Another quarter is in the books. I hope you all are holding up well in this current economy with rates up, job loss increasing and overall markets being blah.

There was a lot happening this quarter so we can get right into it.

Federal Student Loan Repayments Start…

After over 3 years of forbearance of both interest and monthly payments, Sept 1st marked the beginning of interest being reapplied and October is the first month your regular payments restart.

This was largely federal loans so anyone with a private loan or who consolidated has been chugging along with their regular payments (and hopefully you locked in historical low rates for a long period of time at least).

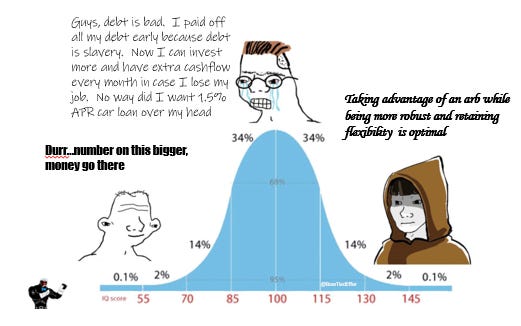

Long-time readers know our view on this have been consistent.

If you get a 0% interest loan and don’t have any payments due, it is perfect opportunity for arbitrage

Putting your normal payments into any safe yield-bearing instrument is free money

(technically you could have just put the principal portion of each payment over the last 3 years in and pocketed the interest portion to stay on the original schedule - but why overcomplicate it)

On the last day of August you lump paid in all that money you been stacking

Either you pay the full account value (puts you way ahead of schedule since you earned a lot of interest in the meantime) or

Put in the money you contributed and pocketed the interest you earned

If you did this you came out way ahead after the last 3 years. We walked through this in depth here:

Arbitrage Opportunities & Revisiting the topic of paying off your debt

It is with a somber heart that we write this post to you today. We want to discuss a serious illness that is affecting our society. It is a silent disease that plagues our communities. It can affect the young, the old, men & women, all races, religions, and creeds. However it appears to heavily be focused on the below 30-year old and above 60-year o…

If you didn’t have a federal loan, but were able to refi down at historic lows (2.5% on a 5yr here), it still makes sense to put money in a 4.5% high-yield saving account or 5%+ CD/UST instead of making extra payments.

Anyway, if you do have federal loans, be prepared to make payments this month.

Speaking about other free money opportunities…