Roth IRAs get a lot of love and rightfully so. They allow you to diversify your retirement tax-basis, lock in taxes today, and lower headaches in retirement from an unknown tax liability bomb, political risks on taxes, and RMDs forcing inefficient behaviors.

If you are new to Roths, you really need to consider them as it can be a huge benefit in retirement and you are limited to how much you contribute each calendar year. And if you miss the contribution cut-off you can never go back.

What is a Roth Account?

A Roth account is a retirement account that you fund with after-tax money and it grows tax-free and when you get to retirement you can take withdrawals tax-free. Most of us have heard of Roth individual retirement accounts (IRAs), these are your own account you set up at a brokerage like Fidelity.

But many employers have been adding a Roth 401k option to their 401k. These operate a lot like Roth IRAs, just with a lot of the downsides that come with your 401k. (See 15 must know downsides of 401ks here).

Why Roths?

Roth accounts have a handful of benefits over regular traditional IRAs. The biggest benefit is that you lock-in a known tax-rate on your contributions. A huge problem with qualified pre-tax investment accounts (trad IRA and trad 401k) is that you don’t pay taxes until you withdraw the funds in retirement.

You have no idea what your future tax rate will be. This depends both on your retirement earnings and the rate a future Congress decides to tax you. With a growing deficit, increasing calls to ‘tax the rich’ (aka tax the poor saps in the middle and upper middle class who can’t afford high-priced tax experts), and historical tax rates that have been significantly higher, we aren’t comfortable having all of our retirement funds accruing a large unknown future tax liability bomb.

And if you think “I will just pass the money along to my heirs or limit my withdrawals of the money”…let us introduce you to required minimum distributions (RMDs). These are a huge problem for retirees. The IRS doesn’t want you to never pay taxes on this money, so they have a set schedule that you need to withdraw your qualified funds at.

The types of accounts covered by RMD rules are:

The current RMD schedule is below, but it will be changing going forward due to the SECURE Act 2.0 changing the starting RMD date. However, this gives you an idea of how it works:

The RMD schedule is based on the distribution period. You take your total value of the 9 accounts listed above, and every calendar year you divide it by the distribution period. We did it for you to give a percent withdrawal. The distribution period is based on a standard mortality table.

So if you are 80 and have $1,000,000 spread across the 9 accounts, you need to divide $1mm by 20.2 which results in a 5% withdrawal or $50k. And then that $50k is taxed at some future tax rate and may be significantly less after-tax.

For the astute reader, you recognize the pain it is to track numerous accounts and your withdrawals from all the different accounts to ensure you hit your RMD number.

But don’t worry, if you mess up this calculation the IRS only charges you a 50% penalty on the underdrawn amount…but they dropped it to 25% with the SECURE Act 2.0 and if you correct it, then it is only 10%. Imagine being 80, missing your $50k withdrawal, getting a 50% penalty, and then maybe another 50% tax. Your $50k is now ~$12k. An all in 2/3rds reduction in your income you worked 40 years to save up diligently for. Fun.

Roth accounts don’t have RMDs and don’t have a future tax liability. This benefit can’t be overstated enough.

There are some other benefits of Roths, including more flexibility in being able to withdraw your contributions without paying tax (since the money was already taxed).

