10 REAL "Inflation-proof" Career & Money Tips College Graduates Need Now

Helping you avoid HFSP advice

I stumbled across this article with ‘expert advice for new graduates’. It may have triggered me…

Since a Twitter Thread isn’t the ideal place to refute an article, we decided to take it to the substack. Let’s take a look at all these ‘experts’ advice and see if we can’t fix it up to make it actually helpful.

1. Review student loans

“Parrish advised new graduates to compare them to current rates refinance lenders are offering. That way, they can refinance for a lower rate, especially for private loans.”

I know the FOX article was about recent graduates, but how do you bring up student loans without hitting the root cause a bit…Why do you have student loans in the first place?

First piece of advice around student loans should always be “Don’t get student loans”. Impossible you say?

Choose a cheap college

Probably an in-state state school. Or see if any schools have a student share program (ie a sister school in another state that will allow you to go there for in-state tuition prices)

Note-This likely isn’t the “school of your dreams”. Don’t be stupid and pay $100k extra because you ‘love the campus’ or ‘it has a great atmosphere’. It isn’t the ‘best 4 years of your life’.

Scholarships, scholarships, scholarships, grants and awards

Apply to all and everything. There is an absolute crazy amount of $500-$1,000 prizes out there that very few people apply for. Be one of those people who apply.

Financial aid

This doesn’t stop at filling out a FAFSA and hoping. Reach out to school to see if they have any programs or additional aid.

I didn’t go this route. One of my friends used ROTC for basically free college and was able to be a reservist to fill out his required commitment. Having a contract is less than ideal, but worth looking into if you are really in a bind

Take courses at community college

Just make sure they transfer to your main school

College has a ridiculous amout of useless gen-ed required, take those for significantly less at a community college.

Be an Resident / Community Assistant (RA or CA)

RA/CA typically get room, board, and sometimes a stipend. Typically you do some training before the semester starts, you have to be on duty a few nights a month, and have to do activities for your floor. I did it, it is good pay for what you need to do.

Take AP courses / HS classes for college credit

(Note -H/T BowTiedShrike for comment-completely blanked on these so adding them now)

AP courses allow you to take a ‘college level’ course at your HS and then pass a standardized test to earn college credit

Many state colleges work with local HS to accept some honors level courses for college credit (only applicable to that local state college)

I was able to have 1.5 semesters worth of college credit when I graduated HS. Very low/no cost way to get credit and spend less time at college.

Ok, but lets assume you are a recent grad and got some student loans….is the advice above good? Should you refinance or consolidate?

No. Most likely its a hard no.

First, I would not touch federal loans if you have them. There is a growing chance some portion of them get forgiven. You wouldn’t want to refi and consolidate your federal loans and find out you made yourself ineligible for $10k+.

Even if you have a high rate on your federal loans, 6% on $10,000 is $600 a year. If you have lots of student loan debt, you could make extra payments. Start with the highest APR private loans first. But I’d only pay the minimum payment if I was close to $10,000 in debt just in case there is forgiveness.

Second, anyone telling you to hurry up and pay down/off federal student loans at this point is crazy. Federal student loans were as low as 2.75% . If you are a recent grad with loans, you likely have some very low rates on a portion of your loans. If you consolidate or refi, you lose those low rates.

Instead, keep the loans separate and pay any higher APR loans down first while paying the minimum payments on the low APR federal loans. Yes, the avalanche method which is infinitely better than the snowball.

2. Eliminate debt

"Chances are, you’re not making grown-up money just yet. So don’t go buying a new car or a new house," Ramsey, the author of eight number-one best-selling books, also told FOX Business…."Instead, get yourself out of debt,"…. "Get seven jobs, sell stuff online, do whatever it takes to pay off student loans and any other consumer debt you’ve racked up."

Question…Why did you go to college and put off being an adult for 4 years to graduate with a bunch of debt and a career you do ‘not make grown up money’?

You botched up some part of the process. If you are going to college, make sure you are going for a major that makes it worth your while…

Putting aside a poor career & college choice, how does the rest of this section’s advice hold up?

Now I love going after old Davey Boy as much as the next guy, but he isn’t completely wrong here. You should be building numerous income streams while you are young.

.

.

[waits for hell to freeze over for agreeing with Dave Ramsey…]

.

.

But unless you have ridiculous high APR debt 5%+, start putting some money into investing. Are you getting your 401k match? Contributing to a Roth IRA? HSA? These are all habits you should start now. For example, a 401k match is a 100% return, don’t forgo that to pay a 4% loan down slightly faster.

