Buying vs Leasing A Car 101 - Introduction to Leasing

A User Request For A Financial Breakdown of Options When Getting a Car

[F’er Note - I am going to try a different structure going forward. I have been writing free posts and paid posts with little connection between the 2 each week. Also, since my paid posts were on new topics, I had to provide a decent amount of background.

I am going to try to do a free post at the beginning of the week that introduces a concept and provides the background. This post will be synthesizing hours of useful information into the post. Even if its a topic you know, you will likely pick up a few tidbits. (My posts have been running 2,000-2,500 words each and substack puts most at 8-12 min reading time. Not bad trade off to get hours of information in 10mins).

The paid post will be later in the week and will provide the same deep dives as before. But without needing an introduction, I can spend more of the paid post running tests on the topic and providing valuable analysis and conclusions.

Additionally, this will allow for some better congruency of a theme for the week.

For example - this free post will lay out and summarize the car leasing vs car buying question. After reading this, you will be ready for the paid post where we see if all the anecdotes used hold up and what the optimal decision is. A 2nd paid post on the topic will compare buying new vs used and will come later.

We will test this structure. Feedback is always welcome on what works best for you.

And this is the 3rd subscriber request to get bumped to the front of the release schedule, so if you have any topics please request away. I am writing to help you out, this is largely stuff I do & know in my own life already.]

Buying vs Leasing A Car 101 - Introduction to Leasing

So you are in the market for a new vehicle. Congratulations.

You have probably heard that leases are terrible and expensive.

“They require perpetual car payments!!!”

“It is forever debt!!!”

“And you never own your vehicle!!!”

“They are super restrictive and hit you with a bunch of hidden fees at the end!!!”

Or maybe you heard how great leases are and that owning a car is a bad choice since as soon as your factory warranty runs out, everything breaks and the maintenance cost of owning it go through the roof. (I have an uncle who has only ever leased vehicles because any issue he can just bring it to the dealer.)

There is a lot of anecdotal pieces of advice out there. But what are the actual facts?

[Note - car deals vary from model to region to dealer. You can have 2 dealerships in the same state running very different deals and promotions. This series will go over the basics, but watching your local market for good deals, shopping around, and looking at the numbers you actually get is important.]

Most people understanding buying a car, but leasing is a different and opaque process for many, so...

How Does A Lease Work?

First off, what is a lease and how does it work?

Leases are like rent. If you are familiar with renting a home, leasing a car has many similarities.

You don’t own the car, but you are paying to use it. The dealership has the title and you have a contract telling you what you must and can’t do while using the property

This includes how many miles you can put on it, and the type of maintenance & upkeep that is expected, and limitiations to modifying the property

Just like you likely can’t paint the rooms in your home rental, or if you go beyond regular expected wear & tear you lose some security deposit, when you lease a car you have similar rules

You may have to pay a refundable security deposit at the dealer of 1-2 months payment.

If you try to break the lease contract early or break any of the rules in the contract, you will likely pay sizable fees.

The big one here is the mileage limit. Leases can have limits of 10k miles a year. If you go over, you pay a fairly high per mile charge.

You need to return the property at the end of the contract, and some contracts allow you the option to purchase at the end

So Why Would You Lease A Car?

The monthly payments for a lease tend to be lower than the payments for a car loan.

Lower monthly payments is one key difference between leasing a car and renting a house. When you rent a house, you typically pay more than the equivalent mortgage would be. But when you lease a car, you actually get a fairly substantially lower monthly payments than buying a similar car.

Additionally, leases allow you to get a brand new car every couple of years and the vehicle will be under warranty the whole time you drive it. There are people who want the newest features in a car, especially as the tech in cars get more advanced years to year. A lease is an easy way to also have that newest feature.

There are also situations where getting a new vehicle every couple years may fit your lifestyle. If you are a young single guy who is planning to get married and start a family soon, you may be changing your vehicle every couple years anyway. You may have a fun car now, a sensible sedan after marriage, a small SUV after your first kid and then upgrading to a 3rd row as your family grows. The timing on leases may fit your changing lifestyle.

Many people shy away from leases because the contract is confusing. And admittedly, it isn’t as straightforward as a car loan. So how does a lease contract work?

Maths Behind Calculating A Lease Payment

[Note- Calculating a lease isn’t something you ever have to do, you can just ask your car dealer for a bunch of quotes and look at the results. There is no reason you would ever need to calculate your lease payment from scratch…it’d be a waste of time.

However, if you are looking at a quote and want a general idea of what is going on, here is how it works.

Also, turning your lease rate/money factor into an equivalent APR to see what rate you are getting could be helpful (money factor * 2400).

Full disclosure, I had to look up this calc & the actual names of the steps from edmunds. It is pretty interesting to see.]