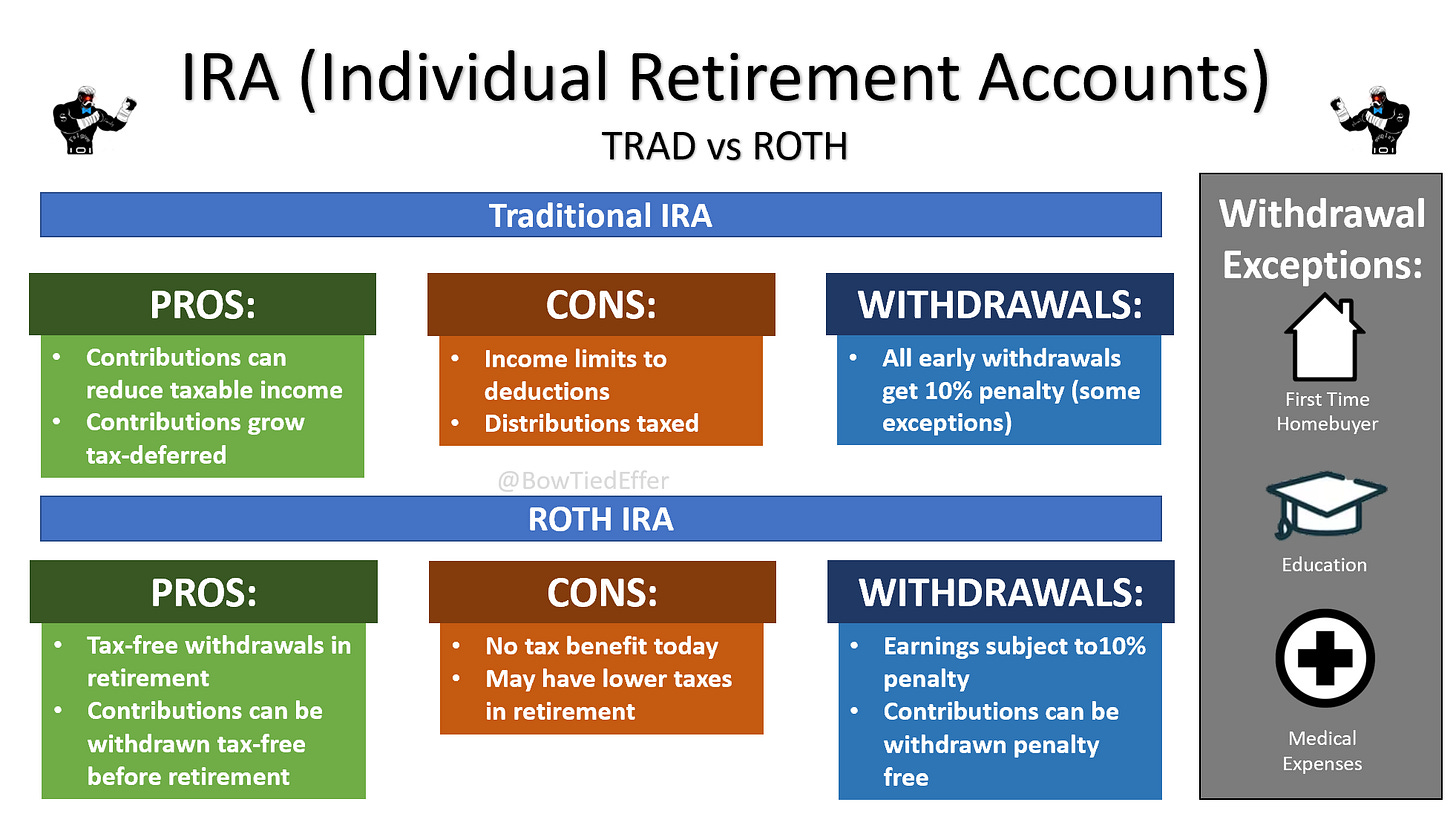

Below is a quick comparison of Trad vs Roth Accounts:

Roth Limits & Cut-offs

One of the biggest downsides to a Roth IRA is the limit to both contributions and income cut-offs.

You can only contribute $6,000 a year to a Roth IRA ($7,000 if you are over 50) in 2022, and this increases in 2023 to $6,500 ($7,500 for those over 50). You can have separate accounts for both you and your spouse so that doubles the amount you can put in, but the limit is still fairly low.

And if you miss a calendar year, you can’t go back to fund it. So you need to be diligent about contributing to your Roth every year.

Although, you can still contribute to the prior year through the tax filing date. So in 2023, you can still open and contribute to a Roth account for your 2022 amount through April 18th-ish.

We are going to call that out because many people don’t realize this and we don’t want you to miss it….

You can still contribute to your 2022 Roth limits through April 18, 2023….Do it. Do it NOW

But Roth accounts also have income cut offs where you can not contribute to a Roth if you make too much. The limits are:

$144k for single filers in 2022 or $153k in 2023

$214k for married filers in 2022 or $228k in 2023

If you make more than these cut-offs you are unable to contribute to your Roth….unless there is another way….