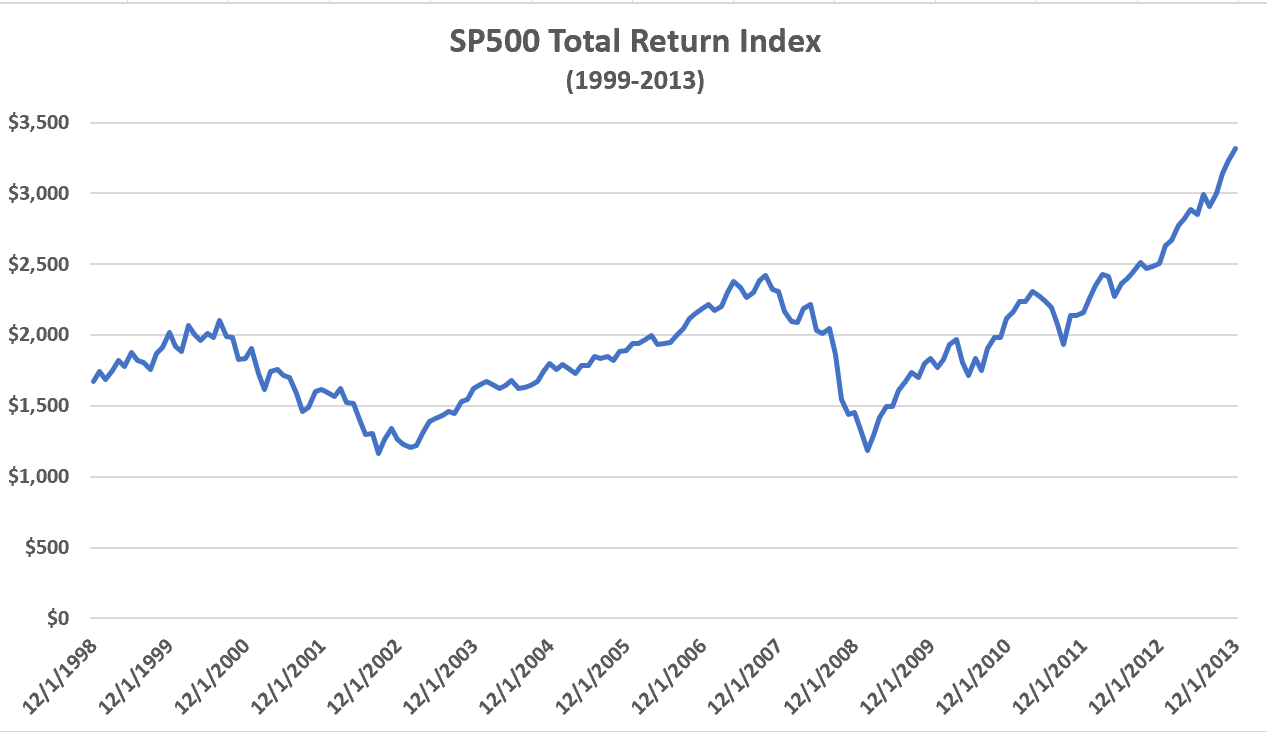

As shown in the chart above, historically the SP500 has recovered from any large draw downs. The market dropped from ~$2,000 in lated 1999 to nearly $1,000 in 2002. However, it recovered to a new high of nearly $2,500 in 2007, before being cut in half again in 2008.

[Note - We use the SP500 Total Return Index as it reflects the dividends paid by the S&P index. The numbers here won’t match up with the price on the regular S&P index as that ignores the dividends.

The Total Return index is therefore a better reflection of the actual returns achieved by a buy & hold investor]

When you are younger, decreases in the stock market are actually a positive as they allow you to accumulate more shares cheaply. During both 2001 and 2008, you would be able to purchase shares at nearly 1/2 the price of their recent highs. Holding for a few years returned more than 100% as the market came back.

However, when you are older, you have less time for the share price to recover.

For instance, you had a goal of $1 million for your retirement portfolio. If you had $1 million in 2000 with a planned to retirement in 2001, your portfolio would be closer to $500,000 after the crash if you were all in equity. It would take nearly 6 years to 2006 before you portfolio value would recover to $1 million, assuming you didn’t need to take any money out of it.

