Opportunity Costs - Expensive Decision Blindspots

Why you are likely overestimating the payoff of your decisions

I love opportunity costs.

Actually, no, i hate actual opportunity costs. They are terrible, but I love the concept.

And people are absolutely atrocious at even thinking about them.

Opportunity costs are intangible which makes them off the radar for most people. And not understanding opportunity costs leads people to make a lifetime of suboptimal decisions.

Worse yet, when you don’t understand opportunity costs, you can do a bunch of actions that you *think* are helping you, but are actually holding you back from success. But since you are doing something & that something has a net positive, it *feels* good.

Even in business, people don’t understand opportunity costs.If you have sat on project teams where the company wastes $250,000 in salary to ‘save’ a $100,000 one time expense, you have witnessed this.

Making decisions without evaluating opportunity costs is common and a very expensive blindspot. Let’s help you get better.

What are Opportunity Costs?

Opportunity cost is the ‘unseen’ cost of the benefit missed by choosing one option over another. When you are evaluating the success of a decision, you need to compare it to the next best option.

Opportunity Cost Example

Opportunity costs are more clear when looking at an example.

You spent time doing research and purchased an individual stock. Let’s say Apple.

Apple increases 30% on the year. Nice - your killing it bro - you are stock market genius.

But you can’t just look at your Apple purchase in a vaccuum

Let’s say that your next best choice was an SP500 ETF. The SP500 index increased 28% on the year.

Suddenly, your 30% looks less impressive. +2% but with less diversification & you spent time researching and your time has value.

But the SP500 benchmark isn’t your only choice. Let’s say you brought AAPL as a tech play. If you didn’t buy AAPL you would have bought NASDAQ ETF (QQQ).

QQQ returned 35% over the period

Now your 30% on Apple is -5% vs the next best choice. Not only did you underperform the index, they also spent time researching Apple & took on single name risk.

What appeared to be a great decision in a vaccum ended up being a negative due to the opportunity cost.

[Note: 30% return is great. The point of constantly looking at opportunity cost is to find the value maximizing decision. If ETF buying gets you the same returns as your stock picking, you are better off just buying the ETF and spending that now free time on a more value-additive use.

If you only ever look at the result in isolation, you will continue making subpar choices. Like every stock-picking gooroo who is talking about being up X00% in the last y years when we are in a historic equity bull run. How do they perform vs just an ETF purchase when you adjust for the time researching?]

By comparing your decisions made vs the ones you didn’t make, you can get a better reflection on the success of the decision

Opportunity Cost & Inflation

If inflation is running at 10%, the cost of all items you purchase is 10% higher in a year. (For simplicity, assume uniform inflation). That means if you pre-purchase items that you need in the next year, you save 10%.

For example, assume a roll of toilet paper is $1 today. Inflation says it will be $1.10 in a year. If you go through 100 rolls in a year, you could buy all 100 right now and store in your closet. A year from now it would cost $110 for those 100 rollls. But you spent $100. That is a 10% return.

If you can buy and store toilet paper for a 10% return, that should set a floor for your other decisions.

If you have the option of investing in a CD at 3% but you can buy toilet paper for 10% returns, the opportunity cost of investing in the CD is forgoing the 10% butt wipe return. $100 in a CD grows to $103 so your return on the investment isn’t +$3, it is -$7.

[Note - yes, buying toilet paper, toiletries, non-perishables, etc is only scalable to a certain point. But people talking about what to do with an extra $1,000 should be looking to pre-buying toiletries as their comparison. If you aren’t clearing the rate of inflation with your decision, you are investing suboptimal]

Dave Ramsey & No-Debters Don’t Understand Opportunity Cost

The above is important because when you don’t consider opportunity cost, you think a decision you make is better than it is.

Enter my favorite grifter…err…gooroo, Davey Boy Ramsey. Davey Boy likes to point out the interest you can save by making extra payments on your mortgage. ‘If you pay down your mortgage you will save over $65,000 in interest payments.” WOW. WOWIE WOW WOW…

I checked, here is the proof in graph form. Sure enough over 360 months, your total interest paid is $158,000 making the minimum payment and only $92,000 making an extra 33% payment each month (works out to an extra payment each quarter). And your mortgage is paid off about 11 years early (19 year mortgage):

“Oh no, F’er, it looks like the old grifter has you beat. Plain as day there is $65,000 in interest extra you are paying. Also look how early that mortgage is paid off. Cha-Ching Davey Boy is right!!!” - you may be thinking if you haven’t been paying attention.

But the old con artist left out an important detail. He is telling you to pay the equivalent of an extra $350 a month (pay $1,400 vs $1,050). BUT, if you keep paying only the $1,050 minimum a month, what do you do with the $350 you didn’t pay? What is the alternative? Do you burn it? Bury it? Put it in a savings account at 0.01%?

