We have got a few DMs from people looking to buy their first non-401k stock purchase. First - congrats. It is a big positive step to be saving and investing.

Second, we figured it was a good opportunity to do a write up so we can point followers to a post instead of typing it out.

If you are new to investing, this will cover the basics. Even if you have been doing it a while, you may pick up a thing or 2.

Opening An Account:

If you don’t have a personal account, this would be step 1.

We trade with Fidelity and in our experience, it is one of the better brokerages. They have the standard no fee trades and give you the ability to purchase their low-fee ETFs (more on those later).

But mostly it is the customer service. They have actual knowledgable people who can answer questions for you. We have owned securities going through corporate events like stock splits, warrants, conversions, etc. We have yet to have an issue that we couldn’t solve on the phone with their DOMESTIC help desk. This is huge if you have used a discount broker (IB or robinhood) and can’t get answers to even basic stuff.

[Note - we don’t trade with apps, and have refused to download the fidelity app (partly security reasons and partly not liking small screens), so can’t comment on it. The app is relatively new so no idea how seamless that is.]

Opening an account on Fidelity is easy.

Just click on the “Open An Account” in the banner on the home page and you get to a page to choose your account:

Choosing Which Account To Start With:

If you look at the above, you see multiple accounts to choose from. What is the difference?

Rollover IRA - this is for moving money that is already in a qualified or Roth account into an IRA account with Fidelity. If you left a job and had a 401k that had both traditional 401k and Roth 401k money in it, and you want to move that money from your old employer to your own individual retirement account (IRA), this is the option you would choose.

The other options are keep the old 401k with you old employer, but often ex-employees need to pay administrative fees when doing this. Or you can roll an old 401k into the new 401k at your employer. Personally we move it to an IRA so we have more options

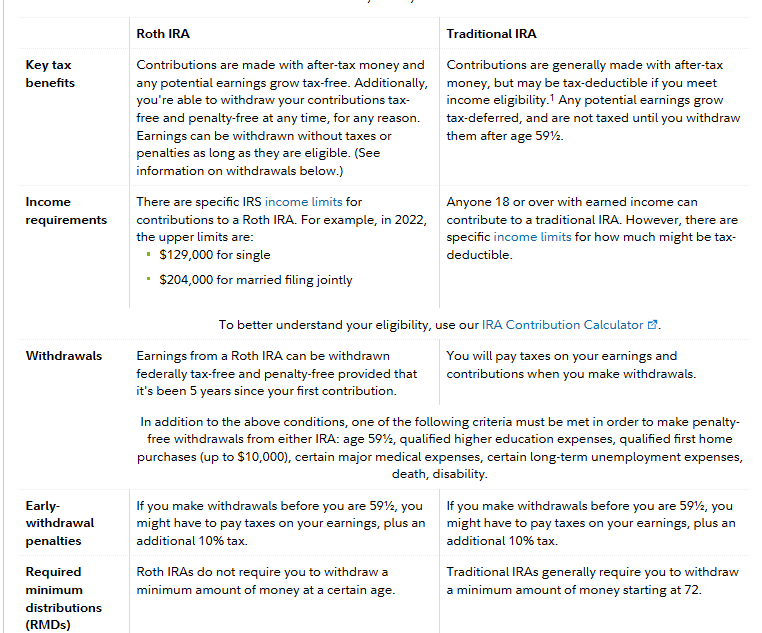

Traditional IRA - A traditional IRA is just like your 401k. You deposit money on a pre-tax basis and it grows tax-deferred then gets taxed when you withdraw it in retirement. There are lower limits to trad IRA annual contributions than your 401k. But, most 401ks limit your investment choices to those your employer chooses while a trad IRA lets you invest in any security or fund you want.

Roth IRA - A Roth IRA you contribute money on an after-tax basis but it grows tax free and your withdrawals are tax free. There is also more flexibility in using your contributions. However, Roth IRAs have income limits that prevent you from contributing directly if you earn too much. (You can do a backdoor Roth to get money into a Roth IRA, more on that later).

Brokerage Account - This is a standard investment account. There are no tax benefits, but there are no limitations in how you deposit or withdraw your money.

Fidelity even has a nice comparison table for you to see the difference in a Roth vs Trad IRA if you want a bit more details:

Which account should you open?

It is largely up to you. If you make less than the income limits, we would recommend a Roth IRA as you get some tax benefits and it helps to diversify your tax risk since your 401k is likely mostly made up of traditional 401k money.

[Note - In short - Roth accounts you know your tax rate (it is your current tax rate) and you pay taxes now. Trad accounts you don’t know your tax rate as it will depend on your income and how much the tax code changes between now and retirement. If you had a crystal ball and knew if your tax rate was going to be higher today vs when you retire, you could choose the best option. Since you don’t know that, we like to spread our investments across both.]

Since we assume with $32 Trillion national debt and so much animosity against anyone with any wealth, that our taxes will go up in the future, we are big proponents of Roth IRAs.