That means if you were turning 65 in 2001, your options would be:

Retire and live on 1/2 of your target or

Work till you were 71 to retire with your $1 million.

[‘Tism note - Yes, that is rough mafs. Technically if you kept investing in your 401k you would hit $1 million before 2006. Also, each additional year you work would be 1 less year** you would need to fund your retirement for and 1 more year your social security would grow. Also, you would retain your employer benefits for an additional year…etc etc…but we ignore those nuances for simplicity above.

(**1 less year to fund retirement because we assume you die at the same age. So if you die at 85 and retire at 65 you need your savings to last 20 years. But if you retire at 66 and die at 85 your savings only needs to last 19 years). ]

The traditional solution to the problem is to start allocating into the less volatile bonds as you near retirement.

Bond vs Equity Returns Over Time

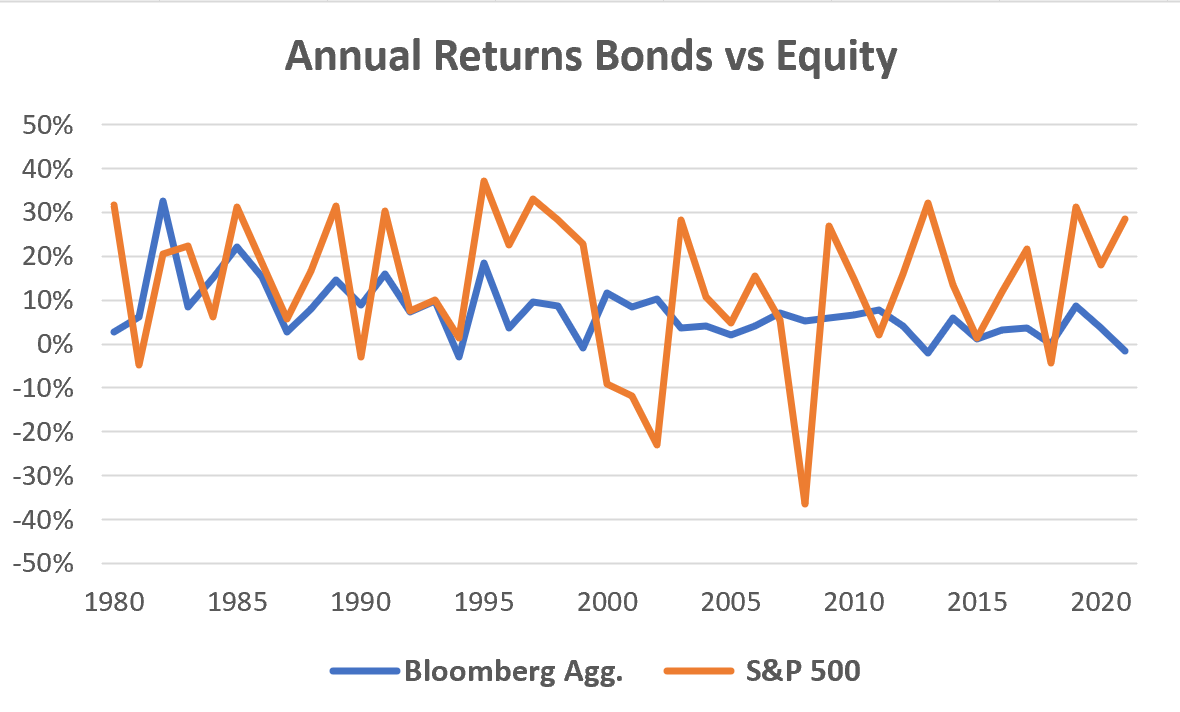

Historically, bonds and equities are weakly positively correlated. That means that they tend to move in a similar direction, but at a much different magnitude.

The actual correlation in the annual returns is approx. +0.15 on a scale of -1 to +1.

A perfect positive correlation of +1 means the numbers move exactly the same (when equities up 10%, bonds would also be up 10%)

A perfect negative correlation of -1 means the returns would move exactly opposite (when equities up 10%, bonds would be down -10%).

The correlation of the bond & equity index shown above is close to 0 but positive. This indicates bonds and equities move in similar direction but at much different magnitudes. Therefore,

When equities go up, bonds returns tend to be positive, but at a smaller gain

For example, equities up 20%, bonds may be up 3%

When equities go down, bond returns tend to be negative, but at a smaller loss

For example, equities down 30%, bonds may be down 5%

Therefore, allocating a mix of equities and bonds will lead to a better relative return for the amount of volatility due to the diversification.

