Buffet. Graham. Lynch. Templeton. Bogle. Munger. Soros. Dalio. Icahn.

Everyone knows the names of the titans in the stock picking industry. Guys who over the years seemed to be right more than they were wrong and made massive wealth in the markets.

[Note - Let’s put aside previous critiques about manipulation, insider trading, sweetheart deals, regulatory capture, etc. etc. Or if some of these guys have extremely…ermm…questionable morals and ethics and/or politics. The point isn’t to get hung up on the finer points, just that some people seem to really have a knack at the stock market.]

Whether they used value investing, macro factors, arbitrage, technicals, options, or some other system, there are a handful of people who have been able to amass vast wealth in the market.

Your average twitter gooroo (aka po boi) knows the secret to follow in the footsteps of these legends…allegedly…and tells you to just keep buying, DCA, buy low-cost ETFs, etc. etc.

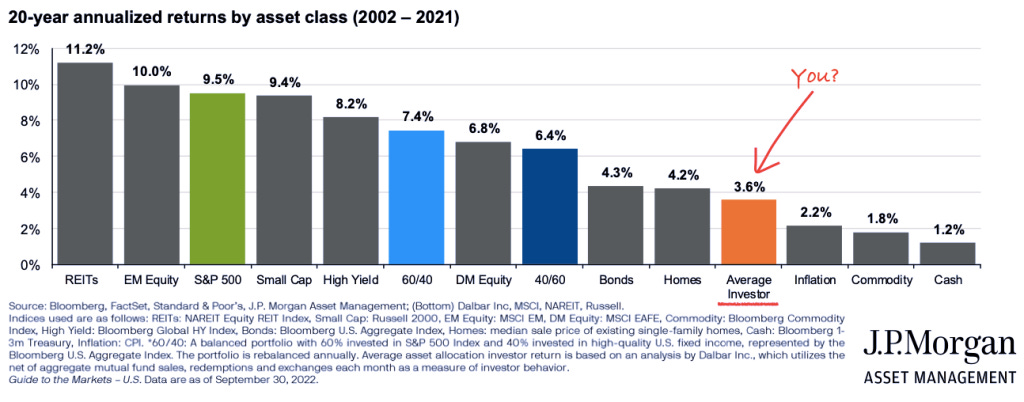

But most retail investors continue to vastly underperform the markets. In fact over a 20 year period the average investor underperforms nearly every asset class there is. And it doesn’t matter what the 20 year period chosen is, it is a constant theme.

So what is going on?

This week, I am going to introduce a little thought experiment to ask the question, “are these legends really that good or can it be explained as random chance?”

What if, on a pure skill and stock-picking basis there are 1,000s of guys just as good or even better than a Buffet or Dalio? Is it possible that most of them ended up with mediocre results despite their ability?

[Again, ignoring all the grift like getting sweetheart deals from the government or buying a stock then bribing…i mean ‘donating’ to politicians to get them to pass a law that benefits the company you just purchased.]

And yes, I happened to watch some of Trading Places a few weeks ago and it sparked this top. This is a great movie that has been meme-ed into social consciousness with references and jokes for 40 years to the point people don’t even remember the OG. Atleast click the link and read the the wiki synopsis of it if you don’t know.

Then we will wrap up with some takeaways that may make you a better investor.