In todays 8% inflation environment, you are likely better off investing as you would expect a higher return on investing than that cheap debt. You have to look at the opportunity costs of the 2 options:

If you have 20% credit card debt, you absolutely need to get rid of that. You already know about credit cards, why are you carrying a balance when you can get 0% interest loans from credit card companies?

In summary, maybe pay down debt, but it depends on APR. And don’t forget the potential student loan vote buyin…err…student loan forgiveness… from the gov’t that could be a $10k payoff.

3. Build a budget

"Trying to negotiate a salary without knowing how much you need to make is like trying to build a house without looking at the plans before you order the materials," said Josh Simpson

There is a lot of reasons to build a budget. Track your spending, find where you are leaking money, plan better and invest. If you are running out of money every month or not saving at least 20%, you should do a budget to see why.

You know what isn’t a great reason to budget? Negotiating a salary.

“Sorry, my budget says I need $100,000 a year, can you double this salary offer?”… No company cares about your budget.

I read this section a few times because it feels so unrelated. Yes you should budget & Yes you should neoitiate salaries….but these 2 things have almost nothing in common. Your addiction to consumerism doesn’t justify getting paid more.

About budgets, they are great if you aren’t able to control spending, but just don’t go crazy micro-budgeting. Your first few years out of college should see good salary growth & big life changes (marriage, first house, kids, etc) which makes any budget only helpful for the short-term. You are better off setting a high savings rate and living simple. Spend your free time on a side income rather than fiddling with a budget spreadsheet every month.

And you should set up an automated system to handle your spending & savings.

Also, YES you should negotiate your job offer and try to get more money, paid-time-off, benefits, etc.

But your budget doesn’t help you with this. You should go and find the job that makes the most money per hour of work. If you have 2 choices:

Company A you work 40 hours for $100k or

Company B you work 70 hours for $125k

Company A is likely the better choice, AS LONG AS YOU USE THOSE OTHER 30 HOURS TO BUILD A SIDE INCOME.

If your budget says you can live on $50k, there is no reason to take a $50k job offer if you can negoitiate for more.

4. Prioritize a pathway

"Don’t take the job that pays you the best — take the job that sets you up for the future you want," said Ken Coleman. Coleman also recommended that new graduates learn how to budget, so they’ll be able to "live on less" than what they make.

This is toxic advice.

It sounds good and reasonable. And that is why it is so venomous. This is the advice you tell your worst enemies child. “It isn’t about the money, its about the future you want.” Lets quick hit all the reasons this is bad:

You are in your early 20s and the life you want is likely going to change a lot

Your beginning few years’ salary can influence your lifetime income

Budget to ‘live on less’ continues to reinforce the idea that you should take a low wage and live a meager life as some path to happiness. Instead of making a ton of money and living a life of freedom

It assumes you are going to wage cuck for 40 years and barely going to make it regardless so may as well find a job you ‘hate less’

It completely castrates one of lifes big joys - building, challenging yourself, and winning