However, once you open your account, the way you buy and sell securities and the investment choices available to you are largely the same, we can ignore the account type going forward.

Making Trades:

So you opened an account, put in all your personal information, linked a bank account and funded it. Now what?

Now you get to buy some positions.

Equities trade based on ‘tickers’ / ticker symbols / stock symbols. If you have seen $XXX in tweets it is indicating the ticker of the stock.

Tesla = TSLA

Apple = AAPL

S&P500 = SPY or VOO or FXAIX or many other different ETFs and Mutual Funds

If you don’t know the ticker, you can search for the company and find the ticker.

This is what you input when you trade.

[Note - screenshots are where to find things on Fidelity, but most UI is similar enough]

You don’t want your account sitting in cash forever so eventually you want to purchase a security. To do this you click on trade and put in your order:

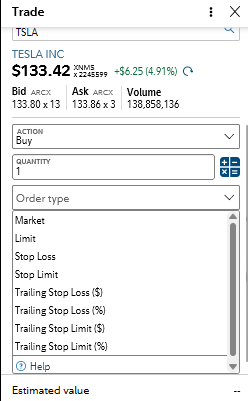

Click trade and a little window pops up:

We are buying stocks. You select which account you want to make the trade in, and it will tell you how much cash you have available to trade. Put in the ticker and then if you want to buy or sell. Select the quantity you want to purchase.

The next 2 options are “order type” and “time in force”. Here is when you have some choices. Let’s walk through it:

Order Type:

Here are the options you are given for order type:

The differences are important so we will walk through them. In general, you will likely use mostly market and limit orders when you start. To be honest, we rarely put stop losses on a trade as we don’t like getting ‘stopped’ out, (which we will explain later).

Market order: A market order executes immediately. If you look right below the current price of $133.42, there are 2 numbers, a bid number and an ask number.

The bid order is the highest price someone is currently willing to sell the security at. And the x13 is the amount of shares available. If you are selling shares of TSLA with a market order, you will get a price of $133.80 on the first 13 shares you sell.

Note - we pulled this screencap after-hours on the weekend so the current price of $133.42 is the last price that TSLA traded at Friday afternoon. If you pull this up during active trading, the stock price should be between the bid and ask price.

Limit order: A limit order only executes at the price you tell it to or better. Unlike a market order, you won’t be surprised by the price you get. If the market doesn’t have enough open interest at the price you want, your order will sit there unfulfilled.

You could put a limit order on TSLA for $100 or $150. You choose the price.

Stop Losses: The rest of the options are for stop losses. This is basically for traders who want to limit how much a stock can go down. Some people use stop losses of 10% or 20% and if the price of the stock drops that amount, your account will automatically sell out.

For us, if we buy a name and it drops 30%, assuming nothing changed, we view it as a chance to buy more on sale. We don’t know if we have ever actually used any of the stop loss choices.

“Getting stopped out” is when you put in a stop loss and it hits. Worse case is the drop is just noise and the stock comes right back. Now you took a loss, aren’t in a name you like, and have to buy back in at a price higher than you sold. There are legitimate reasons some people use stop loss trades, but it isn’t our style.

What do we recommend? Just use limit orders and set the price you want to trade at.

If we really wanted to own TSLA and the ask price was $133.86, we would just put a limit order in for $133.87. That way we know we will likely buy the $133.86 ask, but the most we would pay is $133.87. Assuming you aren’t trading massive money, this acts like a market order with some protection.

Most of the time we will look to leg into a position. If we wanted 100 shares of TSLA and currently owned 0 shares, we may put a 50 share order in at $133.87 limit (so we get some exposure.)

Then we put in limit order at $120 for 25 shares and $110 for 25 shares. That way if the market or TSLA goes down, we can fill the rest of our position for less money.

Background: Bid - Ask & Marginal Transaction

If you haven’t read why stock prices move…it should be considered essential fundamentals. There is a lot more to it than this, but we pasted some of the example we used in that post here.

It is important as hitting a market order means you are buying/selling stock at whatever open interest there is in the market. Big liquid stocks, likely not a big deal as your small order won’t move the stock price. But if you trade a less liquid stock, you may be underwhelmed with the price if you use a market order.

Reminder, we always use limit orders. If we want to get instant trades, we just set our limit at $0.01 below the open bid or $0.01 above the open ask. That way we know we get filled, but the price won’t shock us in a bad way. (And if you are trading options, we recommend limit orders even more.)

Time In Force

The last piece is the time in force. This says how long you want your order open for. When you click the drop down for a limit order you see:

The options here are:

Day - This keeps the trade open for the trading day and will close it at the end of the day. If you don’t want an order sitting out there for months, this is the choice.

Good till Canceled - this is the option we use the most. This opens your trade and it will just sit out there until the market comes to your trade price.

