It was a heck of a week in markets.

I won’t add to the plethora of platitudes flying around or patronize you with head pats.

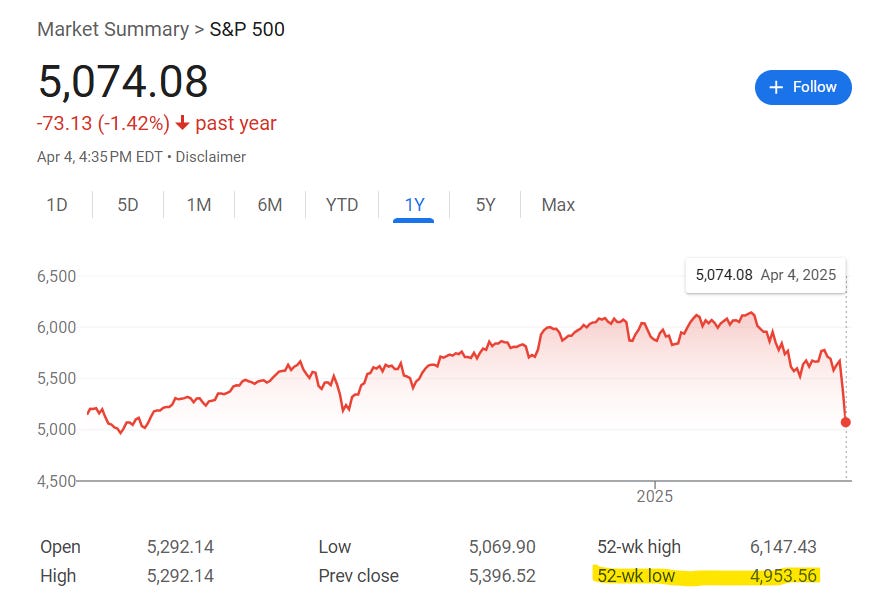

Emotions are certainly running high. For many, outside COVID (where the news focused COVID much more than markets) this is the first real market drop they have seen. And yes, it is scary. We finished today with the SP500 just barely above its 52-week low point and a negative return for the last year now. The market is down ~20% from its highs.

If you do quarterly net worth updates and you were a few days late in Q1 because you were rushing to get your tax stuff done, you probably witnessed your net worth drop for the first time in a long-time.

(If you are a long-time heavy crypto user, you’ve probably fried all those receptors and don’t understand what the fuss is seeing how memes like this are thrown around when crypto drops 70% in a month)

But, take this weekend to go outside and touch grass. Stay off social media where everyone is whoring emotional takes to get a few pennies in Elon bucks. If you are feeling anxious about your portfolio or depressed about the recent drop in value, you are likely to make brash and regrettable decisions going into next week, so find some peace.

Since markets are on most people’s minds, writing about other topics and ignoring markets this week felt like a dodge.

Don’t worry, I am not going to play Monday-Morning-Economist and explain tariffs, prices, and markets. There are a lot of moving pieces in an economy and anyone pretending they know what happens next is lying.

[Though I will say, it is a fairly convincing argument to me that the fact pushing tariffs to get better long-term trade deals and also causing a mini crash that forces the FED to lower rates while also leading to risk-off trade of buying UST so that all the COVID 5-year debt issued 4.9 years ago and coming due can be refinanced lower. That seems plausible.]

This post is going to take emotions out and cover the important lessons to take away from this last week.

Zoom out

How to see if an online gooroo was grifting

What can you do to prepare for the inevitable next big market drop

The recent post about not panicking is still relevant as well. The time to make a change to your investments isn’t when you are watching the market go down, it is when the market is high. After 2 big red days, you don’t want to emotionally sell, because if you are making changes on emotion that means you are likely going to finally pull the trigger and buy higher.

Panic!!!

If my DMs, text messages, emails, conversations, and phone calls from friends, family, and co-workers are any indication, there is panic out in the financial world right now.

With that all said, let’s talk about markets and get your mind right on this.