Budgeting 101: Simple Set-up to Streamline Your Budgeting - Tips & FAQs

Part 2 - Some Additional Details to Help you Succeed

We have a love-hate relationship with budgets.

We recognize many people need a more strict budget. They need to plan ahead for all the money spent and decide where it goes before they spend it. If you have low income or a spending problem, this may be necessary for you.

Personally, we think it is much more efficient to automate nearly all of your monthly transactions. We don’t need a complicated spreadsheet that we need to manually track. If you used our set up from Budgeting 101 then you have:

All your planned investing & savings being automatically contributed & deposited right off the top of a paycheck or on a re-occurring basis from a funded accouont

Enough deposits going into a separate bank account to auto-pay your essentials (mortgage, car loan, student loans, etc)

A 3rd account for your emergency fund

(Maybe another optional account for saving for big upcoming expenses, like an account to save money to pay for a vacation or new vehicle purchase)

A 4th account that gets the remainder of your paycheck that you pay your ‘wants’ (aka discretionary spending) out of

Then you set a buffer amount in your discretionary account (say $3k). As long as you are above your buffer threshold, you are on track. And then:

If you fall below $3k you know you over spent

If you start getting way over your threshold, you know you can invest more

Sinple. 1 Account to track. 2 mins a month.

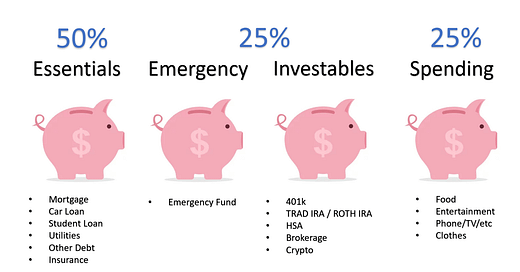

If you recall, we think a 50/25/25 is a good framework to use for a STARTING plan. (much better than 50/30/20). Eventually, you want to bump up your investing to more and more of your income as your income grows.

With that in mind, here are some miscellaneous tips and tricks to help with a streamlined budget.

Honestly, print this out and follow it for a year and you have 90%+ of all your personal financial basis covered. And much more time to focus on the most important part, making more money