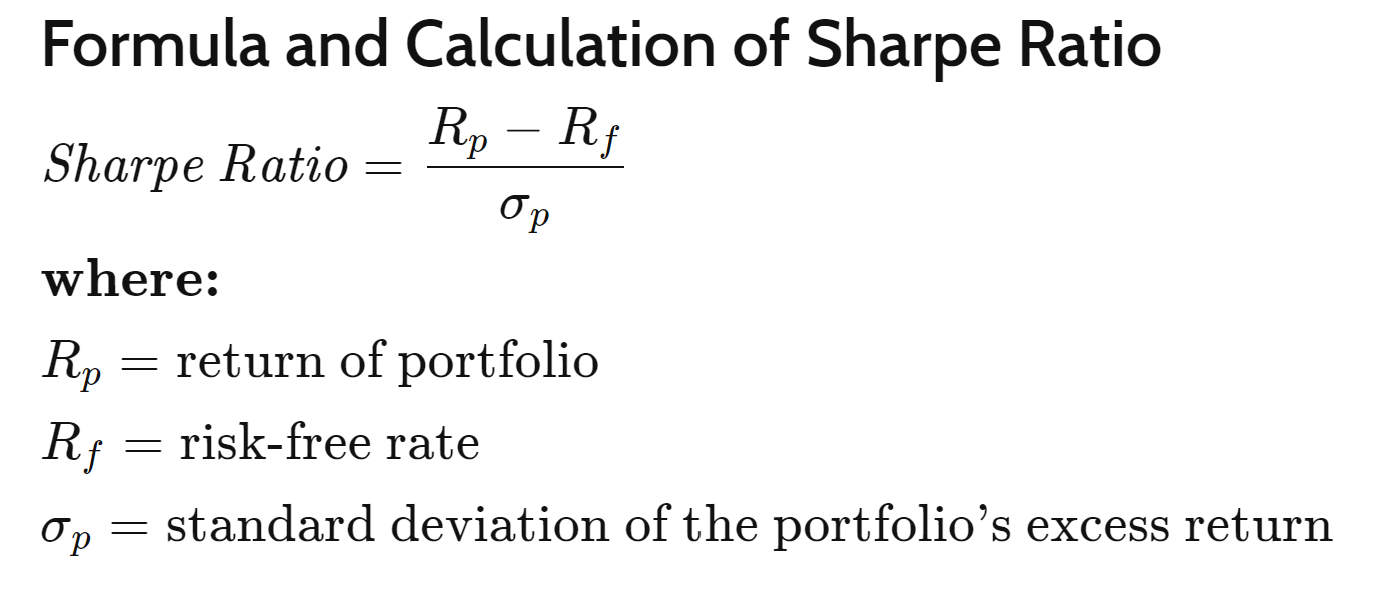

This can be quickly approximated using the sharpe ratio, which is a measure of excess return relative to the volatility. A higher sharpe ratio indicates a higher relative return for the ‘risk’ you take on, very very loosely speaking.

The sharpe ratio is about 45% for both the S&P500 and the Bond index annual returns above. This means that the additional returns you get from equities over bonds is accompanied by a similar incrase in volatility.

However, taking a 60% Equity & 40% bond blend, you get a 60% sharpe ratio, indicating that the diversification leads to higher relative returns for the volatility.

In short, you get more stable returns and a lower risk of a large decrease in your portfolio value.

[‘Tism Note - if you aren’t familiar with the sharpe ratio, it is a measure of the excess return to the volatility of a security. The higher, over the risk-free rate, the return of a security is relative to its volatility, the ‘better’ you are.

The sharpe ratio of the Bond index and S&P index are both ~45% when using the average 1 year Treasury yield as the risk-free rate. Taking a 60% S&P 40% Bond split results in a ~60% sharpe ratio, a significant increase in returns relative to the volatility.

Note 2 - doing the Sharpe ratio using annual numbers isn’t exact, but directionally accurate and useful to illustrate the point.

The point being that you get better return relative to your ‘risk’ under the traditional framework.]

What are Target Date Funds?