Let’s assume you throw that extra $350 a month into a vanilla SP500 ETF and over 30 years you earn 7% a year on it. So now lets compare if you had a total of $1,400 every month and you either:

Followed the Davey Boy method and put all $1,400 into your mortgage and then once your mortgage was paid off, put all $1,400 into investments, OR

Followed F’er and paid the minimum mortgage of $1,050 and put the $350 into investments every month for 30 years

Yup. Davey Boy just cost you over $130,000 in total wealth.

Cha-Ching.

“Buy my 8 books and follow my method and YOU can also be $130,000** poorer for it when you get to retirement” - Davey Boy

**F’er note - you’d actually be atleast $130,160 poorer because you spent $160 on his books

This is opportunity cost.

Yes, you are locking in 4% returns on the interest saved on your mortgage. But your giving up all alternatives you could be doing with that money. If you can find an investment that outperforms 4% over the same time frame, that is a better use of your money.

If you can invest at anything >4%, you should do that instead of paying extra towards your 4% mortgage.

[Note - this is ignoring a host of other benefits of a mortgage, like:

Any tax benefits on mortgage interest

Liquidity of money in a brokerage vs home equity

Long payment history on your credit score, etc ]

Difference Between Opportunity Cost & Sunk Cost

Opportunity Cost and Sunk Cost are very similar concepts and both are costs people have a hard time quantifying. But they are 2 very different costs.

Opportunity cost is the cost of choosing one option vs the next best alternative.

Sunk cost is the cost that have already been incurred on the current choice.

The sunk cost fallacy is when you think “I have already spent X on this, and it will be wasted if I stop and change courses.”

It is a fallacy because at any point in time, your optimal decision is the one with the best expected future return. This is regardless of any costs you incurred in the past. It doesn’t matter how much you have spent in the past on the current path. Those costs are ‘sunk’, you can’t get them back.

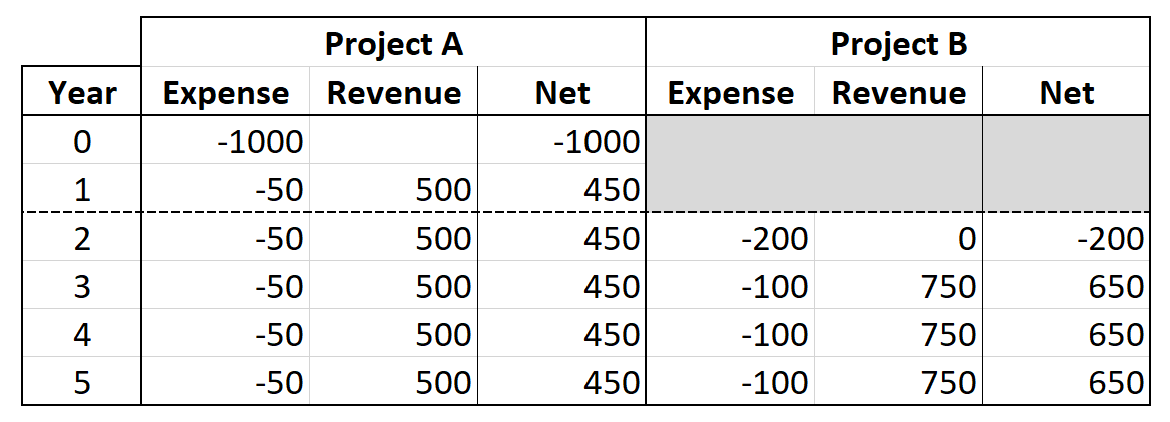

For example, if you have spent $1,000 to buy a machine that cost $50 a year to maintain, but you can earn $500 a year. Then a different opportunity comes along after a year that you need to pay $200 upfront and $100 a year expense but you earn $750 a year.

If you could only do 1 project, what do you do? Do you stay with project A since you are still -$550 on it or switch to Project B?

Most people would be at the beginning of year 2, and look at the $1,000 they spent and keep on the path earning a net of $450 a year. Even though going to the alternative project would earn you a $650 net profit every year and leads to a more profitable outcome.

In this example, the -$1,000 is your sunk cost while the opportunity cost is the ($650 - $450 = $200 of additional annual profit).

Why Is Sunk Cost Important?

I added sunk cost to this post because it is important to not be tied to the decision you made previously.

Coming up with a random example… lets say you spent $200 on books from some gooroo…let’s call him ‘Save Pansey’. You have also been following his advice in locking in 3% returns every year paying down debt while the stock market returned an average of 12% per year. (I know, completely random example). The $ you spent on books and sub-optimal investments and the time you spent reading low IQ drivel is a sunk cost.