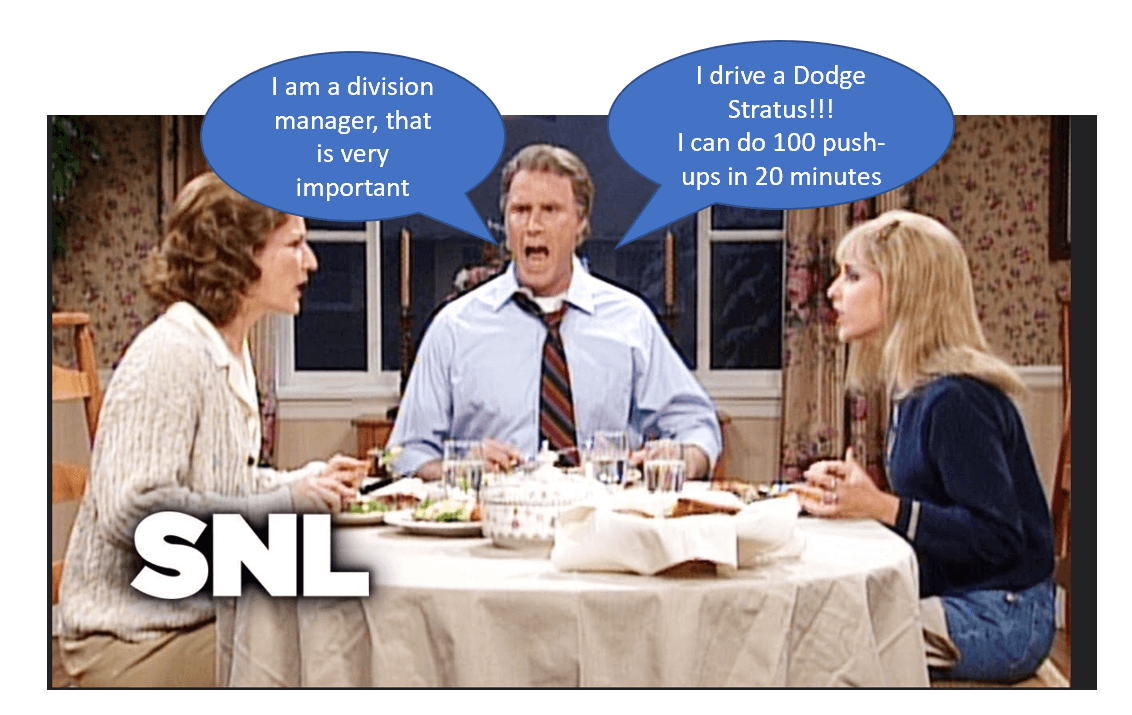

This is how people wind up in unfulfilled lives. You aim for some low unimpressive goal, get there and realize making $60k a year in your 40s as some “very important division manager, in charge of over 29 people” who can “do 100 push-ups in 20 mins”. “You drive a Dodge Stratus Damn It!!! Respect you”

It all sound innocous, but don’t fall into the trap of wasting the period in your career where you have the most energy and time. Spend your early 20s getting as much income as you can between your W2 and your side businesses. When you get older and figure out what you actually want to do, you will be thankful you have those savings for freedom. Remember, MAKING MORE MONEY IS ALWAYS FINANCIALLY BENEFICIAL.

5. Be willing to put in hard work

"A good attitude takes you to great altitude. It is important to show up with a willingness to learn, zeal to work hard, showing up with a ‘can do’ and ‘will do’ attitude, and going the extra mile of your employer’s expectations will all give you great career success and progression."…include putting up to 10% aside from paychecks for "investing and making the money work in the markets"

You want your higher ups to think of you as a hard-worker going the extra mile.

But that being seen as a hard-worker to progress your career is different than working hard. Don’t be that guy cranking away a bunch of extra hours on thankless tasks that won’t get you more money/promotions.

Don’t neglect the political side of work. You want to get the most return for your time and effort spent. Sometimes that means working very hard, but most of the time it is more imortant to work smart.

6. Negotiate salaries, even if they’re entry-level

"You might think that with your age and lack of experience you are in no position to ask for more money, but [it’s better to] get into the habit of negotiating for pay raises and promotions now instead of later," Myers continued. "The salary you earn now will impact the salaries you earn tomorrow."

Yes. We went over this in the budget section (overall just poorly written article that the budget section only talked about negotiating salary and then there is a seperate section on negotiating).

Negotiate salaries always. Worse case they say no and you are no worse off. This is the one section I have no complaints about. “The salary you earn now will impact the salaries you earn tomorrow” is spot on.

Then when you make a job change, look for a 30% pay bump OR a significanly better path to growth & promotions. Why so much?

You are giving up a reputation & all the political capital you have built up

You likely lose some of your vesting, PTO, years experience, etc

You lose the sweet low work, high-visibility role you have carved out (you did carve out a nice high-pay low-effort position in your time right Anon?)

7. Think about retirement and beyond

"Start saving and investing now, even if it is $20 a week or a couple hundred dollars a month, not just for retirement, but also for big events down the road, like buying a home or boat, or saving for a wedding — you can do his with a bank or investment account," said Michael Ashley Schulman

Yes you need to save and invest.

If you only have $20 to invest you need to absolutely increase your income. Something is better than nothing, but investing $20 a week isn’t going to get you there. If you only have $20 a week, you need to do a budget, cut back on spending until you can boost your income.

And if you only got $20 to invest, and you are saving for a boat…unless you are going to be a commercial fisherman what are you even doing? Serious, how out of touch is this guy to recommend buying a boat…the literal “money hole”….to someone who doesn’t have more than $20 to save.

Wedding too. Don’t go blow all your money on a wedding. You want a big wedding, you need to earn it by massively increasing your income, and even then it likely isn’t worth it.

[Note - dont be one of these twits who puts off marriage and kids to save up for some huge dream wedding. Have a modest & affordable wedding. If you really think a huge celebration is needed, do it as a remarriage ceremony for your 10 year anniversary when you have money]

In short, the title of this section is great - save your money and invest. The actual advice in the section is terrible. Don’t save your money to buy boats and lavish weddings. Save your money to invest and get freedom.