Target date funds have recently become immensely popular options in retirement accounts. Target date funds adjust your allocation over time to ‘less risky’ investments, like bonds. The change in your allocation is based on the funds ‘glide path’ and done automatically. They are trying to be the ultimate passive investment.

You can go look at Vanguard’s target date fund list and you’ll see that each fund is based on a future retirement date on quinquennial dates. (Note, if your planned retirement is inbetween the dates provided, you would just allocate to 2 funds. For instance if you were retiring in 2027, you could allocate between the 2025 and 2030 funds):

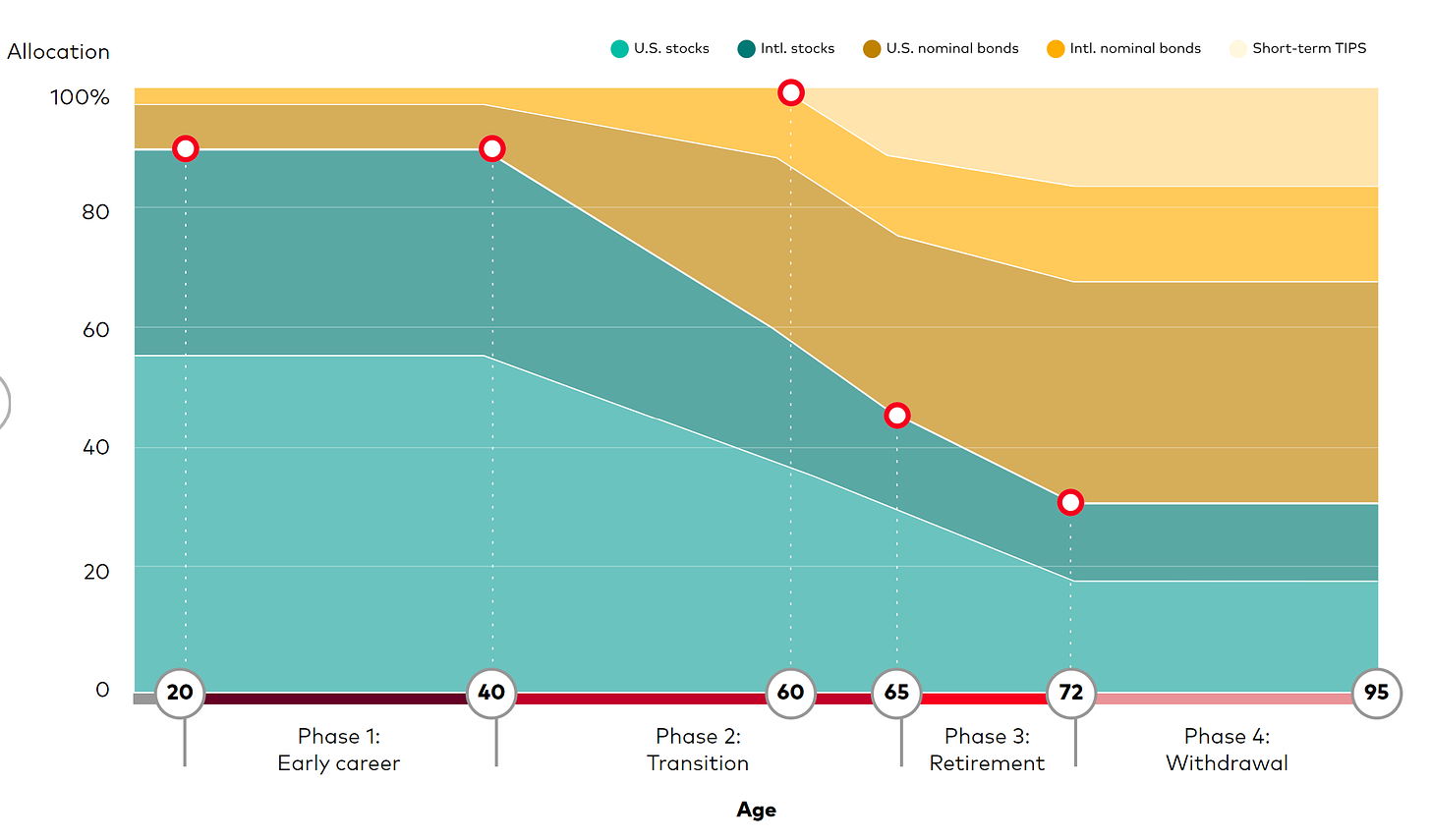

Each fund will follow the a glide path based on the number of years you are away from the fund retirement date. Let’s pretend you were 40 years old in 2020, that means your age 65 retirement is in 25 years, in 2045. You would purchase the 2045 target date fund. Looking at the below glide path, you see that:

Starting at age 40, you are nearly 50% in US stocks, another 40% in international stocks, and 10% split between US & international bonds

As you start approaching pre-retirement age of 60, your combined stock allocation drops to under 60% and bonds make up 40% of your portfolio.