We will use a modest car with the following inputs:

MSRP = $22,000 (the price on the car)

Negotiated Price = $20,000 (the price you actually paid after haggling)

A 36-month lease with a 0.00125 money factor (equivalent to 3% APR)

Residual Percent = 60% for a $13,200 residual value after 3 years

Closing fees = $1,000 (these will vary greatly, just using it as a placeholder)

Trade in of $1,500 and $500 of dealer rebates and $0 additional cash down payment

Quick maths - how is a lease actually calculated?

1. Calculate Residual Value = MSRP * Residual Percentage

(Assume listed car price is $22,000 and residual percent is 60%)

$22,000 x 0.6 = $13,200 residual value

2. Gross Capitalized Cost = Negotiated sales price + All the Fees

Add the lower negoitiated price with all the closing fees and we get what's called the gross capitalized cost.

$20,000 + $1,000 = $21,000 gross capitalized cost

3. Total “Down Payment” (Capitalized Cost Reduction) = Cash Down Payment + Trade-In Equity + Rebates

(Assume $0 cash down payment, $1,500 trade-in, and $500 of rebates)

$0 + $1,500 + $500 = $2,000 capitalized cost reduction

4. Adjusted Capitalized Cost = Gross Capitalized Cost ($21,000) - Capitalized Cost Reduction ($2,000)

$21,000 - $2,000 = $19,000 adjusted capitalized cost

5. Estimated Depreciation Amount = Adjusted Capitalized Cost ($19,000) - Residual Value ($13,200)

This is your depreciation amount, which is the basis of your lease payment.

$19,000 - $13,200 = $5,800 depreciation amount

[Note-Leases can set a residual value not connected to reality. If the lease has a higher residual cost, it will have a lower monthly payment. However, this higher cost will likely also be the one you have to pay if you want to purchase your vehicle at the end of the lease.

This is called a “lease trap” by some. Since you don’t want to pay the above market ‘residual value’, you need to get another lease. So even though you pay a little less during your lease, you are being forced to be a return customer]

6. Calculate Base Payment = Depreciation amount divided by the months of the lease.

(Assume 36 month lease)

$5,800 / 36 = $161.11 Base Payment

7. Calculate Monthly Interest = Adjusted Capitalized Cost ($19,000) + Residual ($13,200) and multiply that amount by the Money Factor

This is called the rent charge.

(Assume a money factor of 0.00125. To turn the unconventional money factor into an APR, multiply by 2400. So here we have a 3% APR on the 36 month lease 2400 * 0.00125 = 3%)

($19,000 + $13,200) x 0.00125 = $40.25 Rent Charge

[Note - there is a section immediately following the calc that deep dives into explaining this money factor. It makes sense once you see it.]

8. Final Lease Monthly Payment = ( Base Payment + Rent Charge ) * ( 1 + Sales Tax )

(Assume 0% sales tax for simplicity here)

$161.11 + $40.25 = $201.36 Total Monthly Lease Payment

Lease Money Factor Explained

At first this money factor was confusing and explanations were underwhelming.

Why 2400? Why not just show an APR? Why does every article seem like it was written by someone who doesn’t actually understand what is going on and just keeps saying multiply it by 2400 to get APR over and over?

After a bit messing with it, it actually makes some sense to express your interest this way instead of APR. Since there is a residual value, doing a standard loan amortization is messier - you aren’t going to $0, you are amortizing to a different non-zero residual value.

When amortizing only a portion of the value, the impact of your standard amortization is less. Ie- the impact of paying more interest at the beginning of the loan and less principal.

The lease simplifies amortization by assuming a flat principal and flat interest payment every month. If you assume that the leasee keeps the contract to maturity, you don’t need a complicated amortization schedule like other loans.

Instead you can simplify to linear amortization and say “over a normal loan, your average payment is $X principal and $Y interest”. The lease just uses these averages for each payment.

