How To Read A Life Insurance Illustration & Using Life Insurance For Tax Minimization - Part 2

How To Read an Illustration of a Common Tax Minimization Insurance Policy

Part 1 we walked through how to use life insurance as a tax minimizing strategy. In that post, I used some general heuristics and wanted to nail down the overall concept.

This week, its time to bust out the ‘tism as we will walk through some pages from an illustration of a fairly common set-up. This is going to be packed with some deep concepts so get a coffee, pack a fluffy lip pillow, and get ready.

Illustrations

By regulatory rule, life insurance needs to be sold with an illustration. There are a lot of rules around what needs to be included, what assumptions need to be made, and what can’t be included. However, outside of that, every company will have a slightly different look and order in their illustration.

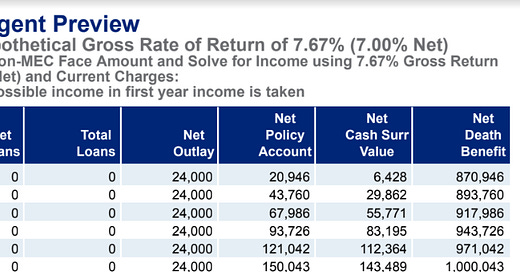

Illustrations are there to show you the projected performance of the product. They need to include things like the cash value growth, death benefits, charges on the policy, any charges that can change and what the guaranteed worst value are for you, etc.

[Note - there are 2 types of values on UL products for charges, bonuses, etc - 1) current = the charges that are currently being used for the product and 2) guaranteed = the highest/lowest the value can become. For example, a policy may be charging 1% a year fee on account vale, but the company may have the contractual right to raise it up to a guaranteed max of 3%.

Now, in practice, companies tend not to do this as it brings on lawsuits and makes it very hard to sell new products (who would buy a product from a company that just rug pulled its prior customers?). But it does happen on occasion. Luckily, illustrations are required to show the performance at the guaranteed charge level as well.]

What people don’t realize, is any reputable company can run as many illustrations as you want. So before you buy, ask them to do various things and see how the product performs.

There are companies out in the industry that are known for designing products that look great in illustrations, but if anything happens slightly different the product bombs. So ask them to run different premium payments, different fund performance, shocks, etc. Really anything you can think of that will help you understand what happens in up and down scenarios. A good advisor will be willing to do this for you.

[Note - There is a ton of information in UL illustrations. The one I have is, unironically, 69 pages. Every rider is spelt out. Every charge is explained in detail (how it is calculated, but it is based on, the current charge and how high the company can raise it (guaranteed charge), how the product works, etc. This is one time its worth spending the time going through a contract in detail and asking questions about any and everything that doesn’t make sense to you.

Working for insurance companies, it is shocking the types of basic questions that come in on old policies that show people clearly didn’t know what they purchased and agents didn’t understand what they sold.]