Between 60 and 72 you continue to decrease your allocation to stock down to about 30% while increasing your allocation to bonds and adding Treasury Inflation-Protected Securities (TIPS) to the mix.

After age 72, your allocation levels out as you are in your withdrawal phase.

The way Target Date Funds achieve these allocations is by investing across other sub-funds. Hence target date funds are called ‘fund of funds’ since it is a fund that solely allocates to other funds, typically within the same family.

Shown below are the 5 separate funds that make up the Vanguard target date fund. You’ll notice all 5 listed funds below are Vanguard funds as well.

The allocations shown are the current allocation for each date. You can see the 2045 fund is 51.88% US Stocks, 35.46% International stocks, 8.75% US bonds, and 3.91% International bonds. In 5 years, you would expect the 2045 target date fund to look similar to what the 2040 target date fund is today.

Many firms also offer different levels of risk on the target date funds as well. They will have a conservative 2045, moderate 2045, and aggressive 2045 fund. The difference between the 3 is mostly how much equity allocation each has at each stage of the glide path.

Pros & Cons of Target Date Funds

Target date funds have become very popular in 401ks and other self-directed retirement accounts. The retirement advice has shifted more and more to having customers be as passive as possible. The help desks tend to direct people to the funds when you call.

Benefits of Target Date Funds (TDF)

Retirement planning in 2 decisions: Target Date Funds allow for you to make 1 decision outside of how much to contribute. You just need to choose the fund(s) for your retirement date. Then the automatic rebalancing as you age is done for you on the pre-determined glide path.

Minor Risk Options: Having conservative, moderate, and aggressive risk options in the same date TDF allows a little more flexibility and customization based on your personal risk.

In short, the benefit of a target date fund is in its completely passiveness. Choose your fund when you start investing, contribute to it and forget about it till you retire.

Cons of Target Date Funds

However, there are several major disadvantages to target date funds.

Fund of Funds: A target date fund (TDF) is just someone else investing in funds for you. Depending on if the fund is active, passive, algo driven, factor driven, etc, you are trusting the allocation and funds that are picked. For example, your target date fund may be investing in active managed ETFs that all underperform the market.

Expenses can be surprising: Relatedly, each sub-fund will have its own expenses and then the target date fund may have a separate expense on top of it. Overtime as your allocation shifts, your expenses will shift. Maybe today the TDF has 10bps of expenses (0.1%), but it has an expensive bond fund and as the allocation to that bond fund increases over time, your expense ratio is suddenly 75bps (0.75%).

Lack of Sub-Fund Diversification: Vanguard’s TDF is made up of different Vanguard funds. If you are 100% in a TDF, you are opening yourself up to risk of a corporate scandal at Vanguard hitting your entire savings.

Other De-Risking Methods Through Portfolio Allocation

Maybe you decided a target date fund isn’t right for you, do you have other options for de-risking?

You may have noticed that your equity allocation for target date funds is roughly following the (100-age)% allocation to equity. This is a commonly used heuristic/recommendation.

This rule says that you take 100 and subtract your age, in order to get your equity allocation percent. So a 35 year old would have a 100-35=65% allocation to equity under this rule. 10 years later at age 45, you would have 100-45=55% allocation to equity.

In fact, there are different takes on the rule to encourage more equity allocations: (120-age)% being a popular alternative, leading to 20% higher allocations to equity for all ages.

Other methods of de-risking with portfolio allocation include:

60%/40% constant split between stocks and bonds with frequent rebalancing

Barbell of short-duration Gov’t Bonds (ie 1 year US Treasury) and Equity

Extensive diversification - include commodities, real-estate funds, domestic & foreign gov’t bonds, developed & emerging markets, etc.