8. Inquire about discounts

"Call your service providers and ask for lower rates or costs," said Lauren Anastasio, director of financial advice at the NYC-based Stash, "The same would go for insurance providers, cable and cellphone providers, etc., who can lower your expenses." "If you have a credit card balance, call the card company and ask them to lower your rate. Surprisingly often they can at no cost,"

Sure. Feel free to do this…but the $10 a month you save after arguing with your cellphone provider isn’t going to make you rich.

You can absolutely call and threaten to leave for a competitor or to cancel unless you get a discount or a restart of the promotional period. There are people who have had satellite radio forever and never been out of the promo period by just calling and arguing. But this falls into the Budgetoooor meme - don’t spend all your time wrapped up in saving pittance. That time is better spent building more income (see a theme yet?)

Don’t carry credit card balances…come on…If you have a balance, read how to get 0% APR on credit cards forever, and then you don’t have to call and argue with them…

9. Make note of financial wellness benefits

"College graduates should pay attention to not only a starting salary or signing bonus, but also the broader financial wellness benefits that companies are offering," said Edward Gottfried, director of product at Betterment at Work,"This could include benefits such as a 401(k), a 401(k)-matching program, student loan management programs, a wellness benefits stipend, a flexible spending account (FSA) or a health savings account (HSA),"

Again, this is something you should look at. But let’s be foreal, if you are making $50k a year, a 3% vs 4% match isn’t making a difference in life.

Don’t major in the minor.

Yes. Know all your benefits and extract most you can from your company. A lot of people don’t look at or take advantage of benefits. Don’t leave free money on the table.

For example, every company I worked for has had a ‘health incentive’. You do some minor things, maybe get your annual checkup or ‘take’ an online course, and you get a couple hundred dollars from the company. The amount of peers who don’t take the 20mins it takes for this ‘free’ money (on company time no less), is crazy.

But end of the day, this isn’t getting you rich.

10. Consider high-income industries

"For example, looking for career opportunities in energy, information technology and real estate may give you the upper hand over careers in consumer discretionary sectors like high-end apparel, entertainment and automobiles," he continued.

Again, great section header, and the actual advice is subpar. Also, why is this #10?

Energy is broad. Green energy is being propped up by gov’ts running out of money. Fossil fuels are trying to be squeezed out. Where do you go that has 10-30 years of profitability? Same with Real-estate which tends to be cyclical and tends to be a good side income.

Develop high-income skills. Sales, Comp Science/coding, fincial knowledge for M&A. These are high-income industries that aren’t going away.

If you can sell, you can always find income.

The world is increasingly going online, coding and computer science will be in demand.

There is always money to be made making deals in corporate finance.

Stay valuable and well-compensated is correct.

Conclusion: 10 Tips For Young Adults

This post is a beast. I’ll skip a long conclusion. If I had to re-write this list, this is how I would do it. And I added 2 bonus ones that are likely even more important.

F’ers list of 12 Tips for Young Adults:

Review Student LoansAvoid Student Loans

Eliminate DebtUnderstand Opportunity Costs

Build a BudgetSave Atleast 25% of Income and Invest It

Prioritize a PathwayGrind In Your 20s - Priortize Later

Be Willing To Put In Hard WorkSelectively Put In Hard Work & Maximize Your Reputation

Negotiate SalariesNegotiate Salaries & Be Strategic With Job Changes

Think About Retirement & BeyondForget About Traditional Retirement, Make & Save So Much You Get Freedom

Inquire About DiscountsBuild & Create To Grow Real Wealth With Side Business & Income

Make Note Of Financial Wellness Benefits

Consider High-Income Industries

Choose The Right Spouse

Choose The Right Area To Live

Go win the day Anon.

Agree completely on use community college to knock out gen eds (or better still AP/IB credit from high school). For major courses, it is more hit or miss.

Also agree on state school or states with reciprocity. Would add that if you need more school after your undergrad, choice of school matters WAY less because it's your terminal school that you cite as your alma mater. Harvard for undergrad ->University of Wyoming for grad school makes you sound like a failure. But you can definitely go Univ WY -> Harvard. Plus for a science PhD, Harvard pays you, not the other way around.

Some (not all) universities have employee discounts-- they let you take a class or two for free each year.

Student loans aren't this simple...

1. Most state schools are not cheap nowadays (even if they are the cheapest option in your state, still not cheap!)

2. Federal loans are limited only if your parents have low enough income.

3. It's silly to become an RA just for the money imo, only do it if you truly want to

4. If you consolidate or refi student loans, you don't lose low rates. Your rates lower, that's the point of refinancing. While I agree you shouldn't refinance federal loans, refinancing private loans are a no-brainer.

I agree with going to community college first, that's a huge money saver.