“Just Keep Buying”

This is a popular concept and even has an entire book on the topic that came out in 2022. The premise is that over the long-run, the stock market goes up and even buying a local high, you will eventually see the market reach a new all-time high.

And to a degree, it has worked.

The markets have continually reached new nominal all-time highs. This book points out a study on investors who outperform the market in their brokerage accounts. And the top indicator of an outperforming investor was ‘not being alive (or not knowing they had an account)’. Basically the individual accounts that performed the best were the ones where the person didn’t touch the account for years because they were either dead or forgot it existed.

This piggy-backs off the older Peter Lynch quote from the 1990s: “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

He referenced that if you invested at the highest or lowest point in the 60s, by time the 1990s rolled around your annualized returns would have been 10% or 11%. So the difference over the 30 years was roughly 1% annualized. Which is something, but if you sat out for long stretches of time, you would have missed a lot more of those returns.

And again, there is truth in that.

But the reason these quotes and books need to be written is behaviorally, people tend to do ‘something’.

Is there a way to feel better about your downside risk while not leading to gross underperformance?

I mean, the markets do go down, and sometimes they go down significantly.

Luckily, there are ways to limit your downside that don’t involve completely exiting the market or missing out on all the upside. And if you can identify where we are in the investment cycle, you can start to incorporate some protection strategies that can help you feel better about your portfolio so you can stay the course.

This post will walk through the investment cycle and offer some ideas you may consider. But first…

Why Markets Trend to Reaching All-Time Highs

Inflation.

We can get fancy and talk about efficiencies, GDP growth, population growth, etc etc. But at the core, inflation is a huge driver of markets going up.

To put it in a very simple example, imagine a company that sells $100 of goods and has $80 of expenses and $5 of taxes (25% tax rate on $20 pre-tax) for a $15 profit per share. It trades at a P/E (price of a share / earnings per share) of 10, so the stock price is $150.

A few years later everything experiences 20% inflation. The company sells $120, its expenses are $96 for a pre-tax profit of $24. At a 25% tax rate it earns $18 per share and at the same P/E of 10, the stock price is $180.

So 20% inflation leads to a 50% increase in the stock price.

Again, this is overly simplified, but at the core, inflation is driving stock market growth.

[Note - the increase in stock price is 30% real return since 20% of the return is lost to inflation. This is also why CPI is a poor measure of inflation and you should be using alternative measures like we talk about here:

Base Measure for Income + A Better Crypto Return Measure Part Uno

You got a 5% raise last year. One of the highest at the company. Sweet Man, congrats. That seems like a straightforward good thing….right? Right? Well, one of the running themes on this substack is, “nothing in finance is as straightforward as the gooroos lead you to believe”.

]

In short, as long as inflation is going, stocks should be reaching all-time highs consistently.

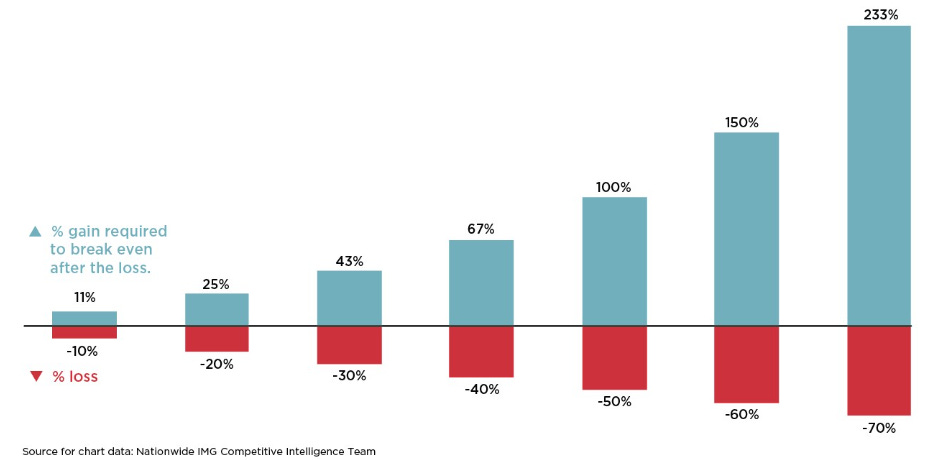

But markets are chaotic and swing from undervalued to overvalued and back. If you can reduce some of your losses, you can really drive long-term outperformance. Remember, a 20% loss needs a 25% return just to get back to 0%. If you can lower your losses, while still getting most of the upside, you can set yourself up to be way ahead.

Imagine if you do it perfect. The market drops 20%, but you were able to avoid that loss. Now the 25% gain has you up 25% vs everyone else who is just back to even.

Let’s get into the details.