High equity allocation paired with buying protective puts

There is a lot of ways to try to manage your portfolio allocation to diversify from being fully exposed to equities. Each has their own pros and cons, but the takeaway is that some diversification going into pre-retirement decreases some of the risk of major portfolio losses…maybe…

How Portfolio Diversification Helps In The Pre-Retirement Years

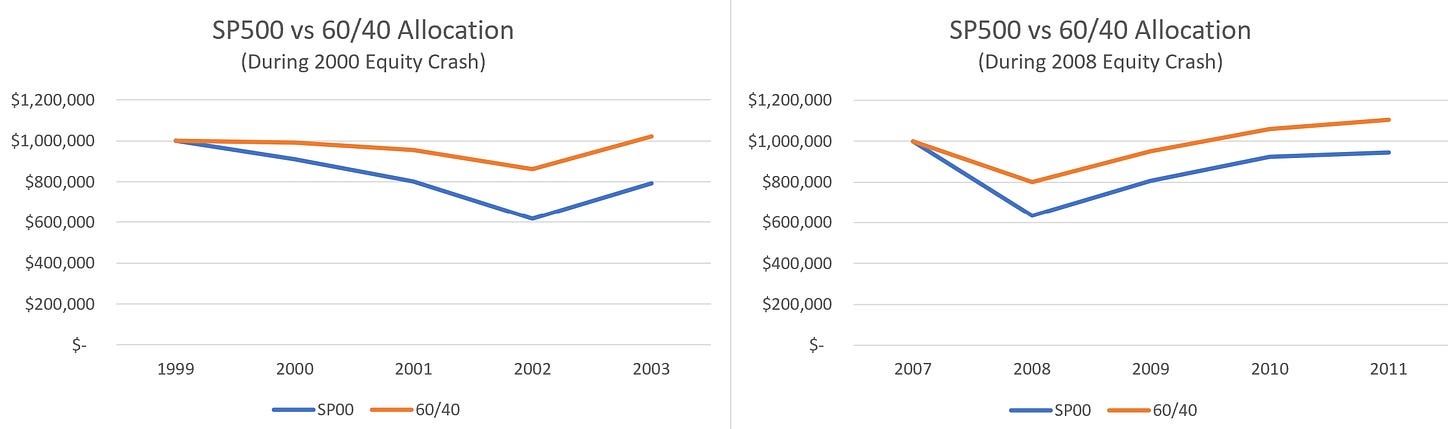

One quick example to show how diversification can help in the pre-retirement years. For simplicity we will just use a 60/40 allocation to equities / bonds which is the equivalent of a 60 yr old for (100-age)% and roughly TDF. When we look at the worst return periods from 1999-2009.

Starting with $1 million, if you had diversified away from 100% equities and into a 60/40 blend of stocks and bonds, you would have vastly outperformed in both the 2000 dot com bubble burst and 2008 financial crises. Your portfolio loses would be less at the bottom and you would recover back to $1 million faster.

This is the first order thinking that results in the recommendation for diversifying as you go into your pre-retirement years.

[‘Tism Note - if you are looking at your 60/40 portfolio today (thanks for reading Boomer), and seeing it being down bigly, it is because bonds have been crushed in the first half of 2022. A future post is going to deal with correlation more]

Both the last 2 crashes saw ~40% decrease in equities at their lows. If you were near retirement and the crash happened, that means you are retiring with 40% less savings. If you follow the 4% rule, that means you withdraw 40% less money each year ($24k vs $40k in this case).

However, if you diversified with fixed income, you would see <20% decrease in your portfolio. This would be much more manageable.

Conclusion: Intro to Target Date Funds

Target Date Funds and de-risking into retirement have good marketing. Having diversification and/or an increased allocation to lower volatility assets as you get close to your retirement date has historically helped to avoid massive portfolio value losses at an inconvenient time.

The paid post later this week will show the impact of target date funds on your retirement projections. It will piggie back off some themes we have been discussing: (1) compounding is double-edged sword, (2) mafs iz hard, and (3) most ‘expert’ recommendations for retirement savings are not enough.

Till next time, Anon

Thanks for the post! Other ways to reduce sequence of return risk is though Whole Life Insurance or Annuity type of products. These are complex products, so you will need someone who can help you go thru different situations/scenarios and design it in an optimal way.