So if you find a new path that is more profitable, you can’t look at costs already spent when making your decisions on what to do next.

If you keep on the same suboptimal path, instead of switching to a better alternative, you have a negative opportunity cost in the future.

Minimizing Opportunity Cost with “No”

“Most people think saying ‘No’ is selfish. But saying ‘No’ is the least selfish answer you can give. When you say ‘No’ to one thing you are only saying ‘No’ to that one single thing. But if you say ‘Yes’ to one thing, you are implicitly saying ‘No’ to every other thing you could be doing during that time”

-A wise man who understands opportunity costs… (aka me to my wife when she asks me to go somewhere I don’t want to go)

Opportunity cost doesn’t have to be in a financial construct. Your life is full of opportunity cost decisions you make. Any time you devote to an activity is time you are not spending on all the other activities you could be doing.

When you start to view your decisions more like tradeoffs, you will be able to much easier say ‘no’ to low value add tasks. If you say yes to some negative expected value activity, you are saying ‘no’ to every other activity you could have done with a better payoff.

Example - If you have a ‘drama friend’ who is a drag to hang out with but they always call to ‘catch-up’ and then just dump all there stuff on you. Telling them ‘no’ isn’t selfish. It is more selfish telling them ‘yes’. Listening to them you are implicitly saying ‘no’ to all the other people in your life you could see at that time.

If you don’t particularly enjoy yardwork and you want more time to work on side income, then say ‘no’ to yardwork and outsource it.

The list goes on and on of tasks you probably are doing that the time would be better spent elsewhere.

Wrap-Up on Opportunity Costs

Understanding opportunity costs can help you get a much clearer understanding of the outcome from your choices. People genuinely will believe paying down a low cost loan as the best use of money because the *see* the balance going down and it *feels* like progress. But if you frame your decision as ‘missing a 7% return for a 4% return or a -3% return decision’, you have a better framework for optimal decisions.

[Note - before any FIRE people get uppity, yes there is some utility people get from less debt. That’s fine. If you are stressed and miserable with debt, and the value you get from carrying 0 debt is higher than accruing wealth…that is a perfectly individual opinion.

However, you should recognize that you are making suboptimal decisions for personal reasons. People don’t have good intuition on finances. They see the group think around the no debt movement and get sucked in. Sadly, they are usually the people living closest to brok and need to be making every decision optimally.

If I went to twitter and said “I just purchased a 3% CD for the next 30 years!!!”. no one will care. That doesn’t seem impressive. But say “I paid off my 3% mortgage early” and the no debt people come out in droves to celebrate. The return you locked in is the same.

Again, we have had over 11% annualized return over the last 10 years. If you put extra money into your mortgage at 4%, you actually lost 7% return in opportunity cost. Just say “I prefer to be debt free and I am willing to underperform by 7% to do it”.]

Back to the example in the introduction, next time you are on a project team to save expenses and the salary involved is more than the projected save, ask about the opportunity cost. If you have an average manager, you will get a lot of sputtering and buzzwords. If you have a sharp manager he will explain how salaries are fixed cost, and directly pointing to an expense save is an easier story than trying to claim credit for revenue growth. (ie- sharp managers understand opportunity cost, but also understand the politics of ‘look like you are making company a profit is more important than making the company a profit’).

Why should you care?

Make sure in your personal life, you are looking not at the value of an action alone, but the value of an action relative to the other actions you are forgoing

If you work for a big company, your goal isn’t value maximizing for the company, but value maximizing for your own compensation - sometimes those 2 are aligned, many times they aren’t

However, if you have your own business, make sure you are running it to maximize company value

Look for highest return tasks

Don’t spend time on low value add and/or time consuming tasks

When employees bring a success - make sure you compare it vs the other actions that employee could have been doing over that time

One Last Anecdote:

I was working in an area with 2 separate models early in my career. One team had to be very precise to a big regulatory change. My team didn’t need our model to be precise. However, in the excitement, my manager set up a joint ‘task force’ and both teams made the same extensive changes in the 2 models.

It was a ton of OT to get it done. Once completed, the other team got a one-time extra bonus for all their work while our team got nothing. I was livid and went to the grand-grand boss.

He listened and his response was “thats great, but you guys could have spent 1/10th the time and swagged it. You don’t get rewarded for being inefficient, your time would have been better spent on something else”.

So why didn’t you course correct us? “No one asked me, and if the team wanted to work extra OT for free to make a better model, why would I stop you?”

Good lessons to learn early in the career if you continue wagecucking. Also, that guy has had a very successful career since then.

This is great! I'm looking to buy my first house soon, any advice on terms and money down? I was looking for a post That is sort of like a beginner guide to your principles. Do you have anything like that for stuff like buying houses, buying cars investing, insurance, budgeting?