Fill or kill - This choice will send in your order and if it can’t be immediately fully filled, it is canceled. If you want X shares or nothing, this is the choice

Immediate or Cancel - This is like Fill or Kill but allows for a portion of the order to be filled.

We pretty much use good till canceled (GTC) orders 99% of the time. We don’t want to be staring at the stock screen, so we instead choose prices we want to buy or sell at and put the order out there till the market comes to our price.

Just be careful with buy GTC orders. They last for 90 days typically. This means you can put in an order and 89 days later get a surprise transaction. If you aren’t paying attention, this could mean buying a stock well after your forgot why you were going to buy it and after the story has changed. Every once in a while just go clean up your orders.

ETF vs Mutual Fund vs. Individual Stocks

The last piece you need to decide is what to buy. If you are starting out, ETFs are a good basic play.

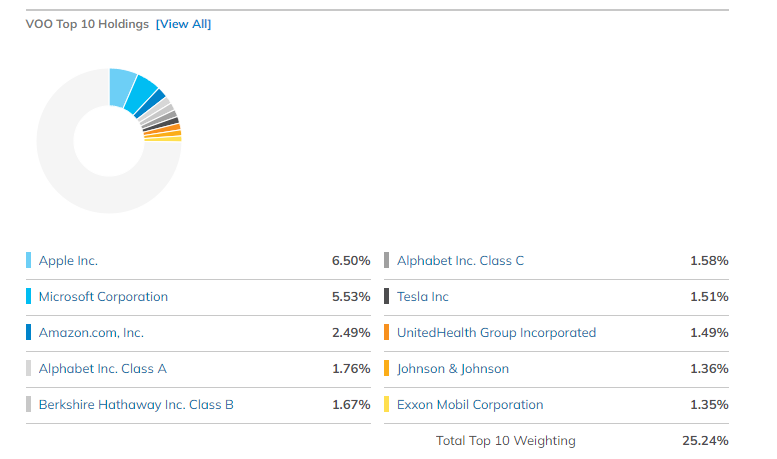

An ETF is an exchange traded funded, and most of them track an index. The ETF will buy the securities in the index and hold them at roughly the allocation they are in the index. If you buy an S&P500 ETF and the S&P500 index goes up 5%, your ETF will go up about 5%.

So an S&P500 ETF will buy the ~500 securities in the S&P500 at about the same allocation.

Since the person managing it is just buying and selling shares in the ETF based on trying to re-balance to the index, the fees on a passive ETF are much lower. Vanguard is the gold standard for low fee ETFs - they have fees that are in the basis points (a basis point is 1/100th of 1% or 0.01%).

Mutual Funds are similar to ETFs in that they hold a basket of securities, but they tend to be more actively managed and have higher fees. (Although the lines are blurring a bit).

[Note- there are also some nuanced tax differences, but that is beyond the scope needed for a 101 post.]

Individual stocks are just buying the a single companies stock. You get full exposure to what the company stock does. When you buy a stock you own 1 piece of the company.

Diversification

If you are starting out, having ETFs will give you ample diversification. You get a basket of 500 companies with the highest allocation to the larger companies in the index.

Currently Apple is the largest company at 6.5%.

You could buy VOO and consider yourself diversified. You could also buy VTI which is the Vanguard Total Market index which has positions in nearly 4,000 securities. Or you can buy a mix of VOO, QQQ (NASDAQ), IWM (Russell 2000 small cap) etc to get a mix to the different sectors.

But having an ETF will give you ample diversification in itself.

If you go the route of choosing individual names, the rule of thumb is 25 securities (assuming they are not all in the same sector) gives you peak diversification.

Additionally, many people have rules like a 5% max position size or 10% max position size in their favorite names as a way to ensure they aren’t over exposed to one name. But this is for later when you have a larger portfolio. If you only have $5000, having 25 names would be $200 to each, which is too mall to make a difference.

TLDR:

If you have never invested before.

Open a Roth IRA at fidelity

Deposit some money

Buy VOO to get Vanguard’s S&P500 ETF with a market order

Use a GTC Limit order for VOO at a few dollar below where it trades

Congrats. You now are on your way to investing. Take some time to experiment. The good thing about Fidelity (no commission trades), Limit orders, and a Roth IRA is you can buy and sell 1 share of a stock without worrying about tax consequences, wash rules, or fees. You can’t contribute more than a few thousand to a Roth each year so its not like you can blow a 6-fig bankroll.

[Note - there is some rules about day trading and trading before cash settles (~3 day settle). So this isn’t an invitation to do 100 trades a week. But you can buy a stock and sell it a week later or buy it and play with the different stop losses and not have to worry.]

Then subscribe and follow along and you can learn how to trade options in a way that actually gets you paid AND lowers your portfolio volatility.

Conclusion

This post should give you everything you need to open your first account and make your first trade.

If you have questions you can drop them in the comments or DM us on twitter.

Good luck Anon.