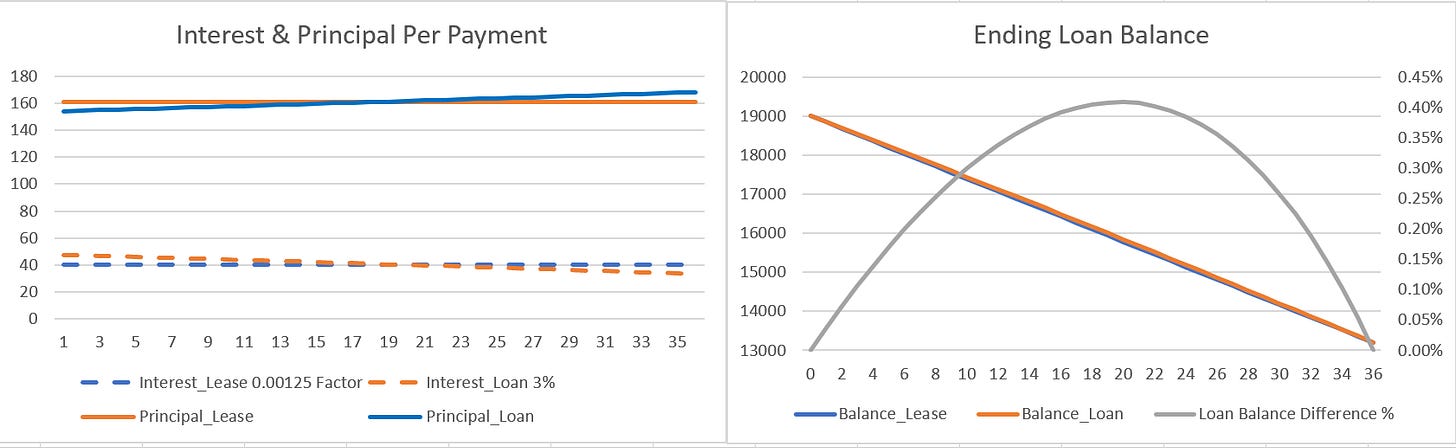

The actual difference is very small. In a traditional loan, you pay ~$8 more interest in your first payment and ~$8 less interest in your payment at month 36. The total difference in the loan amount (gray bar on right chart) is less than 1/2%.

The 2400 factor to get to an APR is due to taking:

2 = The average vehicle value over the lease is calculated as:

( beginning value + residual value ) / 2

12 = months in a year

100 = to make a percent a nominal number you multiply by 100

2 * 12 * 100 = 2400.

Pros & Cons of Leasing

Allright, what are the benefits and downside of a lease vs owning the car outight.

The Benefits of Leasing a Car

Get new cars frequently

Do you put a ton of value on new things, new tech, latest innovation? A lease allows you to get a new vehicle every 2-3 yrs.

Are you in a changing family environment like previously stated or in a short-term position that you only need a car for a couple years?

Lower monthly payments than financing same car with a car loan

The Down payment is generally lower or even $0

Unimpacted by decreasing resale market. Since you don’t own the car, you don’t own a ‘depreciating asset’. If the resale value of the car drops, you are unimpacted.

For instance, if a year after release, it is discovered that model vehicle has a fault in the engine that causes it to break down in 5 years. The resale value of the car would be way lower than originally expected

Benefit from a higher resale market. Buyout options are common and allow you to purchase the car when your lease is up. If you really like the car OR if the resale value of the car is up compared to the residual value you benefit.

May 2022 - used cars are trading for more than their original new car prices. If you have a lease with a buyout option maturing, you could buy the car at the contractually agreed price and turn around and sell it for a profit.

It isn’t common that used car prices are this high. But this is an example of options having value. Buyout option means if the resale market is down, you have no downside, but if resale market is up, you can keep the upside.

Maintenance & Repairs likely fully covered under dealership and manufacturers warranties for normal wear & tear. Many leases will also include the oil changes for free if done at the dealership.

Additional GAP Insurance may be included - Dealer may pay for any GAP insurance between your regular car insurance and the full pay-off value of the vehicle if totaled.

The Downsides of a Lease

Have to deal with car dealers every few years…enough said

Open to the changing car market. If the car market gets tight when your lease is up, you may be forced to look to buy or get another lease at a much higher price

Restrictions and requirements are many & costly

You will have a limit on how many miles you can drive. Some leases are limited to 10,000 miles a year while higher mileage leases may be over 30k miles. But having the higher mileage leases comes at a significantly higher monthly payment, up to 50% higher. (The DOT says the average person drive 13,000 miles a yr)

Leases may charge up to $0.50 for every mile over. If you drive an extra 1,000 miles in a year, that is $500 of fees

You also probably don’t get any money back for unused miles

You will also have maintenance that you will be required to do on time

Breaking any of these covenants in your lease end up being extremely costly

Unable to modify the car in any way - some people like making mods to their cars

You can’t build equity. Even though a car’s value decreases. If you take a 5-year car loan and pay it off, you own the car and it likely still has resale value if you want to get rid of it.

Breaking a lease is costly. If you are leaving the country or no longer want the leased car, it is costly to break the lease.

Have to read the lease contract often. All these restrictions, requirements, fees and rules mean you need to read your lease contract and be familiar with it. When you buy a car, you just need to pay your loan and the rest is your choice.

Summary - Leasing Or Buying A Car

That is the overview on leasing a car vs. buying a car. Leases get you a lower monthly payment and new cars every few years. But they come with rules and restrictions.

The next post will compare the actual financials of leasing cars or buying cars over an extended period of time. We will prove out what the maths say is the better option depending on the type of car owner you are.

One last ending bonus takeaway. I have a family member who has only purchased pre-leased cars. They claim that the lease contract means that you know the car got all its maintenance and didn’t get excess wear & tear. They swear its the best used car purchase you can make.

This is awesome 👍 thanks so much , interms of buying I always heard that looking at resale value is the best way to judge what to buy. For instance something like a Toyota Tacoma right now has tons of resale value, do you find this to be a viable way to buy?

I'm actually in the process of moving into WL and would appreciate any pointers to accurate assessments of it you may have.

Personally like the tax free growth of principal but maybe I'm missing something.